Better pay and education are helping women to become a more powerful economic force. That’s a good thing. In fact, in 2013, younger women were 7% more likely to have a bachelor’s degree than similarly aged men. The number of women-owned firms grew by 50% between 1997 and 2011. And though the average working woman’s salary is only 84% that of a working man, the next generation is catching up: Among young workers, women’s hourly earnings are approaching parity at 93% of men’s.

In light of this growing clout, Pershing, a BNY Mellon company, recently conducted a survey of female investors to learn more about how women are engaging with the financial industry. With better pay and more income to invest, women are increasingly interested in the best investment practices and financial advice.

Kim Dellarocca, a managing director at Pershing, noted that 35% of women who don’t use financial advisors don’t trust advisors to look out for them. “While trust has to be earned over time, advisors can start earning that trust by listening to women and their unique goals and taking the time to plan for those goals, as opposed to setting women up with a ‘one size fits all’ strategy,” she says. “The good news is that the women we surveyed who do use advisors expressed almost 100% trust in their advisor.”

Still, even though some financial services companies have increased their efforts to reach women, the industry continues to fall short of meeting their unique needs, according to the survey. Here are six factors that have a fundamental impact on women’s financial health, along with some advice on what women can do to address their specific concerns.

Women expect to live longer

Women who live to age 65—retirement age—are expected to live an average of 2.3 years longer than men who reach the same age. Plainly, this means women need more savings to sustain their retirement.

Women are not earning as much as men

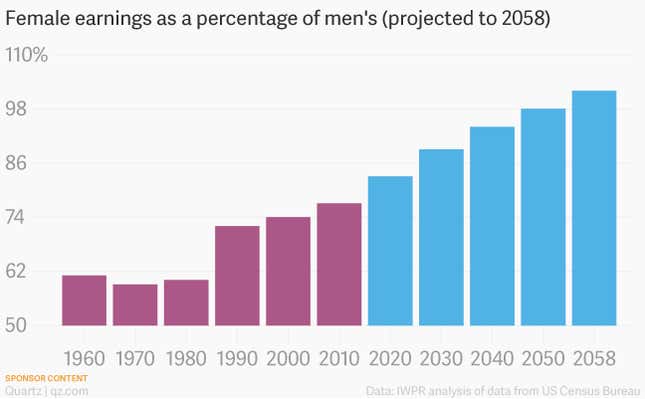

Though the wage gap is closing, a lifetime of depressed wages means that women will earn about two-thirds what men will. If the pay difference continues to close at a slow pace, working women will not earn as much as working men until 2058.

Women are more likely to face gaps in employment

Family planning sometimes requires that women put their careers on hold, which depresses their income. Further, women are more likely than men to take time to take care of aging parents or others, spending about 12 fewer years in the paid workforce.

Women have lower savings levels

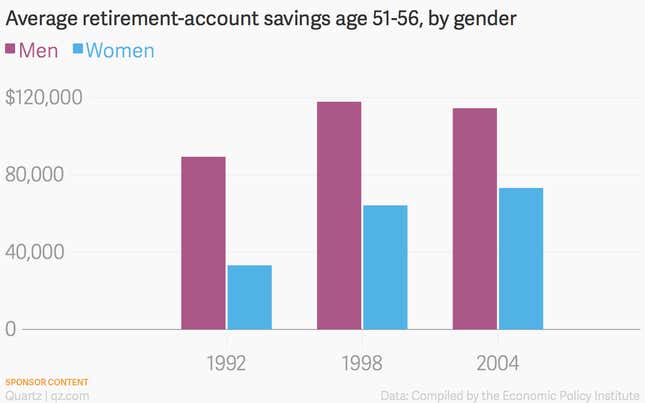

Over the last few decades, on average, women’s (aged 51-56) retirement-account savings are worth about $50,000 less than men’s, leaving women with less to spend for the longer time they spend in retirement.

One reason, Dellarocca notes, may be that women tend to put their needs second. “Our studies show women have a high propensity to put their wellbeing after others,” she says. “Because women like to invest with purpose we find that creating ‘buckets’ to save in can be a very useful exercise for women.”

Creating different accounts—college savings, healthcare, housing, fun, flexibility—and saving within these buckets tends to fit nicely with the way women think and their desire to align their wealth management strategy with their life, she says.

Women pay more for healthcare

There is a greater chance that women will be financially impacted because of a chronic or terminal illness. On top of that, women pay more in average annual health costs than men, making it more likely they will need to tap into resources meant for retirement.

Women will pay more in taxes

Over the last four decades, growing economic opportunities for women strongly correlate with a decline in marriage rates, and many wealthy women are choosing to forego marriage entirely. Still, because of public and private incentives around income taxes, Social Security, IRAs, and more, single women—particularly higher-earning women—could lose over a million dollars in their lifetime compared to married women.

Further, 80% percent of women will be single in their final years, and will face a higher tax rate because of it. Older men (75%) are much more likely to be married than older women (45%), but married women are more likely to outlive their spouse: There are over four times as many widows (8.5 million) as widowers (2.1 million). Setting aside the heartbreak of losing one’s partner, widows must prepare to make financial decisions that have long been made jointly.

Surviving spouses face a particularly difficult challenge in planning for the future of their estate, says Dellarocca. True, the transfer of assets to a surviving spouse is fairly straightforward; and when the second spouse passes, the assets will often pass to children, grandchildren, other relatives, and charitable causes.

But Dellarocca says this process involves more in-depth estate planning, knowledge of estate and inheritance taxes, as well as possible trusts, charitable donations, and more.

Adding to the challenge is the fact that women tend to be too conservative in the way they manage risk, a trend that accelerated after the 2008 financial crisis.

But viewing risk simply as a question of losing money or not, warns Dellarocca, ignores the complex reality of securing savings that are both sufficient and liquid.

“Developing strategies to manage risk, not fear it, is something else women can do to prepare for a secure retirement,” states Dellarocca.

Learn more about how BNY Mellon has been calling greater attention to the needs of women investors here.

This Sponsor Content Bulletin was not written or created by Quartz’s editorial team. This article was written by Quartz’s marketing staff and sponsored by BNY Mellon. The views expressed in this material are not those of BNY Mellon or any of its subsidiaries or affiliates, including Pershing LLC, member FINRA, NYSE, SIPC. This material is intended for general information and reference purposes only and is not intended to provide or be construed as legal, tax, accounting, investment, financial or other professional advice on any matter.