Sony’s stock jumped 8% and Nintendo’s climbed 4% after the Chinese Ministry of Culture announced, earlier this week, that it would consider lifting its 12-year ban on video games consoles. But more telling was Electronic Arts’ announcement the next day that it lost 13% in revenue in the last quarter.

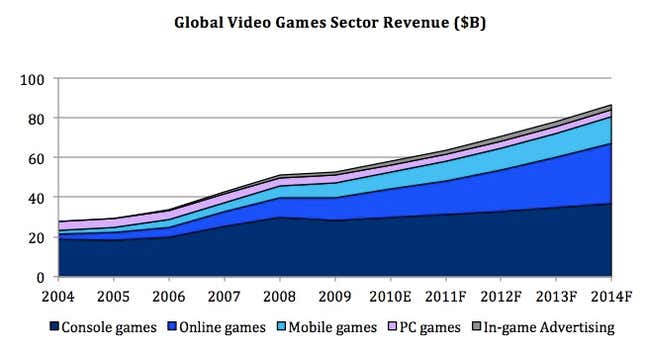

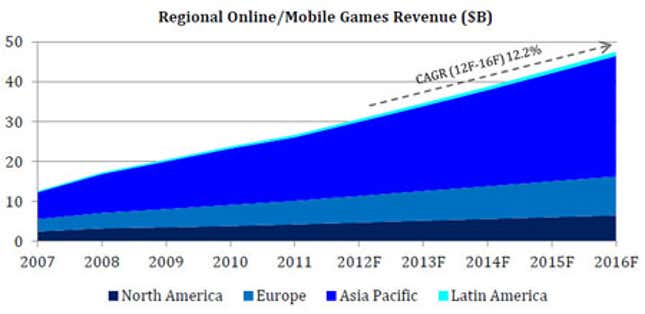

Even if the Chinese start buying Wiis, Xboxes and Kinects in their millions, gaming long ago began its shift (presentation; see slide 9) away from consoles to phones and tablets; away from paid single-player games to social games and free-to-play MMO (massive multiplayer online) games; and from America to Asia. Despite their hunger for Asian market share, companies like Nintendo and Sony simply do not make the kinds of games where the growth is.

Despite the console ban, gaming is huge in China. Since 2011, the country has been, with its 300 million or so gamers, the world’s largest games market, and will account for a quarter of the world’s sales by 2014, according to Digi-Capital, an investment bank. But the Chinese market is dominated by online social gaming, and the mediums of choice are PCs and mobile devices. This has paid off handsomely for online gaming companies—especially local ones like Tencent and NetEase, which reap 50% margins on games that cost relatively little to produce. But it has made life hard for those in the business of making console games, which can require investments of up to $20 million.

With their hardware banned, Western game-makers have had to create online-only version of their games for China. But that’s not the only hurdle they have faced. Cultural idiosyncrasies demand the re-imagining of each game for the Chinese market. As Activision Blizzard CEO Bobby Kotick described it (paywall), the Chinese version of “Call of Duty” was a wholly different experience from what, for example, Americans were used to. “How you play, what you play, customization of weapons, the types of characters, the equipment you use, the game modes, and the maps are all unique to the Chinese market,” Kotick said.

Another obstacle is widespread Chinese piracy. Some 77% of software (including video games) is estimated (pdf, p.4) to have been pirated in 2011, costing $8.9 billion in losses. Piracy has rendered the Chinese film and music market virtually worthless to Western firms, and once the ban is lifted, Western games makers might face the same fate. (The way they make money from online games is by charging for in-game goods like extra weapons.)

But even if they’re not selling game software, the new Chinese market for hardware could still be a big boost, right? Well, maybe not. Chinese are already used to buying games consoles on the black market, as well as pirated versions of games for them. They have also become skilled at adapting the pirated games to run on PCs, through emulators or virtual controls. A recent Barclays note explains that, “While it is not officially approved, many Chinese gamers already can purchase pirated copies of game software in the China market currently and this is widely available and gamers already have the choice to play consoles if they want to… Making [the purchase of consoles legal and] official eventually may not have such a big impact in changing gamers’ behavior.”

In any case, console games—and the hardware they run on—are a declining share of the world games market, as the first chart above shows. Tencent, the Chinese social game-maker, is worth around HK$500 billion ($64 billion). For comparison, Sony, Nintendo, Activision Blizzard and Electronic Arts combined are worth $46 billion. The jump in console-makers’ stocks is likely to be temporary.