Six sorry charts on Deutsche Bank’s broken promises

It wasn’t a happy time at the top for Anshu Jain and Jürgen Fitschen. The two are stepping aside as co-CEOs of Deutsche Bank, making way for former UBS finance chief John Cryan can take over.

It wasn’t a happy time at the top for Anshu Jain and Jürgen Fitschen. The two are stepping aside as co-CEOs of Deutsche Bank, making way for former UBS finance chief John Cryan can take over.

The German banking giant suffered a series of setbacks—and a general sense of malaise—since the duo took over in mid-2012. Let us count the ways…

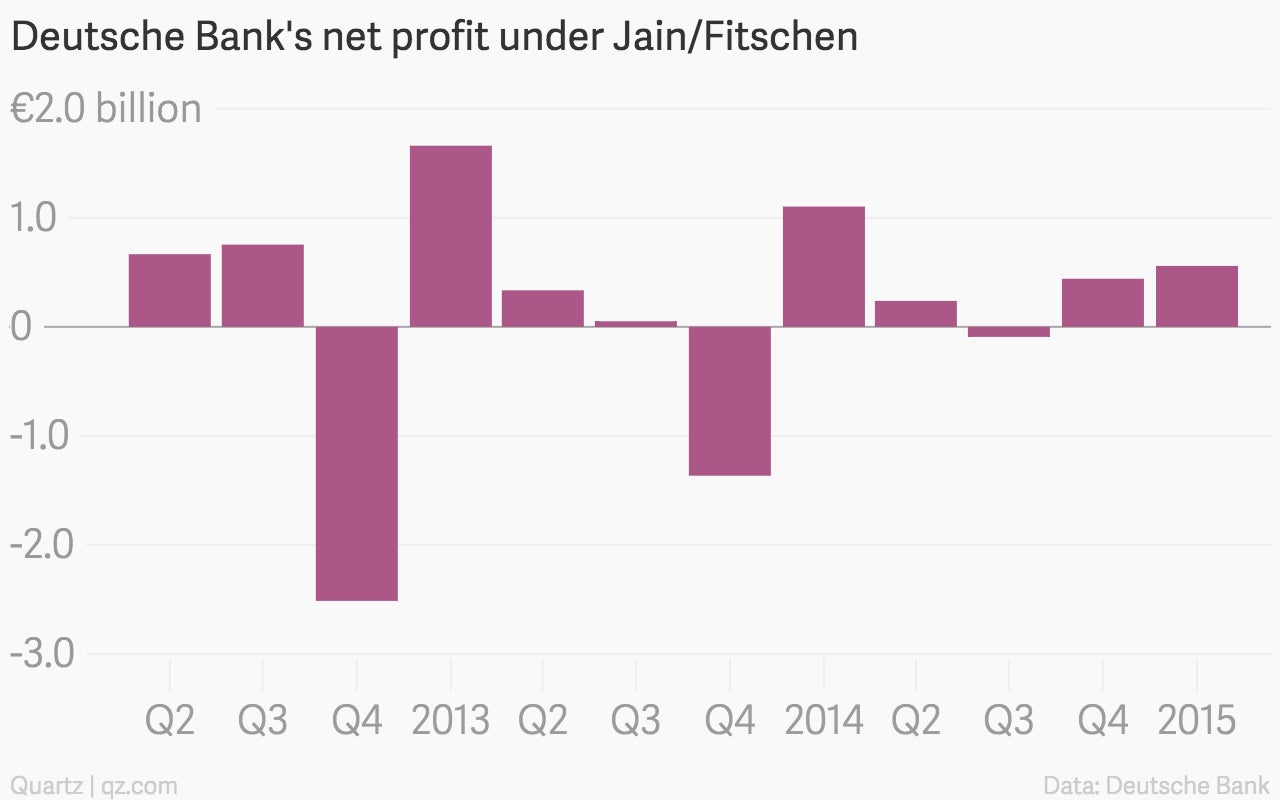

Patchy profits

The business never gained much momentum, generating €1.8 billion ($2 billion) in cumulative net profit over the CEOs’ tenure to date. UBS, which has had its fair share of troubles over the same period, made the equivalent of more than $5 billion over the same period.

