Follow the money: Five surprising charts on US cash

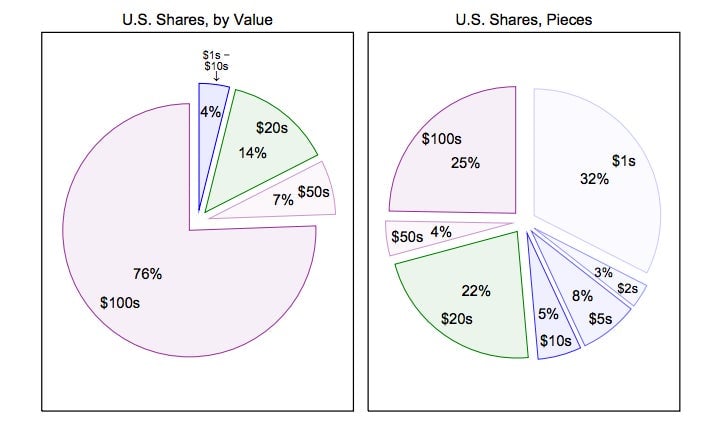

The Federal Reserve recently offered up an interesting report on the supply of greenbacks floating around the United States and the rest of the world. It goes beyond the regular updates available on the US currency supply and includes a slew of charts. This is a topic that we’ve written about before, including the somewhat surprising fact that roughly 80% of US currency outstanding, by value, is in $100 bills. But in terms of actual bills, about 25% are 100s.

The Federal Reserve recently offered up an interesting report on the supply of greenbacks floating around the United States and the rest of the world. It goes beyond the regular updates available on the US currency supply and includes a slew of charts. This is a topic that we’ve written about before, including the somewhat surprising fact that roughly 80% of US currency outstanding, by value, is in $100 bills. But in terms of actual bills, about 25% are 100s.

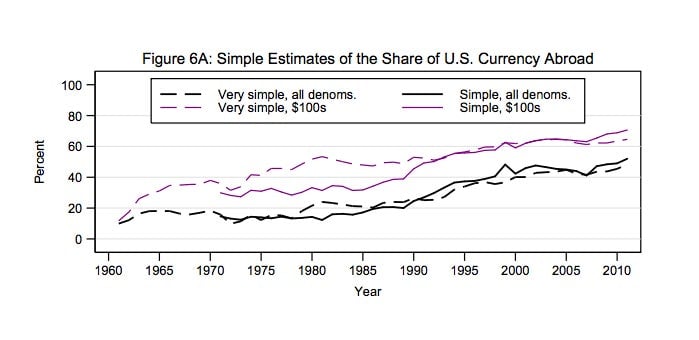

Personally, your reporter sees far too few of those hundreds. Perhaps that’s because most of them circulate abroad, as we told you before. It looks like between 60% and 80% of the hundreds are abroad, depending on what method of estimation you use.

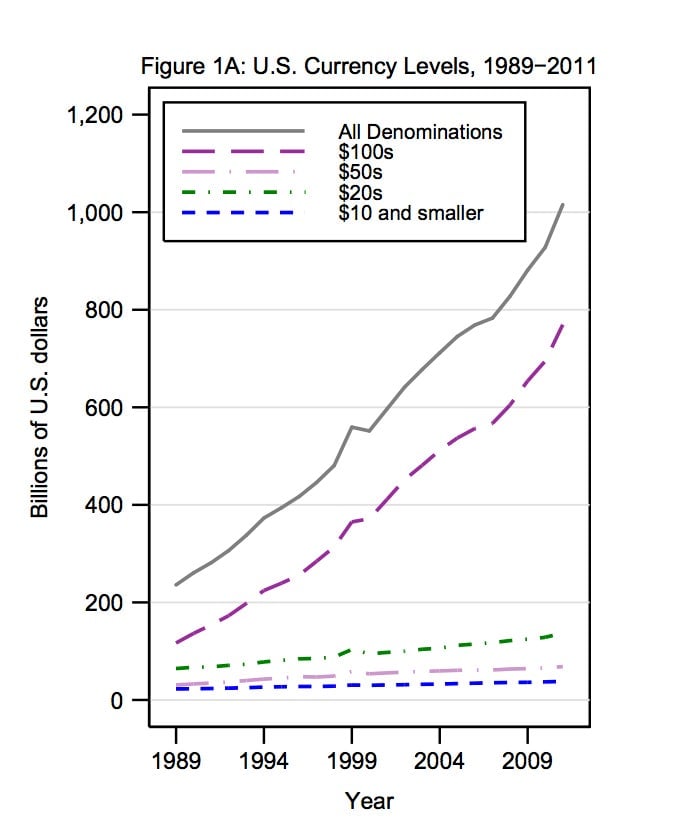

As an aside, currency supply figures usually aren’t the most action-packed data set. And despite all of the recent hubbub about Federal Reserve money printing—a technically inaccurate but close-enough way of describing the Fed’s bond-buying programs—the biggest story in cash over the last few decades was clearly Y2K. You can see here that the currency supply surged as people stocked up on cash in case ATM machines crashed en masse due to the millennial bug. (They didn’t.)

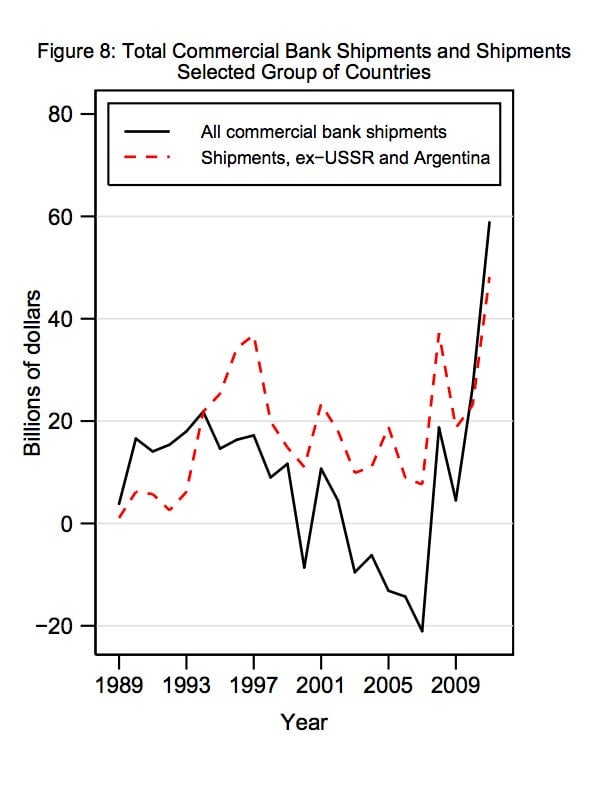

Anyway, so who are the biggest users of US currency abroad? Oddly enough, a detailed breakdown isn’t included in the Fed paper. That info is apparently confidential. But researchers do highlight the fact that ex-Soviet Union countries and Argentina are big dollar hoarders. They started picking up their usage of greenbacks during their respective currency crises in the 1990s. Since then, they haven’t kicked the habit.

So the bottom line is that growth in US currency supply is clearly being driven by c-notes. So what does this tell us? Well for one thing, it kind of flies in the face of those who argue that Federal Reserve easing efforts and large US budget deficits have eroded world confidence in the US dollar as a store of value. Greenbacks with Ben Franklin’s face remain the currency of choice for Argentinians, Azeris, and anyone else outside the US looking to squirrel away a bankroll.