The world’s smartphone manufacturing giants are losing their luster, leading to a steady stream of job cuts inside previously prestigious mobile units.

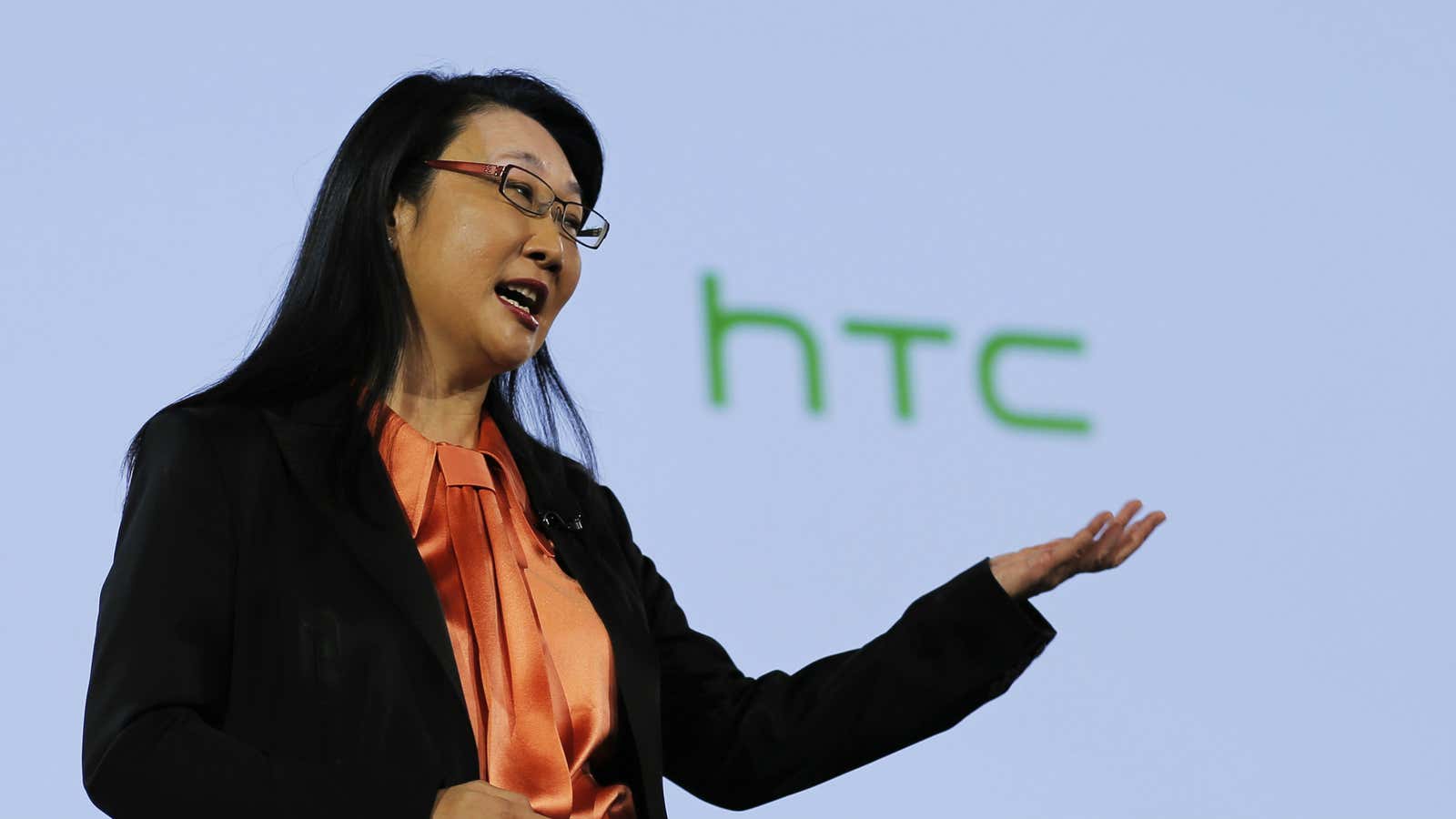

The most recent high-profile cuts occurred last week, when HTC and Lenovo each reported less than stellar earnings reports. HTC, after reporting a loss that exceeded analyst estimates five-fold (and caused its market valuation to fall below its cash assets), told investors it would cut fifteen percent of its workforce, amounting to over 2,000 jobs.

Lenovo, meanwhile, announced that it would reduce its workforce by 3,200 people, and cut its non-manufacturing headcount by 10%. The company didn’t specify which specific jobs were at risk, but it pointed to flagging global PC sales, along with the need to streamline its mobile phone unit, as its key goals for the coming year. The company’s net profits were down 51% year-on-year, and its Motorola handset division saw shipments plummet 31% to 5.9 million units.

Those are only the latest in a string of layoffs to hit the industry. Quartz calculates that top manufacturers have cut about 15,000 jobs, mostly from their mobile divisions, in 2015 alone.

In July, Microsoft revealed it would cut 7,600 jobs from its phone business, a large part of which was culled from its acquisition of Nokia’s handset division. Microsoft has stated outright that device sales will no longer be the core of the phone division’s business, and it will focus on selling software (like Office) and services (like OneDrive) to consumers and businesses.

Back in February, Sony announced it would remove 2,100 jobs from its mobile communications unit, the branch responsible for its Xperia handset line. The unit’s net loss widened from $12.8 million in June 2014 to $184.4 million a year later. The company is now investing more deeply in its components business, which is generating more profit.

Blackberry, unsurprisingly, announced it would lay off an undisclosed number of employees back in May. Once a frontrunner in mobile handsets with a headcount of 12,500, the company now employs 7,000, roughly equal to the number of employees Microsoft just laid off.

The ongoing rise of “other” Android-based smartphone makers is the obvious reason for these cuts. China’s Xiaomi is often held up as the best example of the “cheap Chinese smartphone maker” edging out higher profile competitors. But so-called “long-tail” brands like Oppo, Vivo, Coolpad and Meizu from China, Cherry Mobile in the Philippines, and Micromax in India could also be dart board targets at post-layoff pub crawls.

The total number of Android devices in circulation has increased nearly six-fold since 2012, according to data from OpenSignal.

And more consumers are buying these “long-tail” brands. According to IDC, smartphone market share for “other” brands has more doubled in five years, from 17.1% in June 2010 to 45.3% in June 2015.

Job losses at waning smartphone giants like Nokia and HTC has meant more hiring at these upstart brands—employee headcount at Xiaomi, for example, has jumped from 1,500 in 2012 to over 5,000.