Through a combination of default, de-leveraging and declining interest rates, the burden of monthly debt payments on American consumers has radically shifted over the last few years. Here’s the Federal Reserve’s measure of the household debt service ratio, a gauge of debt payments as a share of disposable personal income. In its most recent update to the number for the third quarter of 2012, the amount Americans spend on debt payments is back to levels last seen in the very early 1980s and 1990s.

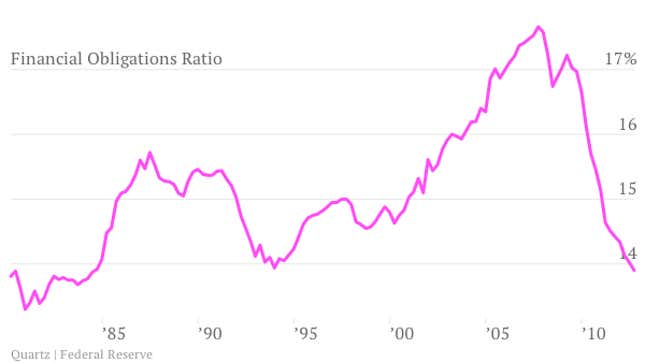

Here’s a similar reading, known as the financial obligations ratio, which tosses in automobile lease payments, rent payments for tenants, homeowners’ insurance, and property taxes to the debt-service ratio.

Lowering the amount of money consumers have to spend on debt payments frees up cash to be spent elsewhere, which is a huge boon for the US’ consumer-driven economy. “This goes a long way to explaining how sluggish GDP can coexist with reasonably robust consumer expenditure and a recovering housing market,” wrote Michael Shaoul, chief executive of New York money manager firm Marketfield, in a note spotlighting the decline. In the US, where more than two-thirds of economic activity hinges on the consumer, this is a trend not to be under estimated. It’s huge, and it’s one of the reasons we believe you should pooh-pooh any notion that US consumers are in danger of cracking any time soon.