“That’s a currency war,” Brazil’s finance minister, Guido Mantega said on September 20. After the US Federal Reserve announced an expanded asset-purchase program—QE3—to boost US employment, Brazil’s central bank responded by selling currency swaps to drive down the Brazilian real; the Central Bank of Japan followed the US lead on September 19 and increased its asset purchase program to protect an appreciating yen.

It may just feel like a recap of a previous devaluation arms race, which prompted Mantega to coin the term “currency war” in 2010. That time too, countries devalued to remain competitive in response to rounds of quantitative easing by central banks trying to alleviate the financial crisis. And as we’ve written elsewhere, the BRICs, once again, aren’t happy. It’s not just that a depreciated dollar will make US exports more competitive, but also that these countries are heavily invested in low-yield US sovereign debt even as many forbid their citizens to invest much money in foreign markets. Never mind that these wounds are by design, to encourage an export-driven expansion.

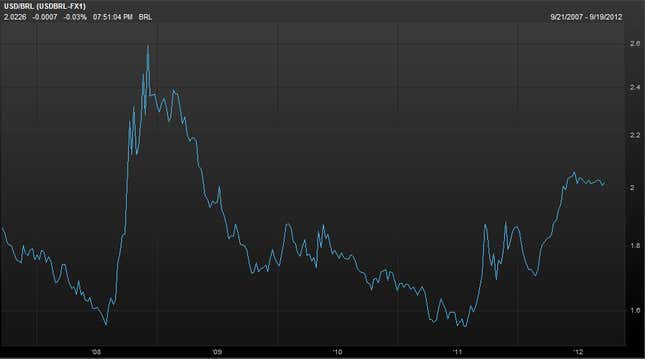

But this time the arguments have less salience. Two years ago the IMF had not yet given the OK to capital controls in emerging markets, and Brazil’s booming economy made its currency an inviting target for speculators. Now, with growth sluggish and a negative current-account balance, the real is no longer the speculators’ favorite. It’s still worth less relative to the dollar than it was when Mantega first launched his complaint:

Or, to put it another way, the global demand problem is more important right now than foreign exchange rates for export-driven economies like Brazil, India and China who are falling victim to slowing growth. While monetary moves might put pressure on their currencies and their reserve assets, they’ll want healthy foreign markets buying their goods, since domestic demand isn’t yet strong enough to support growth. Mexico’s central bank chief, for instance, applauded the Fed’s action as a boon for his own economy. Plus, if easing leads to a boost in commodity prices, as some analysts expect, major exporters of those goods—like the BRICS—will see some benefit.

Currency wars are looked at with some disdain not just by exporting countries, but also by monetary hawks. It’s worth remembering, though, that one of the key features of America’s recovery from the Great Depression was the race to ditch the gold standard—essentially, a currency war of epic proportions.