Former Fed Chairman Ben Bernanke is not happy with Germany.

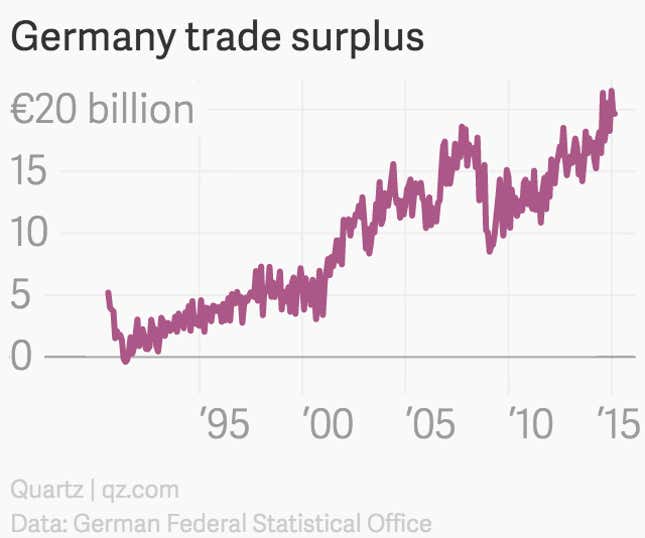

In a recent Brookings Institution blog post entitled “Germany’s Trade Surplus is a Problem,” the former central banker laid out the Keynesian rationale for why trade surpluses—which seem to have mystical powers in the eyes of policy makers—aren’t as virtuous as they seem. He writes:

In a slow-growing world that is short aggregate demand, Germany’s trade surplus is a problem. Several other members of the euro zone are in deep recession, with high unemployment and with no “fiscal space” (meaning that their fiscal situations don’t allow them to raise spending or cut taxes as a way of stimulating domestic demand). Despite signs of recovery in the United States, growth is also generally slow outside the euro zone. The fact that Germany is selling so much more than it is buying redirects demand from its neighbors (as well as from other countries around the world), reducing output and employment outside Germany at a time at which monetary policy in many countries is reaching its limits.

New data out April 9 showed Germany’s surpluses show no signs of abating. They were essentially flat in February at €19.7 billion ($21 billion). But in fairness, with exports accounting for roughly 40% of GDP, it’s difficult to expect any kind of drastic policy shift from Germany on this front overnight.

That said, there are indications that Germany is willing to make adjustments. For example, the country has recently shown signs of moving away from policies that helped snuff out wage growth for roughly a decade, from 2003 to 2013. (For example, Merkel’s government just put the country’s first-ever minimum-wage law into effect.) And in January, real wage growth in Germany was up by roughly 3.5% year-on-year, not too shabby as far as Germany’s recent history goes.

Of course, much of the growth in real wages has to do with collapsing energy costs and falling inflation overall. Still, there are other indications that Germany could be tilting toward a bit more consumption. Retail sales have been robust lately, for example.

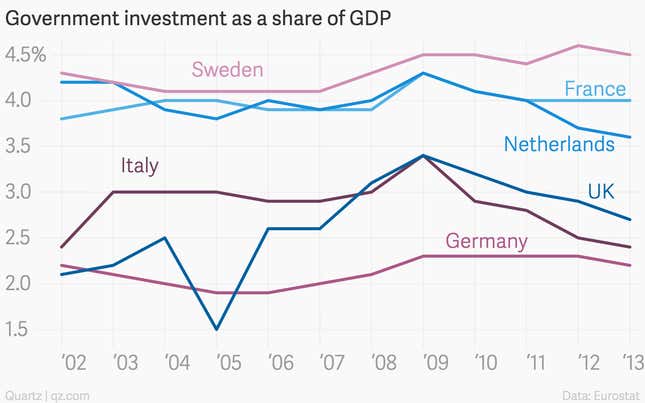

The missing ingredient for Germany is investment. Private investment in the country has been weak in recent years, understandably given the state of the continental economy. Government investment, meanwhile, has been all but nonexistent, at least by the standards of Germany’s international peers.

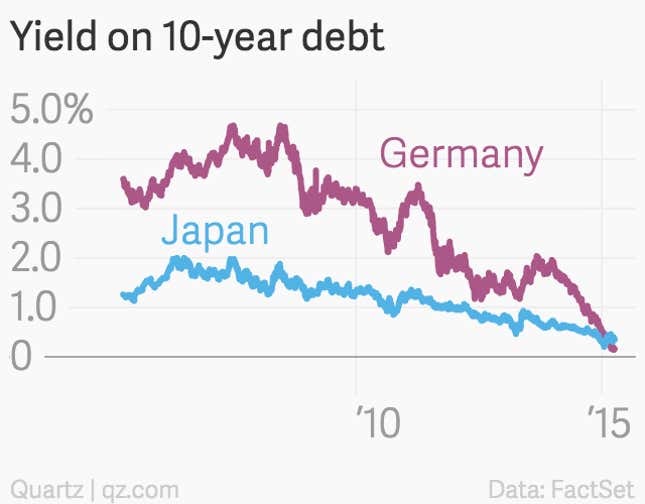

A serious investment surge by Germany’s government would make a lot of sense right now, helping the euro zone as a whole, as well as Germany’s long-term productivity (by boosting education and updating equipment). And if those arguments don’t work, Germany’s leadership should make another case to Germany’s reputedly frugal populace: It’s never been cheaper for Germany to borrow.

In fact, Germany’s political class could credibly sell this as a money-making proposition. The market is asking Germany to pay a mere 0.15% to borrow for 10 years. (Previously only Japan paid interest rates that low because it was trapped in a decades long fight with deflation.)

Unless you think that Germany and Europe are doomed to a deflationary future, that means investors are, essentially, willing to pay Germany to buy its bonds.

Germany should take them up on the deal.