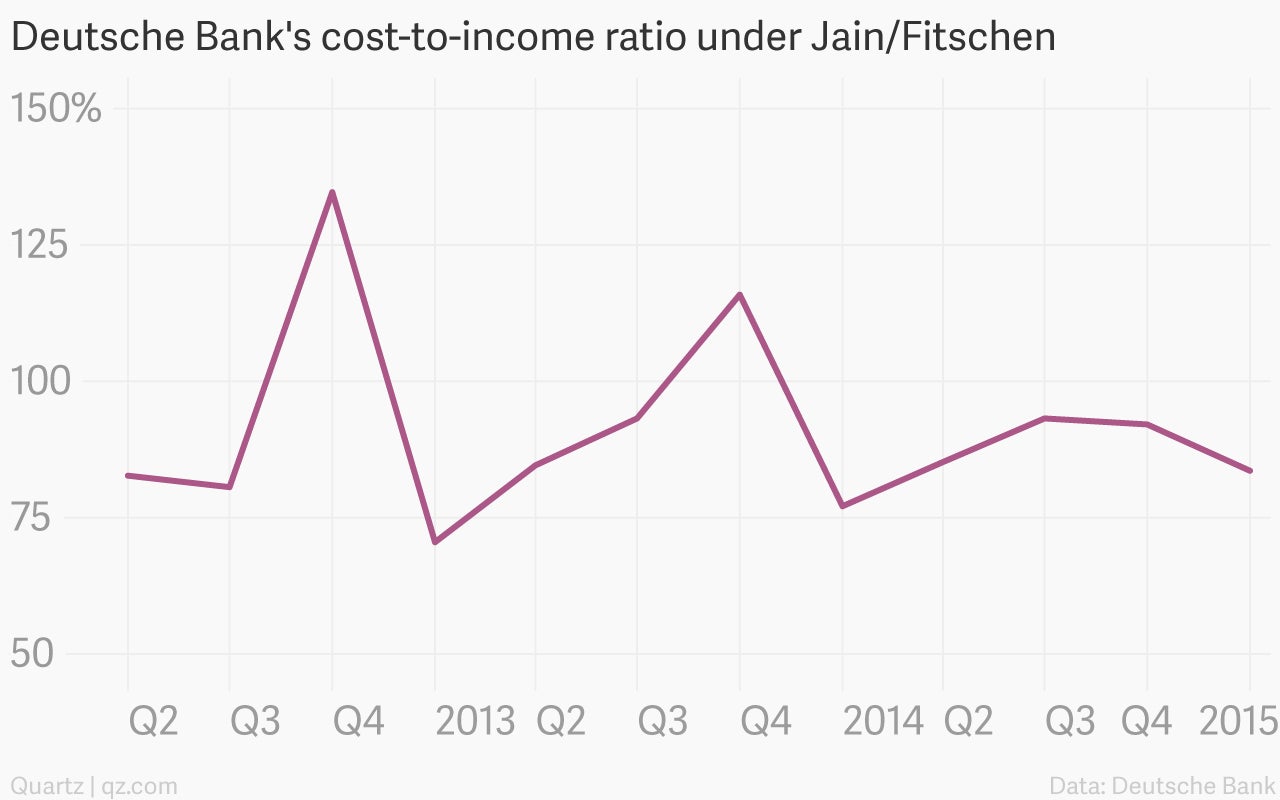

Sticky costs

In a series of grand strategy plans over the past few years—”Strategy 2015+“, “Strategy 2020“—Deutsche Bank has pledged to slim down its sprawling operations. Like other big banks, focus is the watchword: marginal offices are shuttered; risky and expensive operations wound down; investment decisions are vetted more strictly.

