Think back on the state of technology in the 1990s. Among other analog experiences, drivers relied on fold-out gas station maps or directions scrawled by hand to find unfamiliar destinations. In-car GPS navigation systems didn’t even become available until 2000, when a bill passed that freed up satellite signals for civilian use.

All of a sudden, navigation was up for grabs. Automakers like GM, Ford, and BMW quickly rolled out built-in systems, and a slew of tech companies churned out their own standalone devices. Everyone wanted to control the few square inches in the car that told you how to get from here to there. Now, a similar kind of battle royale is set to happen in self-driving cars.

Manufacturers are still three to five years out from actually putting autonomous vehicles into production, but journalists are already reporting that driving—if you can call it that—these prototype vehicles is so delightfully easy that it verges on boring. This ease of use spells out huge opportunity for legacy tech companies. If drivers no longer need to keep their eyes on the road and hands at ten and two, what’s going to get their attention instead?

First, it’s worth pointing out that at least for the next several years, “autonomous vehicle” is a bit of a misnomer. For instance, it will be up to the user to program the vehicle’s speed. And in the event of a near-crash, the driver needs to be ready to seize control of the wheel.

But these technologies will quickly become self-sufficient. A study by J.D. Power surveyed 5,300 customers who had bought a car in the past five years, and found that the five technologies consumers loved most were all semi-autonomous features like blind spot protection, night vision, collision prevention systems, rearview mirror cameras, and self-healing paint. The five least interesting technologies to drivers were health and wellness systems, hand gesture controlled cockpit features, hand gesture controlled seats, biometric driver sensors, and haptic touch screens. In short, more human control inspired less interest.

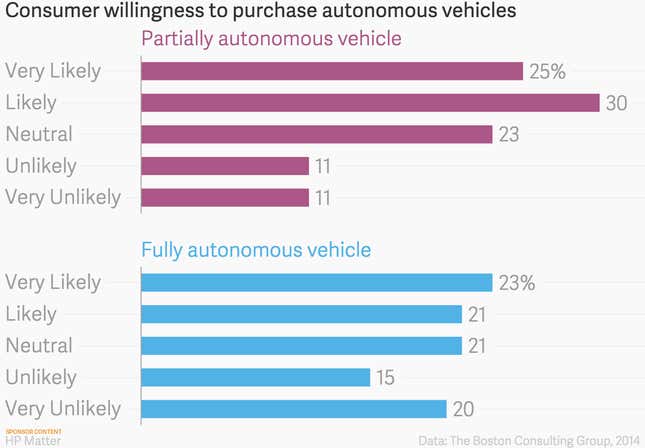

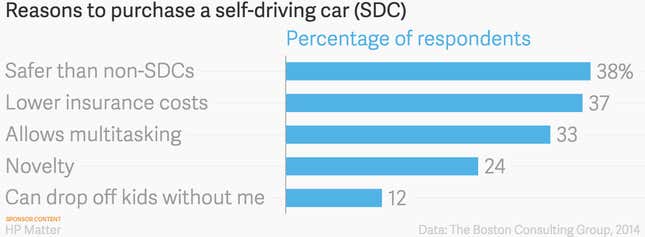

Figures from a study by Boston Consulting Group on consumer willingness to pay for autonomous features aligns with these findings. Around 40 percent of consumers surveyed said they’d be interested in a car that drives itself on a specific route. Likewise, 40 percent said they would like a car that can find parking spots and park itself.

Still, it can be difficult to separate consumers’ interest in these features from their willingness to pay for them. The Boston Consulting Group study asked respondents how much they’d be willing to pony up for automated features, and the results show a kind of upside down bell curve: around 20 to 28 percent said they wouldn’t pay more than $999. But the next largest group, from around 10 to 17 percent, said they would pay over $5,000 for features. The J.D. Power study broke down participants by generation, and while all generations cite price as a factor in what they’ll purchase (it comprises about 25 percent of the total decision making process), it’s the market demand from Generation Y that is driving the demand for new technology. Generation Y, or those born between 1977 and 1994, said they would pay an average of $3,703 for new features compared to $3,007 and $2,416 for Gen-Xers and Baby Boomers, respectively.

If that last bit is befuddling automakers, it’s because senior drivers (along with the disabled) stand to benefit most from robotic assistance on the road. Nevertheless, the data suggest that the success of in-car technology will hinge on luxury, not utility, and carmakers are already demonstrating they understand the trend. Consider the Mercedes F 015 Luxury in Motion concept car, on display at this year’s North American Auto Show. It has four rotating lounge chairs that echo the design of aristocratic horse-drawn carriages and limousines.

As with other luxury goods, design and functionality will need to be superbly inseparable in autonomous vehicles. Technology companies like HP, Google, and Uber are rising to the task, forging partnerships with automakers and developing stand-alone technologies that will usher in a new era of self-sufficient transportation. From fully integrated navigation systems to advanced sensory telematics, these companies are creating the technologies that will put us one passenger’s seat away from a driverless future.

Read more from HP Matter’s Idea Economy issue here.

This article was produced on behalf of HP Matter by the Quartz marketing team and not by the Quartz editorial staff.