“The sunnier side of the Atlantic, for once.”

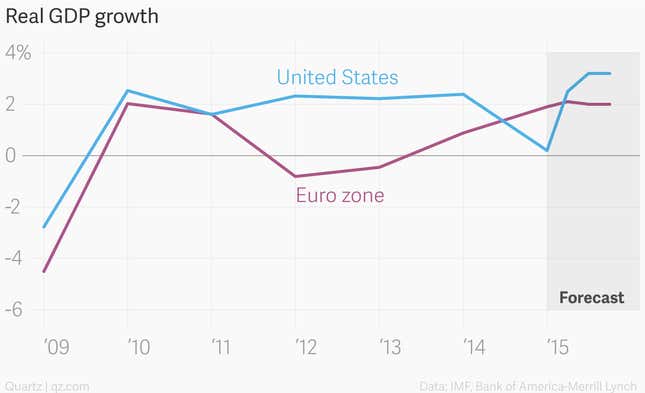

That’s how analysts at Bank of America-Merrill Lynch describe a surprising role reversal in the global economy recently. It may be down mostly to bad weather, but incredibly weak US GDP growth in the first quarter led to something we haven’t seen in a while: The euro zone’s economy is sunnier—that is, it is expanding more rapidly—than America’s, at least for the moment.

Bank of America’s forecasters reckon that first quarter growth in the euro zone will come in at an annual rate of around 2%, well above the 0.2% growth that the US could muster in the same period. (The euro zone’s official data will be released on May 13.)

Although this gap is expected to last very long, a resurgent euro zone is good news for the global economy, especially as it comes during a blip in US growth. Bank of America’s analysts reckon that soft growth in the US can’t be blamed solely on the weather, and stems from weakness in business investment that clouds an otherwise positive forecast.

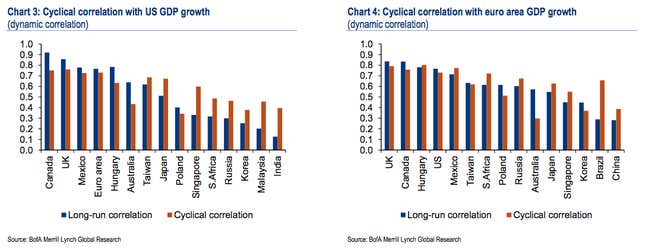

A one percentage-point drop in US GDP growth typically drags down the world economy by 0.3 of a percentage point, with neighbors like Canada and Mexico taking the brunt of the pain. That makes the upturn in fortunes for the euro zone—driven by Germany and Spain in particular, and by the European Central Bank revving up its printing presses in general—more heartening for countries that rely on the Europeans buy more of their stuff.

Beyond its immediate neighbors, the countries whose growth tracks the euro zone’s economic cycle more closely than the US are somewhat surprising. Bank of America tracked “dynamic correlations”—the econometrics are explained in this paper (PDF)—and found that the economies of Brazil and South Africa look more closely correlated with the euro zone than the US, particularly during short-term shifts in business cycles.

Correlation does not imply causation, of course, but “this suggests these economies need not fear a scenario of moderately less US growth,” the analysts conclude. And both Brazil and South Africa could use a boost right now.