Iran deal: Here’s how sanctions paved the way

Today’s historic nuclear deal is a potentially momentous day for the Iranian economy.

Today’s historic nuclear deal is a potentially momentous day for the Iranian economy.

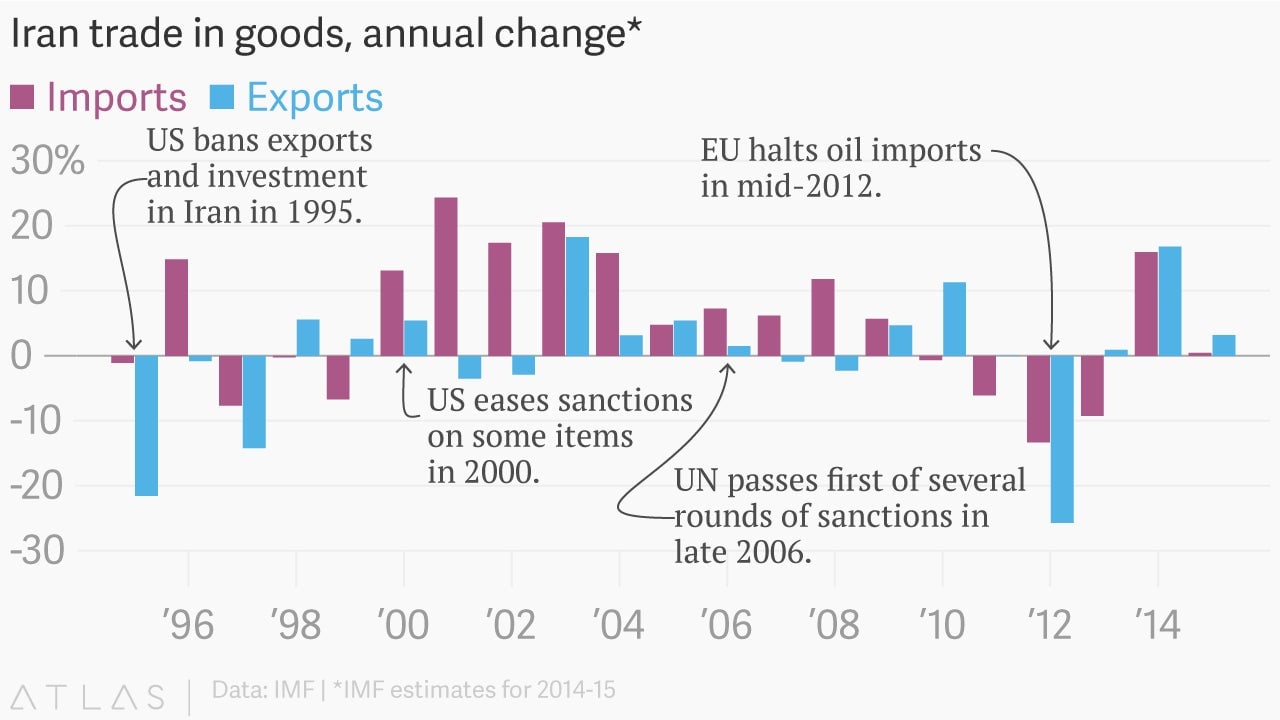

Iran has labored under some form of economic sanctions since 1995, when then US president Bill Clinton halted exports and investments to the country.

But the sanctions that bit the hardest came only recently, when the US and European Union teamed up to tighten the vise on Iran. In a major blow to the country’s energy business in 2012, the EU halted oil imports and blocked insurance for oil tankers carrying Iranian oil.

The IMF estimates that export revenue from Iran’s crude oil and natural gas resources amounted to $118 billion in the fiscal year that ended in March 2012. That dropped roughly 47% to $63 billion the following year, and is estimated to have fallen to roughly $56 billion in the fiscal year that ended in March of last year.

Coupled with financial sanctions imposed by the US on the Central Bank of Iran, it became nearly impossible for the country to secure hard currency. In 2012, the Iranian currency nearly collapsed amid widespread economic pain and rising inflation.

“Quietly, a backlash emerged among Iran’s political elites against the country’s creeping isolation, and the June 2013 presidential election ushered in a moderate new president and the beginnings of a diplomatic breakthrough on the nuclear crisis—achievements that most observers attribute to the impact of sanctions,” wrote Brookings Institution analysts last year.