In the race to lead the solar sector, China will surpass Germany this year, which had the biggest solar market in 2012. In a note to its investors, Deutsche Bank predicted China’s solar market will more than double to 10 gigawatts capacity this year, up from 4 gigawatts, making it the world’s biggest solar market. And that’s thanks partly to, ahem, Germany.

The transformation of Germany’s energy market

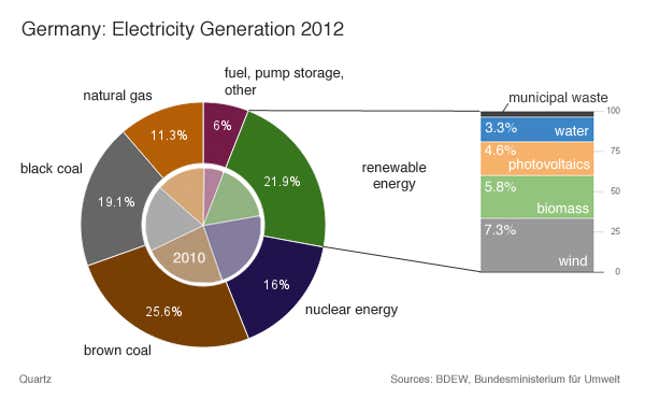

Germany is in the midst of its energy transformation, or Energiewende, which is causing a stir both on the political stage and in the country’s leading industries. The plan to switch from nuclear to renewable energies has become even more expensive than the government had originally thought it would be. In May 2011, two months after the Fukushima disaster in Japan, the German government decided to abandon all of its nuclear power plants. With this decision, Angela Merkel reversed her position on nuclear energy, embracing the values of the Greens whose popularity was then at an all-time high. The plan was to shut down eight nuclear plants immediately and shutter the remaining nine plants by 2022. Merkel also planned to increase the share of renewables in the country’s energy mix to 35% by 2020.

The country’s green electricity producers received more than €20 billion (about $26 billion) in subsidies in 2012, €17 billion (about $22 billion) paid by German consumers, marking a new record in the country’s expansion of renewable energies that started in the 1990s.

The subsidy, called EEG-Umlage is a guaranteed fixed sum paid to renewable energy providers for the energy they produce, which is more than the price they sell it for. The subsidy is paid for by consumers as a feed-in tariff. For solar power, the subsidy is paid both to solar park owners and consumers with solar panels on their roofs. The subsidies helped create a solar power boom.

How German subsidies helped Chinese companies

Although this helped Germany increase its share of renewable energies to 22% last year, it didn’t really help the German photovoltaic (the process of converting solar into electricity) industry, because three-thirds of the solar panels are imported from Asia, mostly China.

If anything, the subsidy has actually had a negative economic effect on Germany, said Manuel Frondel of RWI, a German economics institute.

According to Frondel, Chinese solar company Suntech Power has greatly benefited from the German energy transformation. The company, founded in 2001, became market leader in 2008 and noted an uptick in demand in Germany in its 2011 earnings presentation, because the government surrounding Merkel announced a reduction in subsidies for photovoltaics in 2012. Its sales have gone down last year, Suntech now struggles with an enormous oversupply on the Chinese market, closing a quarter of its solar cell capacity. Chinese Company LDK Solar has been struggling as well, with a debt of more than $2 billion, but has won the support of investors and lenders. The Chinese government has added 7 billion yuan (about $1.1 billion) to its solar sector subsidies, taking the total subsidy to 13 billion yuan ($2.2 billion) this year.

Solar power is not efficient enough

Because of their subsidies, Chinese companies have been able to flood the European market with products under market price, putting pressure on European solar companies. Last October, German company Siemens announced it will pull out of the solar sector. Three years ago, it had bought Israeli solar heat company Solel, dreaming of a “steeping success story.” But the Israeli company turned out to be a disaster.

Chinese companies have found a huge market in Germany. Customers and companies rushed to benefit from the subsidy before it was cut invested into solar plants and panels.

The boom was enough to raise the feed-in tariffs to a record high. This year, Germans will have to pay €0.05 (about $0.07) per kilowatt hour in tariffs, up from €0.04 (about $0.05). That’s about €175 (about $230) a year for a 3-person-household, on top of other increases in the electricity rate. Manufacturers complained about high electricity bills as well, although many companies that highly depended on energy were excluded from paying for the subsidy. To lower the prices, the government had reacted with drastic cuts to the solar subsidy last year. But although demand for solar installations fell in 2012, the number of solar plants installed with a total capacity of 7.3 gigawatts was double what the government had expected.

Germany’s government has been highly criticized for wasting money on the country’s least efficient renewable energy. According to Der Spiegel, 56% of the green electricity subsidies go to solar energy, which has only a 21% share of the power produced by all renewable energies.

Solar power seems a risk-free business at the cost of the people, but the technology in its current state wasn’t ready for the drastic expansion the German market has seen. Solar lobbyists have often talked about the 20 gigawatt capacity of German solar plants, which would be about the same output as the nuclear power plants have. But that capacity is only achieved with the right exposure and temperature. Further, Germany’s focus on solar of all things is interesting because the country, on average, has only about 1,600 sun hours, half of the hours of Spain. The cold, dark winter months mean fluctuations in the energy provided throughout the year, so Germany has to to fall back on reserve power plants or power provided by its European neighbors.

Germany will cancel the subsidy for the solar sector as soon as the solar plants contribute 52 gigawatts to the power grid. Currently, Germany is at 32, meaning the subsidy might end in 2015. China, meanwhile, plans to increase its subsidies, likely extending its lead even more.