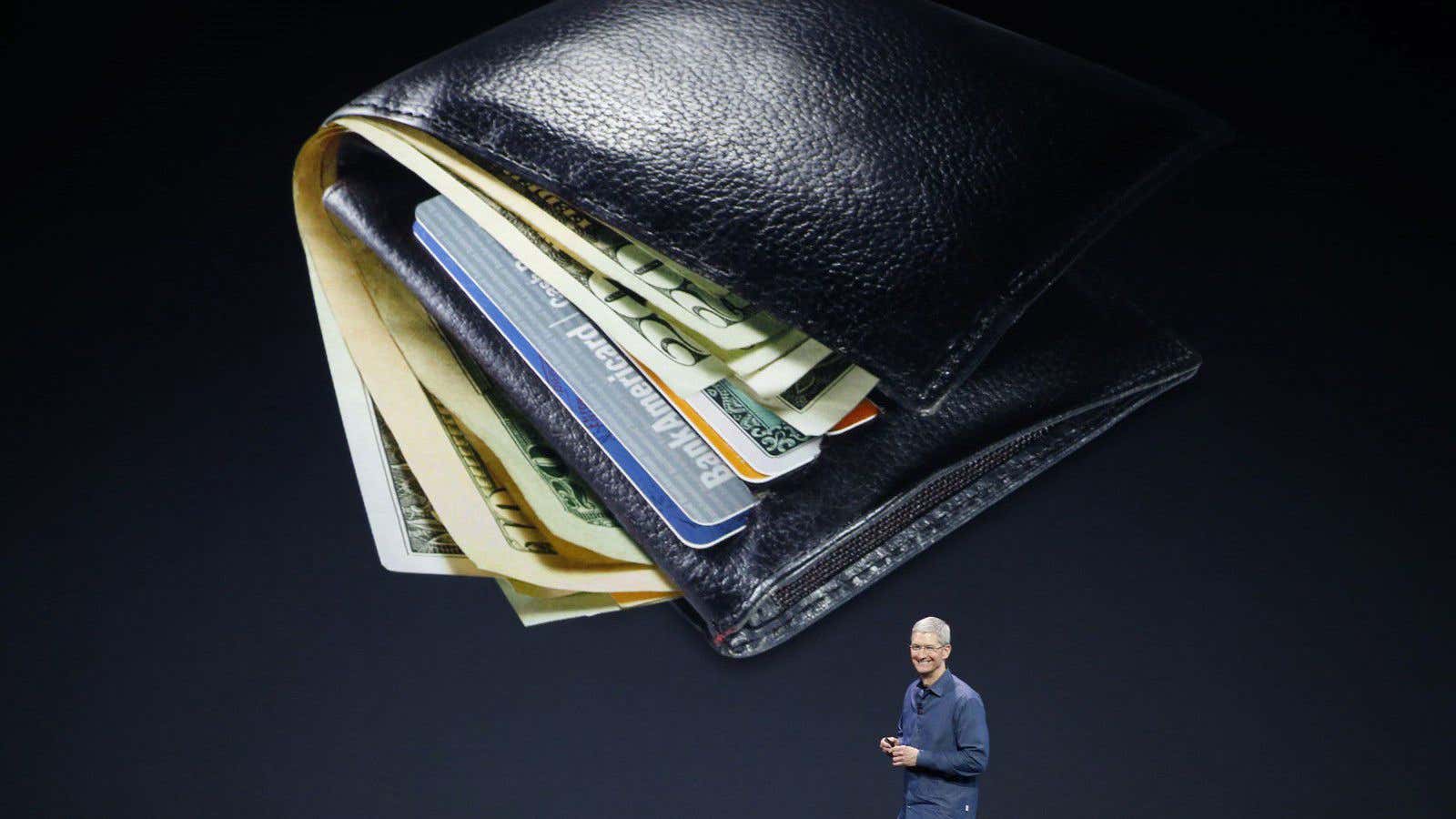

Back in January, Apple CEO Tim Cook dubbed 2015 “the year of Apple Pay.” His bold prediction about Apple’s mobile wallet, which turns a year old this week, might have been a bit optimistic.

But we shouldn’t be so quick to dismiss Cook’s claim outright. The year 2015 could turn out to be a major inflection point for mobile wallets. If so, it would be due in no small part to the US credit-card industry’s long-awaited move away from magnetic-stripe technology.

The transition to chip cards, which became the standard in the US on Oct. 1, was intended to bolster the card industry, of course. But it also offers a rare opportunity for upstarts with contactless (i.e. mobile) technology to become mainstream players in payments.

While chip cards are more secure, they also take longer to process—in some cases up to 20 seconds longer, analysts say. This alone could motivate more customers to use mobile-payment systems, which are typically faster.

Meanwhile, the widespread upgrade of payment equipment to handle the new cards should make it easier for retailers to accept other new forms of payment, like mobile wallets. This is what happened when chip cards became standard in countries like the UK and Australia, which are far ahead of the US now in mobile-payment adoption.

Mobile wallets aren’t just faster than chip cards—there’s an added security benefit, too. Contactless payment systems like Apple Pay (and Android Pay and Samsung Pay, since they use the same underlying technology) rely on a process called tokenization, which turns a customer’s debit- or credit-card number into a random code of letters and numbers; this is what gets passed to the merchant, instead of the actual card number. Tokenization dramatically decreases card fraud because it keeps the card numbers mainly in the hands of the card customer and the card issuer, leaving hackers with fewer places along the transaction chain to access the information. So while chip cards are more secure than mag-stripe cards, mobile wallets using tokenization are arguably more secure than both.

Though the speed and security benefits are apparent, and the merchant infrastructure developing, a boom in contactless payments ultimately depends on the whims of the consumer, which are rarely predictable. But when it’s all said and done, 2015 could indeed end up being the year that jumpstarted Apple Pay.