Under the threat of investigations, lawsuits, public pressure, and online competition, for-profit colleges have been losing their mojo with American students. But the largest for-profit college operator in the US is finding new business in countries less familiar with its for-profit model.

In its second quarter earnings report released yesterday (March 25), Apollo Education Group highlighted its strategy to make up for declining enrollment at its biggest revenue generator, the University of Phoenix, through global acquisitions. Apollo said it was narrowing the focus of its US business to more targeted course offerings and skill certifications, while making acquisitions and opening new programs abroad. Apollo acquired a controlling interest in Brazilian higher education company Sociedade Técnica Educacional da Lapa S.A. f0r R$73.8 million (USD $28.9 million) in December. In May, it acquired 81% of South African for-profit education company Milpark for ZAR 265 million (US $25.6 million).

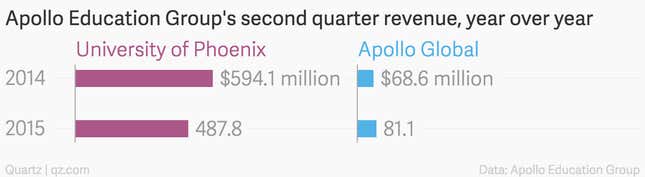

The University of Phoenix accounts for 84% of the company’s revenue, compared to 14% from its global division. However, revenue from the American college decreased 17.9% in the second quarter compared to a year earlier, while Apollo Global’s revenue increased 18.2% over the same period.

The most promising markets abroad for for-profit educators are the ones that are now starting to offer government aid to attend for-profit colleges, similar to the US system, according to Kevin Kinser, a State University of New York at Albany professor and for-profit college expert. Brazil, for example, has long subsidized higher education at public colleges, but as demand for education has increased with its growing middle class, the country has helped cultivate private, for-profit colleges by offering government scholarships and loans to students who attend those schools, Kinser tells Quartz.

A number of the international acquisitions, such as its purchase of Milpark in South Africa, focus on online or vocational training. Milpark offers both on-campus programs and online courses in business and management. Apollo CEO Greg Cappelli said during the earnings conference call he thinks the company is well positioned for growth elsewhere on the continent, as sub-Saharan economies continue rapid growth.

Apollo also has a presence with the Bridge School of Management in the world’s fastest-growing big economy, India.

The lack of regulation over for-profit colleges in these countries could put students at risk of poorer quality education and high debts. The US suffered similarly before clamping down on these institutions, according to a 2012 US Senate report. The Economist wrote last year that Brazil had so far avoided this fate because the federal aid that the country offers students is partially contingent on the quality of the program.

The main photo in this post is by Flickr user Hvnly. The image has been cropped.