Tim Armstrong has long argued that technology companies could help make advertising in all forms of media more efficient. Now he could wind up proving that tech companies don’t need traditional media much at all.

About a decade ago, as the head of ad sales at Google, Armstrong was obsessed with applying Google’s success at selling search advertising to offline media. He helped convince the company to try to sell ads in magazines, on radio, and on television.

His logic was that those media accounted for by far the biggest pools of advertising revenue, but Google could sell the ads with its own superior technology, extending its reach and enlarging its profits along the way. He wanted to bridge online to offline media, and went around drawing a stick man sketch on napkins to explain how things should look:

Armstrong’s plans at Google didn’t work out. Google’s TV, radio, and print initiatives all quickly fizzled, hobbled by the unwillingness of media companies and ad agencies to welcome a Silicon Valley interloper into their businesses. Armstrong eventually decamped in 2009 to become the chief executive of troubled AOL.

Today’s $4.4 billion deal to sell AOL to Verizon is another powerful signal of how internet companies are invading the core revenue lines of traditional media, like the ones Armstrong unsuccessfully pursued while at Google. A central rationale for the acquisition is that it gives Verizon AOL’s technology for efficiently selling and targeting video ads to phones, laptops, TV sets, and whatever other devices people may use in the future.

Armstrong’s earlier efforts to bridge online to offline seem quaint now that all of media consumption is effectively moving online, whether it’s via an internet-connected cable set-top box or a smartphone. Offline—with vestigal exceptions such as print editions and terrestrial radio—is now online, and the revenue has followed.

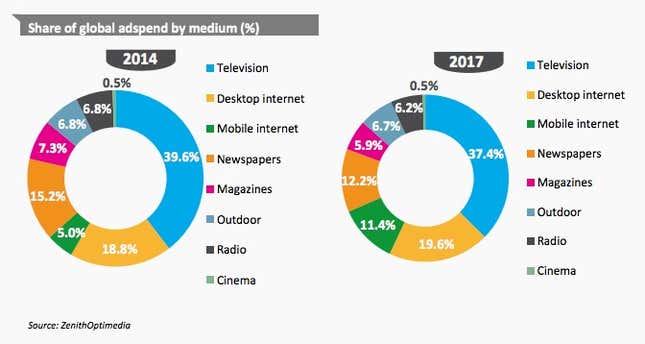

In 2005, online advertising represented less than 4% (paywall) of global advertising revenue, according to ZenithOptimedia. By last year, that was up to about 24%, and it’s projected to hit 31% by 2017, as these charts from ZenithOptimedia’s annual forecast in December show:

Online advertising is forecast to be the only area of market share growth across the next few years.

Armstrong’s tenure at AOL has included several miscues in media, like Patch, the local news sites that he eventually had to ratchet back, and Huffington Post, which hasn’t generated as much revenue as he might have hoped. But Armstrong’s instinct that the advertising industry would migrate toward technology has proven correct over time, and that might prove to have been the only bet that mattered.