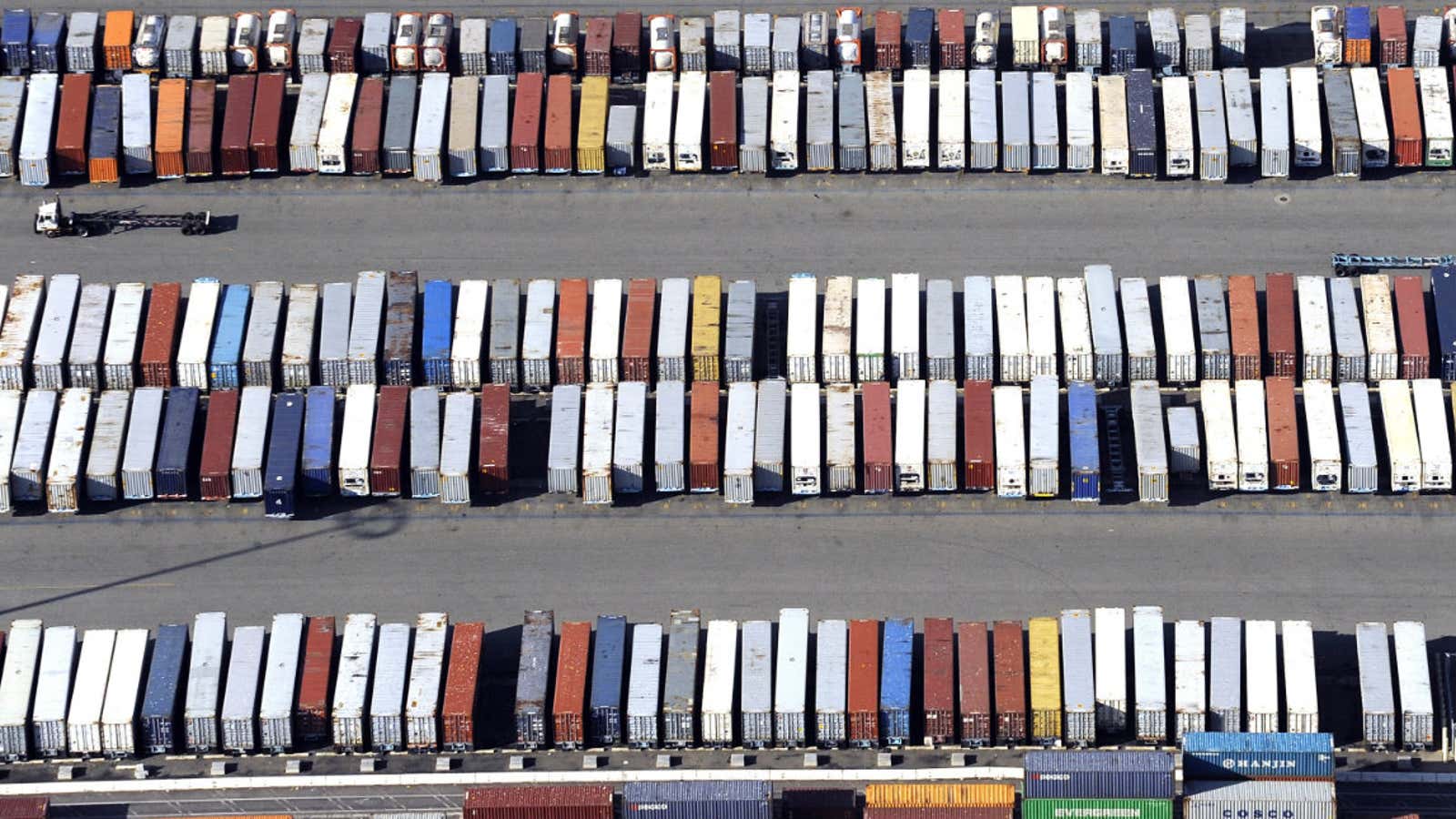

Americans are buying in bulk again.

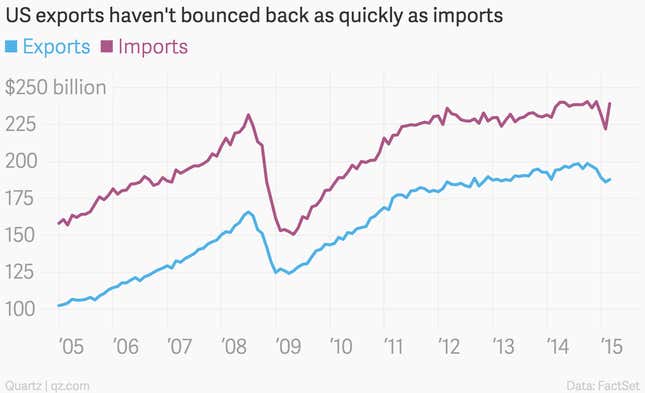

The US Commerce Department’s trade numbers are in, and imports are surging. This comes after a sharp slowdown over the last few months, and it puts the US trade deficit at $51 billion, the highest it’s been since 2008. The US economy imports a lot when it’s really humming, so this should be encouraging news after a particularly weak first-quarter GDP reading.

The strength of the US dollar might still be holding back exports, though. They haven’t returned with quite as much force.

There are a few different ways to read the data.

Optimists on the US economy will point out that more than half of the import growth—$9 billion out of $16.4 billion—came from consumer goods.

A more neutral take is that the import comeback is merely a function of backlogs getting cleared from the loading docks after the West Coast port slowdown earlier this year. That’s the way most economists are framing things. Barclays notes that the data on imports from Asia, with an additional $13.1 billion coming from China and Japan alone, go a long way toward supporting that view.

Pessimists will warn that the new figures mean the first quarter will look even worse than it did before, since sluggish exports were a drag on growth and the trade deficit turned out to be bigger than the estimates that the government factored into its initial GDP report.

“This means that we will likely see, from trade alone, a downward revision to real GDP by over half a percentage point,” Bank of Montreal economist Jennifer Lee wrote in a note to clients. “In other words, that measly 0.2% a.r. [annual rate] rise in Q1 GDP will look pretty good after the revision that will come out on May 29th.”