It’s shortly after midnight, and you’ve just been awakened by a phone call from one of your company’s attorneys. She is letting you know that, as an officer and director of the company, you have been named as a defendant in a major securities class action lawsuit. The suit alleges that you, along with the company’s other directors and officers (D&O), have made misleading claims about the state of the company’s compliance with the environmental regulations in several of the countries in which the company operates. In addition, she adds, regulators in one of the countries have filed a separate but parallel lawsuit that also names you and your fellow D&O as defendants.

After you thank her and hang up the phone, you try to remember when was the last time the company had reviewed its D&O coverage, and whether that coverage would be sufficient for the challenges its current D&O—including you—were about to face.

D&O targeting is on the rise

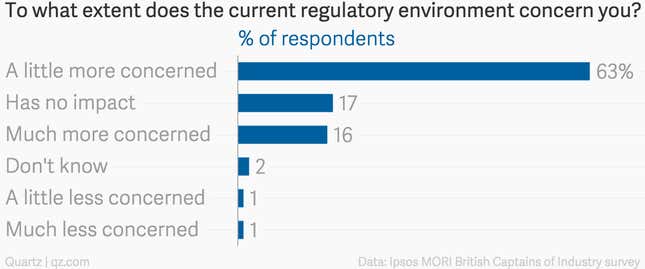

While the above scenario is hypothetical, it reflects the reality that more and more directors and officers are facing, as their companies increasingly fall under the sometimes burning lens of political and regulatory scrutiny, and face lawsuits that stem from shareholder activism. And they are feeling the heat. In a recent survey of more than 100 corporate-level officers and board members in the United Kingdom, for example, almost 80% of the respondents said they were concerned about their potential liability in the event of D&O-targeted litigation.

Their concerns did not arise from overly active imaginations

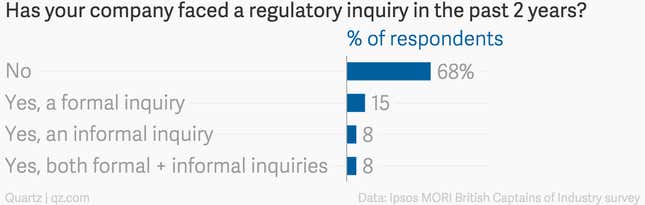

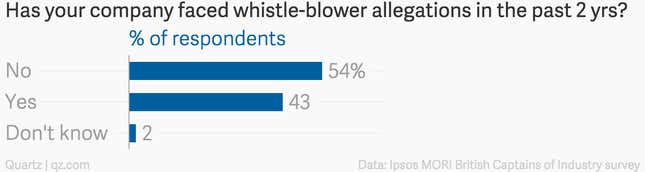

Over the last two years, almost one-third of all large businesses in the UK faced some form of regulatory inquiry. As in the US, a number of these inquiries led to financial penalties, which in the UK were up 52% from 2012 to 2013. In the same period, 40% of these large companies—dangerously close to half—were on the receiving end of a whistle-blower’s accusation of company wrong doing. (Britain’s regulators encourage whistle-blowers, and are considering, via the UK’s Serious Fraud Office, following the US’s lead in financially incentivizing them.) In all of these actions, the targeting of individual directors and officers is on the rise, as the public increasingly calls for accountability from those at the top, who are guiding the company and have been invested with fiduciary responsibility for it.

D&O denial?

Clearly, the extent to which the situation in the UK can be extrapolated to other markets will vary. But a look at some of the other findings of the survey is revealing in that it uncovers what may be a dangerous sense of complacency among some directors and officers in the face of rising levels of risk—particularly for companies operating as multinationals, where expansion into international markets brings with it the need to comply with myriad complex local regulations that may impact the effectiveness of an existing D&O policy. (For example, failing to comply with local regulations relating to tax and insurance can, in some countries, result in fines and penalties for both the D&O and the company.)

While almost eight out of 10 directors and officers surveyed said they were concerned about their potential liability as a D&O, only about one in four felt that their personal assets were either very or fairly exposed. This sense of complacency might in part be due to the fact that 78% of those surveyed believed their companies’ D&O policies were globally compliant. But are they?

The importance of frequent coverage review

All indications are that regulatory scrutiny and shareholder activism are on the rise globally. As these forces continue to unfold, and as political and regulatory conditions in both developed and emerging markets continue to change rapidly in response, it is important, from a risk management perspective, to conduct frequent reviews of a company’s D&O coverage. This is particularly true of multinationals, where local regulatory changes in the various markets where the company operates may change with sudden timing and in unpredictable ways.

In reviewing your company’s coverage, it’s vital to ask yourself, in your capacity as a director or officer, whether you clearly understand the risks you are facing in today’s complex business environment, how their realization might impact you, and what can be done to mitigate them.

Read the latest insights from AIG here.

This article was produced by AIG and not by the Quartz editorial staff.