In the bond markets, boredom is a currency.

Most fixed income investors crave stable, low-volatility investments that quietly and reliably pay chunks of interest until they roll off into the great bond market hereafter.

That’s especially the case in the market for government bonds, and specifically the market for the United States’ government bonds, where the US Treasury Department has built up decades worth of credibility with investors by catering to those tastes.

And while it’s not exactly true that the US has never defaulted on its debts—FDR’s abrogation of the gold standard in 1933 qualifies as at least a partial default—US Treasury bonds remain the the premier place for everyone from Chinese central bankers to Michigan mutual fund investors to park their spare cash while earning a modest return.

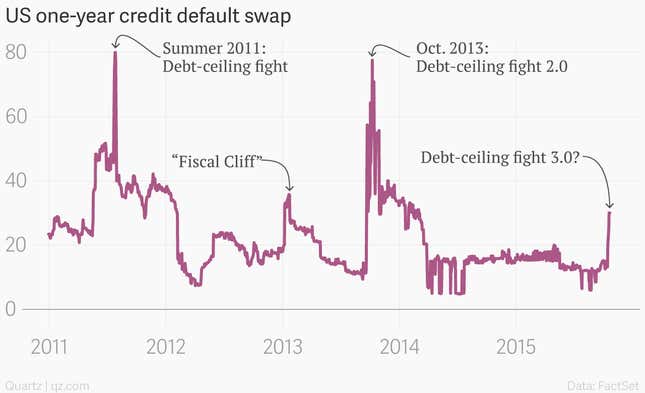

But in recent years, the reputation has been smudged. A running fiscal battle between Congressional Republicans and the Obama administration has resulted in several instances of brinksmanship related to raising the ceiling on US debt. A debt ceiling fight back in 2011 was a prime reason credit rating firm Standard & Poor’s actually stripped the US of its AAA rating that year. Several replays of that fight—the “fiscal cliff” of early 2013, the debt fight of October 2013—have done little to dispel the appearance that America’s budgetary process has become increasingly chaotic and subject to politicization.

Now, the US finds itself once again preparing for a fight over the debt ceiling. And this year’s fight could be even messier than usual, given the fact that Republicans in the US House of Representatives are effectively without a leader.

As we’ve pointed out, the financial markets are already showing signs of pricing in additional volatility related to a debt fight.

And today the government itself postponed an auction of two-year Treasury notes, citing debt-ceiling constraints. Effectively the Treasury Department said the specter of a debt fight—which really hasn’t even gotten ugly yet—is already hurting the financial functioning of the country.

The current debt limit impasse is also now adversely affecting the operation of government financing, increasing federal government borrowing costs, reducing the Treasury bill supply, and increasing the operational risk associated with holding a lower cash balance.

Now, Treasury auctions don’t get a lot of attention. And that’s for good reason. To use the appropriate financial terminology, they’re dullsville.

But that doesn’t mean they’re not important. Auctions of US government bonds—in which the Federal Reserve sells bonds to 22 Wall Street banks approved to bid—essentially set the interest rates the US government pays to borrow. And those interest rates—the yields on Treasury bonds—act as reference rates for pretty much every other financial instrument on earth.

In fact, the Treasury Department’s “regular and predictable” schedule for Treasury auctions is one of the innovations that allowed the US government—and by extension the US dollar—to become the go-to place for investors seeking safety. Bond market experts say that the stability of the “regular and predictable” bond market auctions actually translates into decreased borrowing costs for the US. (August minutes from the market advisory committee to the US Treasury show estimates of roughly $27 billion in borrowing costs that were saved since 1998, simply due to the regularity of the bond market auction schedule.)

In short, it’s entirely appropriate for Congress to wrangle with the White House over fiscal issues. But doing it with debt-ceiling brinksmanship damages the credibility earned by generations of American taxpayers. That shouldn’t be given away lightly.