The problem for Deutsche has not been strategy but execution. For example, it has failed, by some distance, to bring its cost-to-income ratio below its target ceiling of 65%:

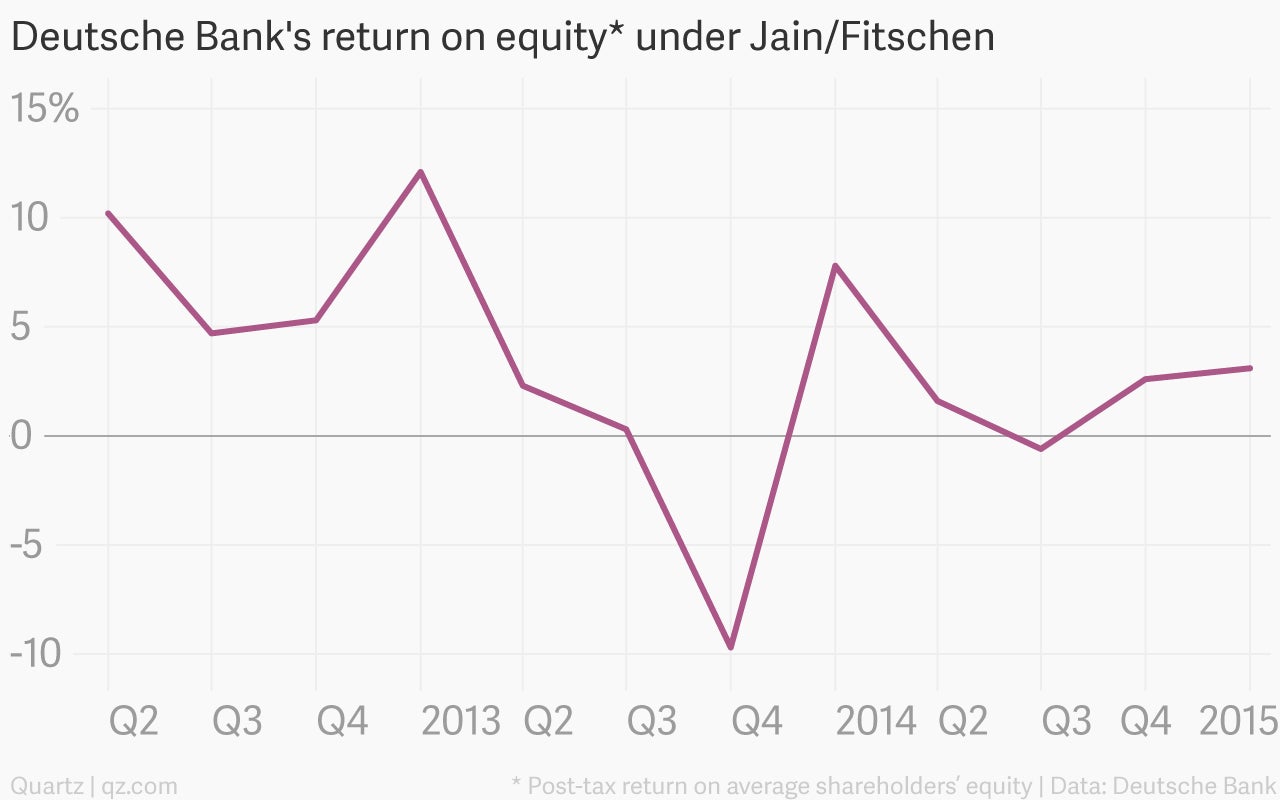

Weak returns

Boosting return on equity has been another major source of disappointment. Shortly after taking over, Jain and Fitschen announced a goal to reach a ratio of 12% by 2015. This has since been cut to 10%, but even that looks a tall order given recent history:

Low valuation

Investors have punished Deutsche Bank for its persistently poor performance—its market value has consistently traded at a fairly hefty discount to the book value of its assets:

