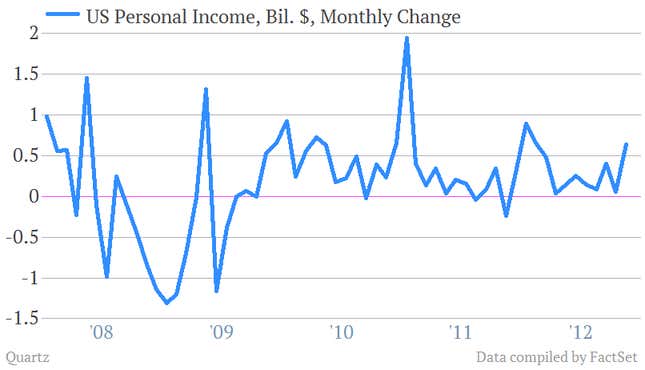

The Bureau of Labor Statistics reported this morning that US personal income rose 2.6% in December—a sharp uptick from previous months. The figure caps off a yearlong trend of rising incomes suggesting that American wallets are padded with increasing quantities of cash. That could fuel more consumer spending, which in turn would cause businesses to produce more, followed by their hiring more workers, driving up incomes even more—you get the idea.

There’s a catch, though. The December data have a lot of noise in them coming from the “fiscal cliff,” the series of scheduled spending cuts and tax increases that threatened to go into effect in the beginning of 2013. Among those myriad provisions were tax hikes on high-income earners, involving everything from income to estate and capital gains. That prompted 233 companies to pay out $30.1 billion in special one-time dividends in the last three months of 2012—7.5 times more the normal number of dividends for that quarter. (Some $8.8 of those dividends went to corporate insiders.)

And most of those dividend payouts, gifts, and other tax-evading measures would have shown up in the personal income average, making it look a lot bigger than it was for an actual average person. So let’s not celebrate the wealth of the American consumer quite yet.