Why Latin American basket-case economies have some of the best-performing stock markets on earth

It’s not an April Fool’s joke.

It’s not an April Fool’s joke.

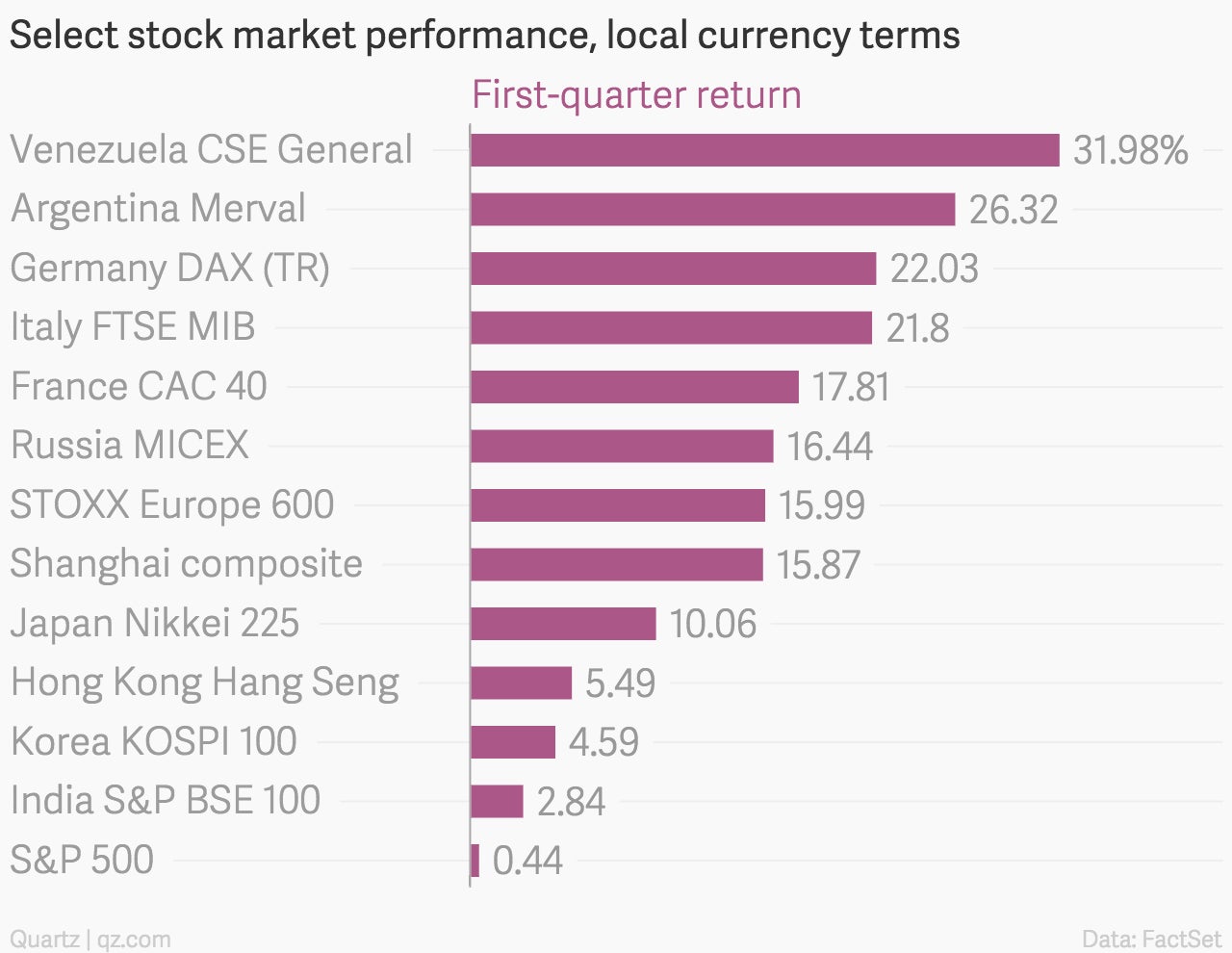

Amid economic disorder and collapsing confidence, stock markets in Venezuela and Argentina are soaring. They were up 32% and 26% respectively during the first quarter, making them some of the best-performing stock markets on the planet.

Finance experts have long debated what inflation should do to stock markets. Traditional theory long held that stocks, since they’re real assets (they represent claims on real businesses that buy and sell in current prices) they should rise in inflationary periods as people use them as a hedge. Subsequent studies, such as this one, found very little evidence that such surges occur with regularity. And many studies have found that stocks actually fall during periods of inflation. Anyone who remembers the atrocious performance of US stocks during the 1970s can vouch for that.

But the old theory seems to be playing out this time around, accounting for the solid performance of not only Venezuela and Argentina but also Russia.

While it’s not a joke, the performance of these markets is still an illusion. The returns in the table above are presented in local currency terms. And the local currencies in Argentina and Venezuela are plummeting, setting off disastrously high surges in inflation. That means in real terms—that is, adjusted for the purchasing power of the currency—these markets likely haven’t gone anywhere at all. (The less-than-forthcoming statistical agencies of these countries make it difficult to calculate the exact real return. Argentina’s currency trades at vastly different rates on official and black markets. Venezuela hasn’t published any inflation data so far this year.)

But even in orthodox economies, the saga of Argentina’s Merval and Venezuela’s CSE General reminds investors of the importance of calculating inflation into returns. Nobel Laureate Robert Shiller believes inflation adjustment is crucial to a proper understanding of how the stock market performs over time, he said in a recent conversation with Quartz. ”There’s been all this talk about new records set in the stock market. They came way to early on that, because in real terms Nasdaq is not anywhere close to new record,” Shiller said.