Merrill Lynch’s private banking group is looking out for its clients’ financial interests, so it published a white paper (PDF) on inheritance titled “How much should I give to my family? The risks and rewards of giving”.

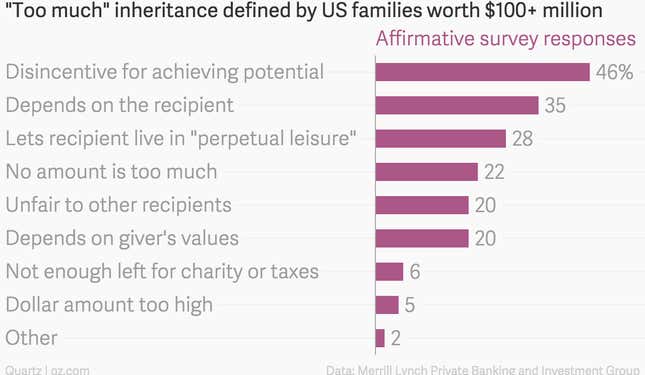

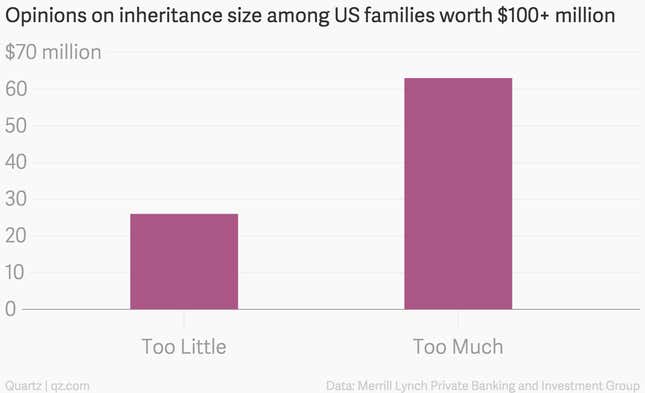

It’s mostly tips on minimizing your tax exposure and instilling financial responsibility in younger generations—”stewardship” is a recurring theme. But for those of us who probably won’t need such tips, there’s still plenty to gawk at. One section uses a survey to break down some of the social parameters around figuring out the appropriate amount to leave, with super-wealthy families eager to strike the right balance between $26 million and $63 million.

But size isn’t the only factor here. The money needs to be spent wisely as well:

The rising generation tends to have a greater sense of ownership of family money when they’re included in family discussions about wealth and develop financial literacy over time. In turn, they’re more likely to view distributions as a privilege and themselves as stewards of wealth, rather than just inheritors.

On the other hand, consider the grandchild who thinks of her grandfather’s monthly distributions as her paycheck. Because of a sense of entitlement to family wealth, an heir like her may be less likely to utilize the money thoughtfully.

Great fortunes are hard to build, but easy to lose.