Hedge funds are finally making money in Russia again

The people of Russia are having a hard year.

The people of Russia are having a hard year.

After crazy inflation and a currency that spent much of last year in free-fall, they now face a looming recession, with unemployment rising and retail sales falling off a cliff.

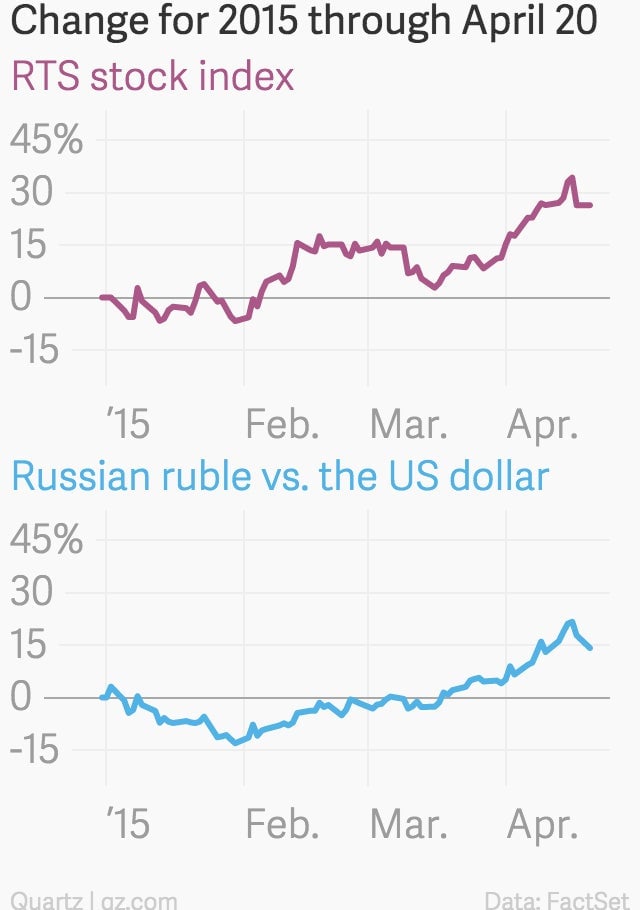

But hedge funds that invest there? They’re having a great year so far. The currency stabilized earlier this year, just in time to catch the RTS stock index pop in February, though March’s returns were far less stellar.

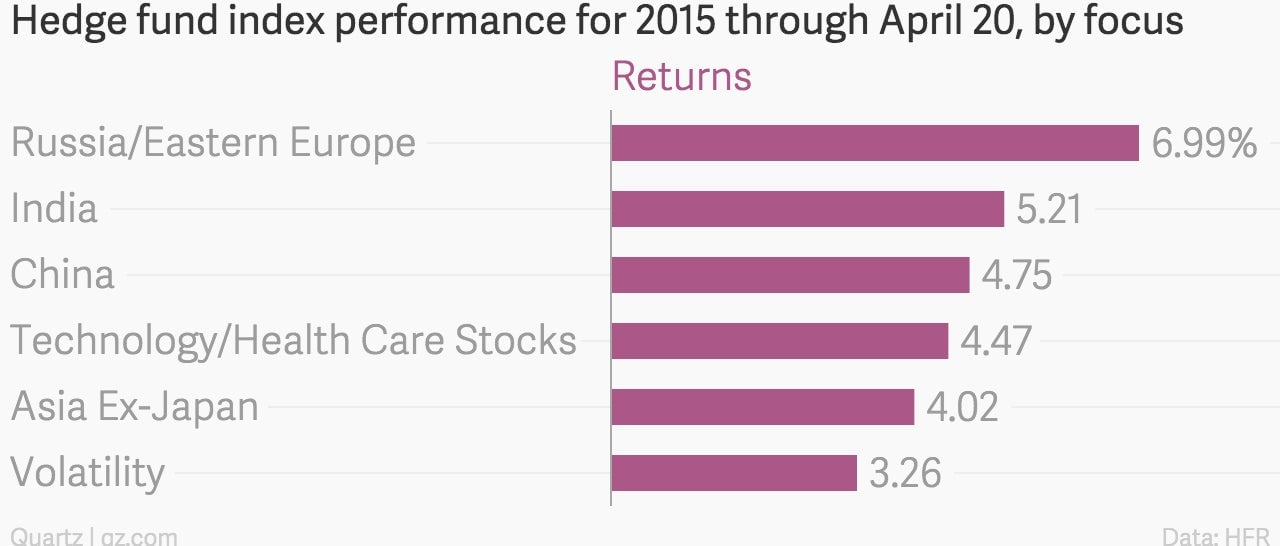

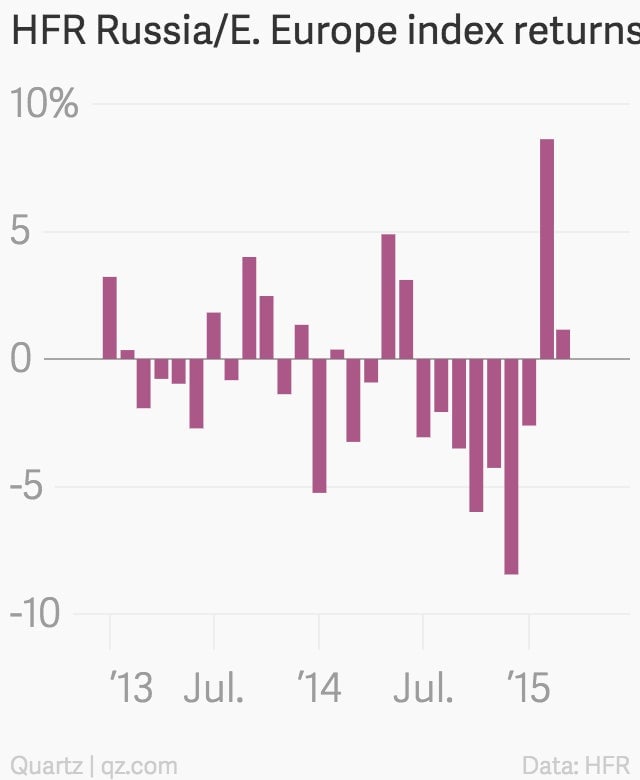

HFR, a research firm that follows hedge fund performance, says that an index of Russia and Eastern Europe-focused funds it tracks are up nearly 7% so far in 2015, besting everything from global health care stocks to frothy Chinese stocks.

It’s important to note, however, that Russia and Eastern Europe-focused funds lost more than 25% last year, which means they have a lot of ground to make up for their investors.