In the year 2000, some European countries were already pioneering the big build of one renewable energy technology, onshore wind. The UK wasn’t one of them. Instead, German, Danish, and Spanish turbines accounted for 85% of the wind energy (pdf) produced in the EU, supported by national subsidy regimes.

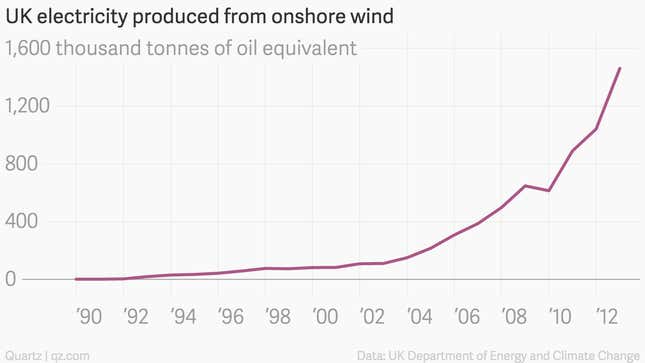

But in 2002, the UK began in earnest to build. The driver was one particular subsidy: the Renewables Obligation, or RO, introduced that year. The money came from consumer bills, and was targeted at the construction of wind farms and other moves toward less polluting sources of electricity. This is what happened, and what has made the UK the third-largest producer of onshore wind energy today:

(The UK is also by far the largest producer of offshore wind power in the world.)

But Britain’s Conservative government now says that new onshore wind projects will no longer be able to access the RO as of April 2016. It’s part of a move towards reforming the country’s entire electricity market, and is in line with European guidelines designed to wean the industry off support.

The problem, as the UK wind industry sees it, is the sudden change in tack. In the autumn of 2014—before the government won a new term in office at May’s general election—it promised the RO subsidy would continue for new onshore wind until March 2017 (pdf, page 37).

More than money, the industry says it craves certainty. Because investment decisions on large infrastructure projects must be made far in advance, a stable regime—one in which the government keeps its promises—is vital to securing commercial investment: the very thing that will allow the subsidies to be removed without leading to a collapse.

Amber Rudd, the energy and climate change secretary who replaced Liberal Democrat Ed Davey after the election, said in a statement that the government wants “to help technologies stand on their own two feet, not encourage a reliance on public subsidies.” The attitude is, essentially, that the subsidy worked and now it’s time to move on. It’s seeking to soften the blow by allowing some projects a period of “grace.”

But what the industry fears is a reversal like that in Spain, where a cash-strapped government removed solar subsidies so suddenly that the industry, and the investment climate, collapsed.

Renewable UK, the wind industry trade body, thinks that’s a possibility. Its head Maria McCaffery called the move “a chilling signal”, not just to wind power, but to investors in general.