European economies shrank last quarter at their fastest rate since the financial crisis in 2009, official data today show. Casting doubt on policymakers’ claims that Europe has turned a corner, the combined output of the 17 countries in the euro zone fell by 0.6% in the last three months of December, compared to the quarter before. GDP for the wider 27-member European Union fell 0.5%.

European businesses appeared more weighed down than expected by high unemployment, government austerity, a stronger euro, and general poor sentiment. “These are horrible numbers. It’s a widespread contraction, which does not match this positive picture of stabilization and positive contagion,” says Carsten Brzeski from ING. According to consensus forecasts, analysts had expected a contraction of only 0.4% in euro zone GDP during the fourth quarter.

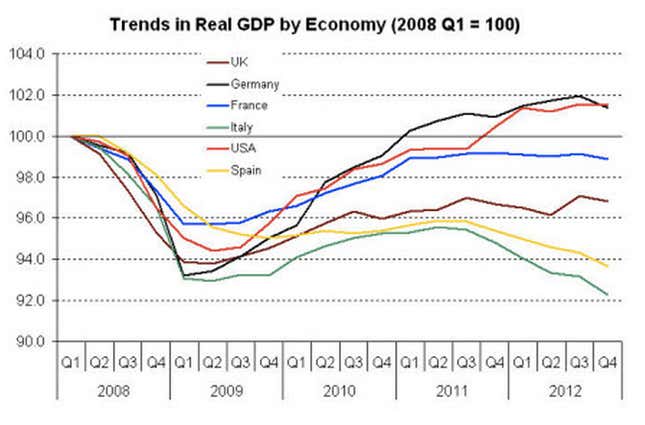

This chart from Bloomberg Briefs shows euro zone GDP slumping back toward where things were in 2008 and 2009.

What’s notable is that the data were the result of contractions in the region’s strongest, as well as weakest economies. Germany saw its economy shrink 0.6% in the fourth quarter, while France contracted 0.3%. The German statistics office said weak net exports at the end of 2012 caused the drop in output. Italy’s economy shrank by 0.9% (its sixth consecutive fall). Portugal, which is something of a poster child for austerity, performed the worst in the region, with GDP dropping by 1.8%.

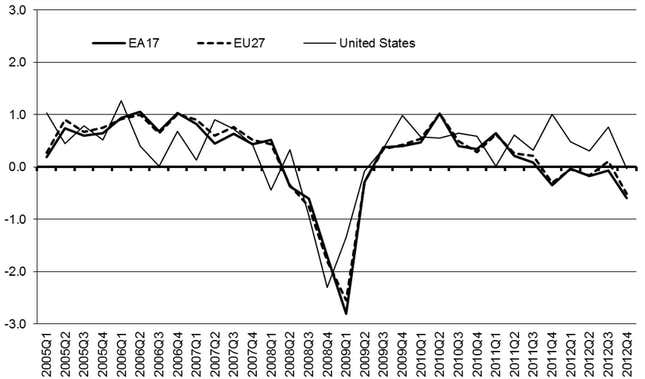

This chart from Markit Economics compares GDP growth of the EU’s largest economies with the United States.

Here’s another way to look at that comparison, from Eurostat.