Americans are dipping their toes back into the housing market

In a sign that America’s housing market is strengthening, housing starts (the number of new residential construction projects in a given month) turned around last month, and there appears to be increasing demand for some of that new inventory.

In a sign that America’s housing market is strengthening, housing starts (the number of new residential construction projects in a given month) turned around last month, and there appears to be increasing demand for some of that new inventory.

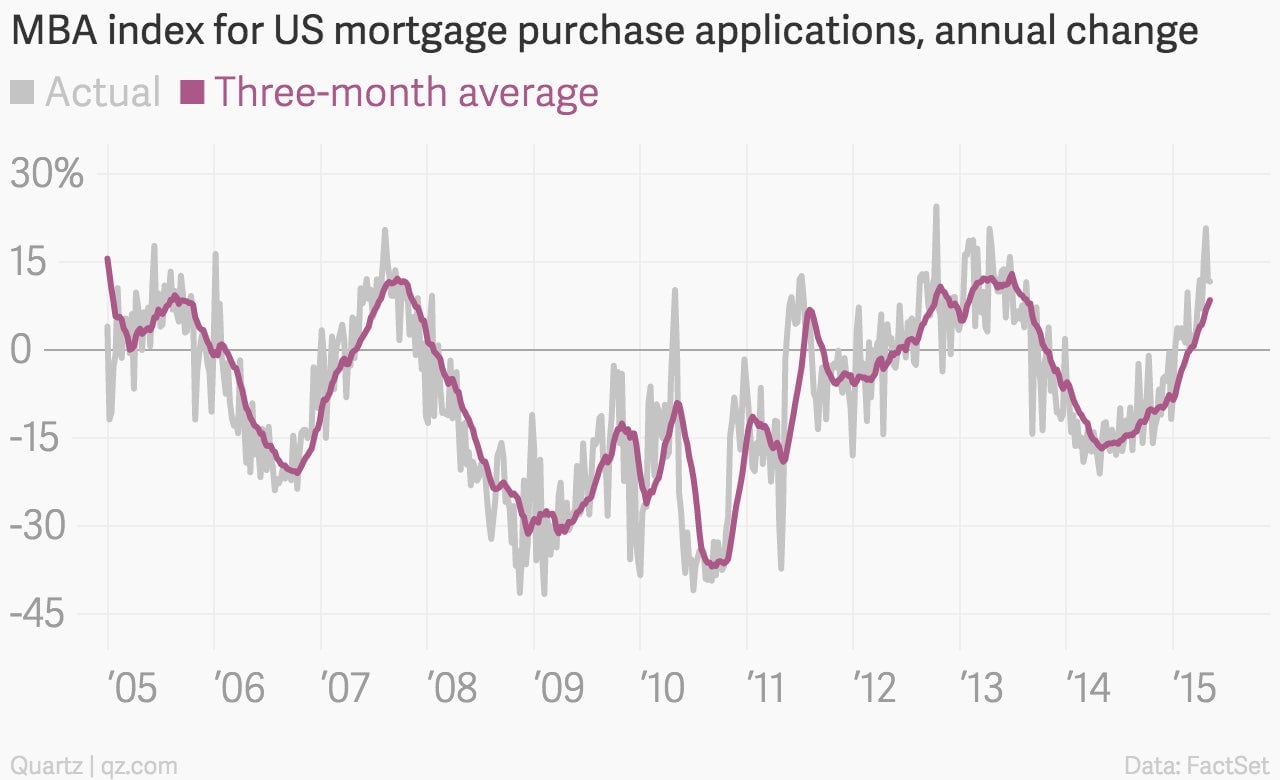

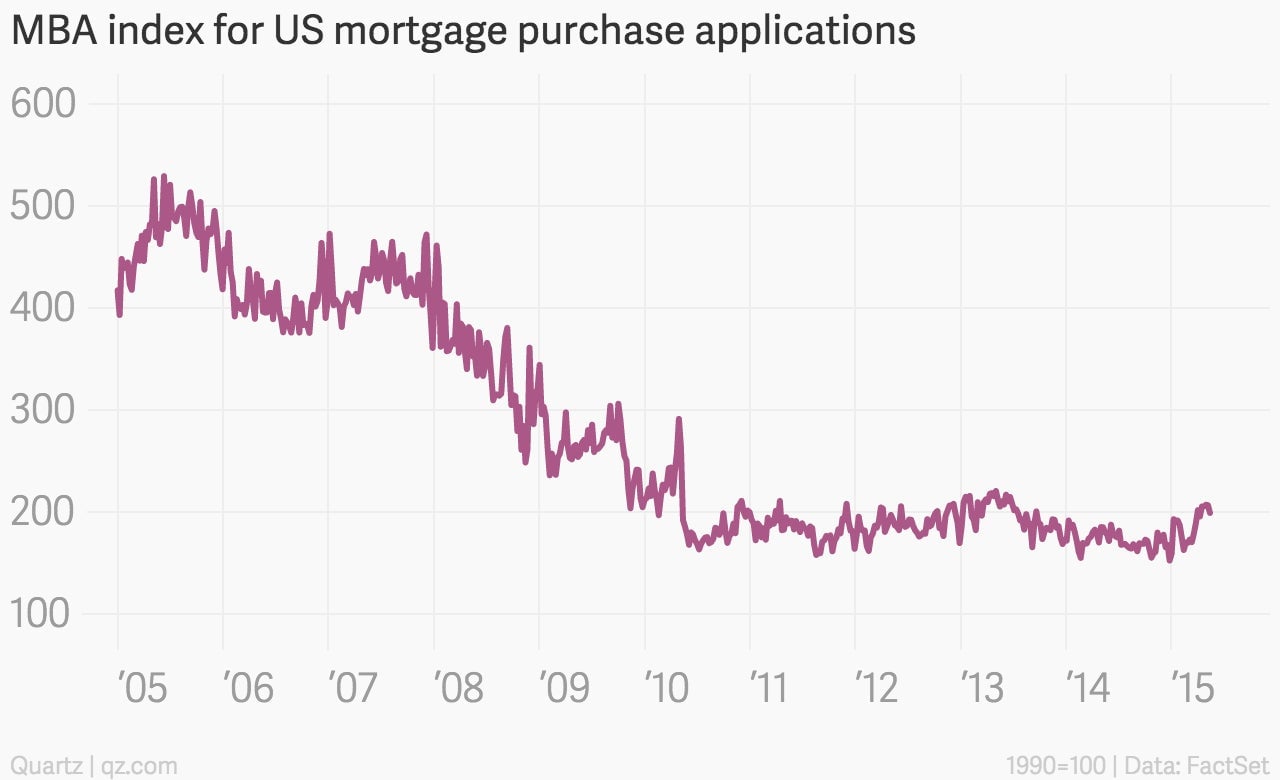

The US Mortgage Bankers Association released its weekly look at the country’s mortgage activity, and while overall mortgage applications (which include mortgage refinancing applications) are slowing, purchase growth has continued to accelerate over the past few months. Last week’s purchase index number, which is based on an industry survey of mortgage activity related to home sales, rose more than 11% compared with the same week of the previous year.

Granted, that growth is coming off of a very low base, given that purchases dropped dramatically after the recession.

Tight credit and stagnant income growth made it harder for Americans to buy homes after the financial crisis. Still, historically low interest rates boosted the number of homeowners seeking to refinance their mortgages (refinancings made up more than half of all mortgage applications last week) in recent years.