Traders love a good oil war.

That message has been plain for months, as oil prices in London, New York and elsewhere have been bid up more than 30% since bottoming out at about $45 a barrel in January. In action this morning, traders pushed prices up another notch (paywall) right after the OPEC cartel announced at its bi-annual meeting in Vienna that it will maintain its flood of oil at the same rate for at least another six months.

OPEC’s move amounts to continuation of an unstated declaration of war that it commenced last November against US shale drillers, whose millions of barrels of production have undermined the cartel’s four-decade-long domination of global energy. Led by Saudi Arabian oil minister Ali al-Naimi (above and left), OPEC believes that it has much greater staying power than US shale, and will ultimately crush the upstarts.

Naimi has made believers of traders, who have watched US drilling rigs halt their work in the face of the lower prices. In a report today, Baker Hughes said the number of working US rigs fell to 889 last month, down from 1,859 a year ago, a 52% drop.

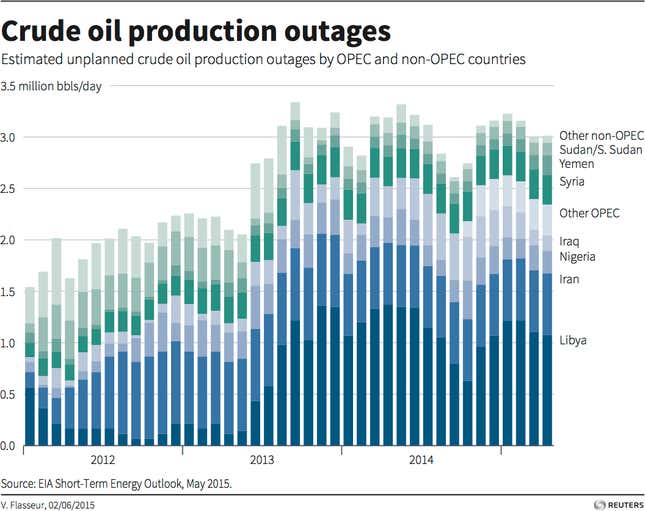

A sharp rise in the value of the dollar this morning shook the traders’ ebullience, and they quickly bid prices back down following the pop after OPEC’s announcement, since a stronger dollar makes oil more expensive and thus could tamp down demand. But by and large, as the war has gone on, traders have seemed largely inured to dynamics that in past years roiled the market, such as the persistence of geopolitical upheaval, which has resulted in some 3 million barrels a day of production capacity being idled, an unusually high volume. Look at this chart.

OPEC’s weapon of combat is the excess of oil that it pours onto the market month after month. Its stated quota—the cap that it confirmed today—is 30 million barrels a day. But it actually pumps much more. According to a count by Reuters, the volume has been over 31.2 million barrels a day in recent weeks. Bloomberg puts the OPEC output at 31.58 million barrels a day.

This glut is fed mostly by Saudi Arabia, which has raised its production by 500,000 to 700,000 barrels a day since November; and Iraq, whose output has gone up by 410,000 barrels.

During the OPEC summit, Iranian oil minister Bijan Namdar Zanganeh said his nation will increase its own production by 1 million barrels a day should a nuclear deal be concluded. In a note to clients, Citigroup analyst Ed Morse telegraphs market havoc because all that oil will simply spill out onto an already glutted market. “Expecting the Saudis to make room for Iran or even Iraq seems unlikely at best,” Morse said.