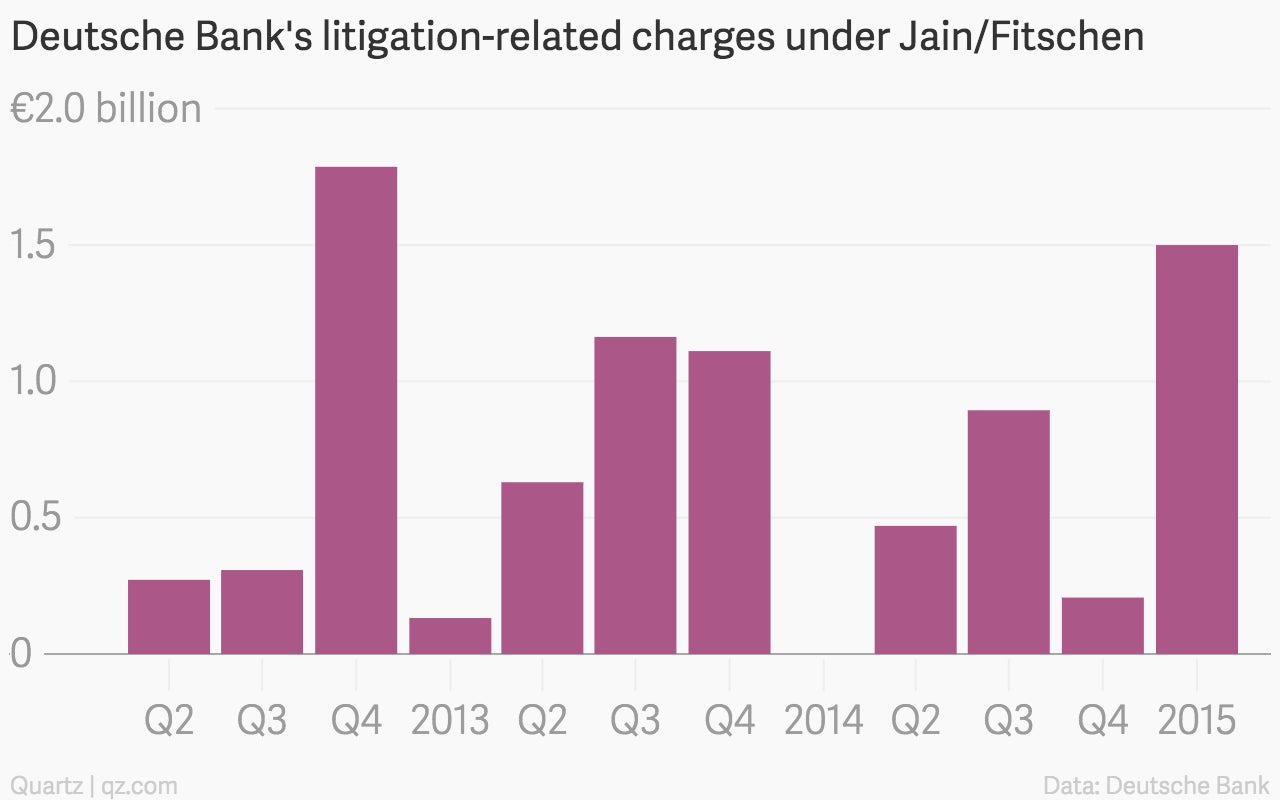

Endless litigation

We once dubbed Deutsche Bank “a legal defense fund with a bank attached.” It hasn’t done much to disabuse that notion in recent quarters—on top of more than €8 billion in litigation-related charges under Jain and Fitschen, the bank still faces potential payouts for allegations of misdeeds in foreign-exchange trading, money laundering, and several other areas.

