Key highlights

- Factors are the underlying exposures that explain and influence an investment’s risk-and-return characteristics. Common factors include value, size, momentum, and credit—but no definitive list exists.

- A number of practical considerations can affect the success of factor-based investing.

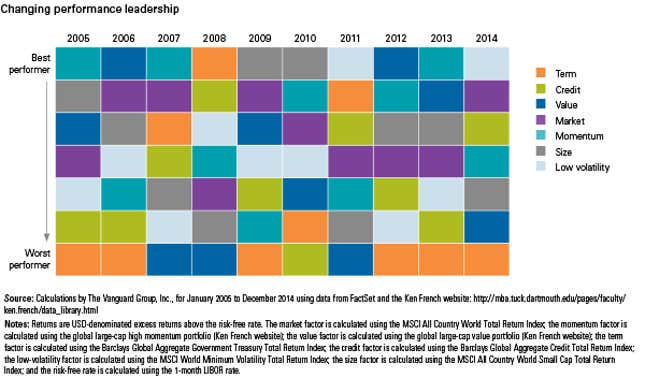

- Over time, the top performers among factor-based investments change, underlining the case for diversification and staying the course in challenging times.

- Vanguard believes that while factor-based investing offers potential benefits in terms of transparency, control, and costs, any allocation to factors is an active decision. When considering a factor-based strategy, investors should think about their tolerance for active risk.

Academic research¹ has shown the potential benefits of investing in factors, the exposures that explain and influence an investment’s risk.

But what happens when research meets reality? Here are five considerations that can affect the success of factor investments.

1. Implementation

Unlike real-world investing, academic research doesn’t require trading securities or incurring transaction costs. So the investment performance associated with factors may differ from the performance reported by researchers, said Scott Pappas, an investment analyst in Vanguard Investment Strategy Group in Australia.

Further complicating the matter, there’s no definitive list of what constitutes a factor. One investment provider’s definition may differ from another’s. So the same factor may produce an array of returns across providers, said Pappas, coauthor of the Vanguard research paper Factor-based investing.

“As with any investment, investors need to be aware that a given factor’s performance may not match up with the research,” Pappas said. “Whether you access them through passive vehicles or active managers, you’ll want to fully understand how factor exposures align with your goals.”

2. Selecting factor exposures

While the choice of factors influences future returns and risk, so, too, does the number of factors used in a portfolio. Like traditional asset allocation, factor allocation is a critical component of the investment process.

Advisors should understand that without exposure to a broad range of different factors, diversification benefits may be limited.

3. Explaining factor returns

A debate exists around the explanation for factor returns. Investor behavior and risk are the most commonly held theories. A value investment, for example, may realize positive or negative returns associated with the risk of changing economic conditions. Or it may benefit from what is known as a recency bias, when investors shun companies with attractive valuations after a setback while overpaying for other companies that have posted strong recent returns.

Over time, the top performers among factor-based investments change, as the chart below shows. The lesson, Pappas said: “When the market factor is underperforming, one of the other factors may be providing a premium. There could be a benefit from diversifying over different factors.”

4. Future return premiums

Will the strong performance associated with certain factors persist? The influence of data-mining—selecting certain information while setting aside otherwise relevant information—raises the question. So does the behavioral explanation of factor returns discussed above: If a given factor systematically presents an opportunity for profit, how long can the opportunity persist once it’s identified?

5. Return cyclicality

As with stock and bond returns, factor returns can be highly cyclical. Investors should be aware that individual factors may underperform for extended periods.

“There’s no magic formula,” Pappas said. “Part of investing in factors is being diversified and being prepared to stay the course when times are challenging.”

A few final thoughts

Vanguard believes that a market-capitalization-weighted index is the best starting point for portfolio construction. While factor-based investing can be a complementary approach and may offer potential benefits in terms of transparency, control, and cost, investors need to understand that any allocation to factors is an active decision, Pappas said. “If you’re interested in factor investing, think about how much active risk you’re willing to take.”

This article was produced by Vanguard and not by the Quartz editorial staff.

_______________________________________________

¹ Scott N. Pappas and Joel M. Dickson, 2015. Factor-based investing. Valley Forge, Pa.: The Vanguard Group.

Notes:

- Past performance is no guarantee of future results.

- All investing is subject to risk, including possible loss of principal.

- Diversification does not ensure a profit or protect against a loss.