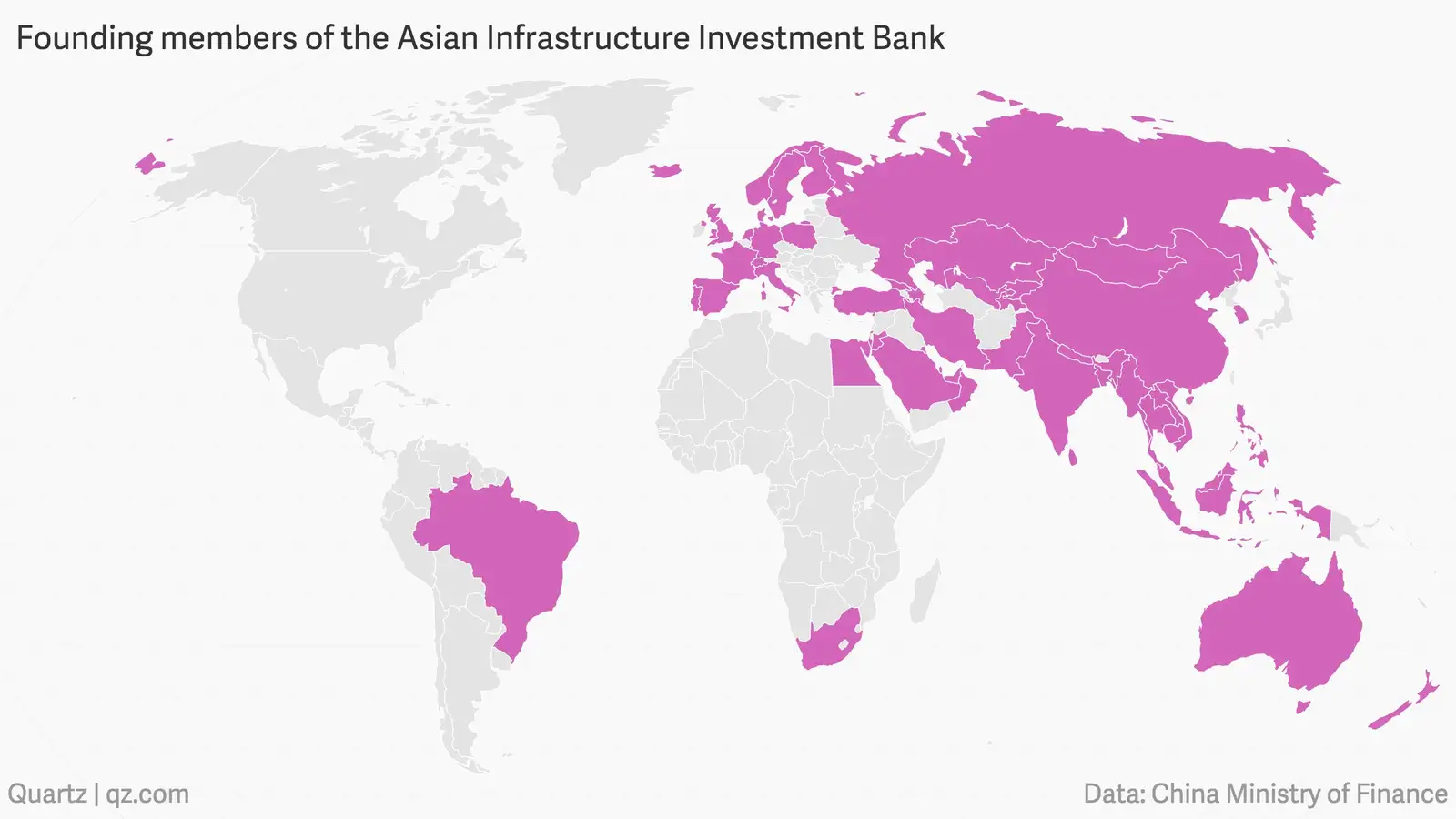

China has announced the 57 founding members of the Asian Infrastructure Investment Bank (AIIB), a Chinese-led initiative seen as a potential rival to the US-dominated World Bank and Asian Development Bank.

Despite US efforts to pressure countries not to join the bank, its official roster includes many of Washington’s closest allies, as well as four of the five permanent members of the United Nation’s Security Council, half of the European Union, and all 10 members of the Association of Southeast Asian Nations.

Sweden, Israel, South Africa, Azerbaijan, Iceland, Portugal and Poland were the last seven countries to apply by the deadline to be founding members of the bank, according to the Ministry of Finance today. Notably absent from the complete list released today is the United States, Japan, Canada, and Taiwan. Canada is still considering joining. Chinese officials, who rejected Taiwan’s application under its own name, say Taiwan is still welcome if it uses a name that signals the island belongs to China.

Some critics worry that Beijing will wield outsize power through the AIIB, using the bank to further its own goals in the Asia Pacific region. Others worry that the institution won’t uphold standards of transparency, debt sustainability, or consider environmental and social issues when funding projects.

Chinese officials have repeatedly said that the bank will be apolitical and sustainable, and that the AIIB’s goal is to fund needed infrastructure projects in the region. Beijing will not have veto power and has promised that AIIB funding will not be tied to Chinese contracts. “AIIB is a bank, not a political organization or political alliance,” said Jin Liqun, a former deputy finance minister tipped as the possible head of the bank, adding that the bank would be “clean, lean and green.”

Economist Joseph Stiglitz points out in the AIIB’s defense that China’s efforts aren’t all that different from American policy after the second world war, when the World Bank was established in order “multi-lateralize” development funds. US concern is less about the bank’s governance and transparency than it is about “America’s insecurity about its global influence,” Stiglitz wrote in the Guardian yesterday.

China’s treatment of Taiwan, which it sees as a rogue province that will one day be returned to the mainland, may be a precursor to heavy handed decision-making to come. In terms of structure, China has proposed giving Asian nations a larger stake in the institution than European ones—splitting a 75% quota between Asian countries based on their economic size, according to Reuters. This set up would, conveniently, give China the largest vote.