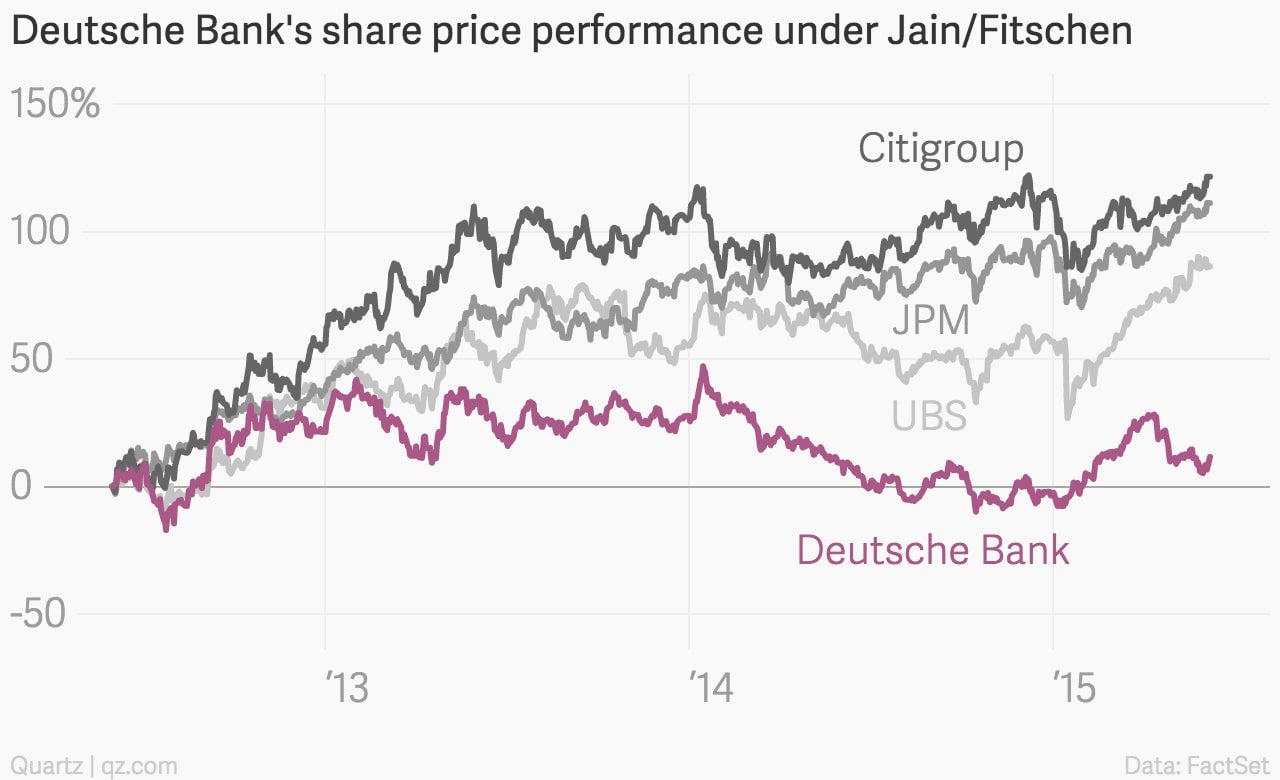

Stagnant shares

Deutsche Bank’s stock jumped on the news of its co-CEOs’ departures. But that wasn’t nearly enough to close the gap on the bank’s rivals, given its market underperformance over the past three years:

Will a new boss turn things around? Cryan has sat on Deutsche Bank’s supervisory board since 2013, so he isn’t untainted by the bank’s recent stumbles. But the former UBS CFO’s track record on cleaning up the Swiss bank after it took a tumble—make no mistake, one that was much worse than Deutsche’s during the depths of the subprime financial crisis—is giving shareholders hope.

Putting a hard-nosed CFO-type in charge also demonstrates a commitment to executing strategy—particularly on costs—that has been lacking under previous management.

“We think that Deutsche is transitioning from one of the least credible management teams in investors’ minds to one of the most highly regarded,” a Jefferies analyst wrote in a research note. “Market confidence on delivery should clearly increase.”