The G20 seems to be deciding that the “currency war” is not a bad thing. Today, the international financial roundtable announced it wouldn’t censure Japan for driving down the value of the yen, and officially disavowed statements made last week by the G7, a smaller group of wealthier nations, that urged countries not to target their exchange rates, which are the mechanism of control used to make local currencies cheaper.

But funnily enough, just as the G20 is more or less coming around to sanctioning the currency war, Brazil, which sounded the first alarms about it in 2010, now appears to be letting go of its own currency suppression.

Last week, we reported that Brazil seemed to be softening its stance in the latest round of global currency skirmishes. Guido Mantega, the country’s finance minister, who coined the term “currency war” and has since been trying to prevent Brazil’s real from appreciating in the face of loose monetary policies around the world, suggested he might now be a bit more flexible. Mantega cited a potential limit of 1.85 reais per dollar, but said this target would be reached gradually. Markets immediately moved on the news, strengthening the Brazilian currency.

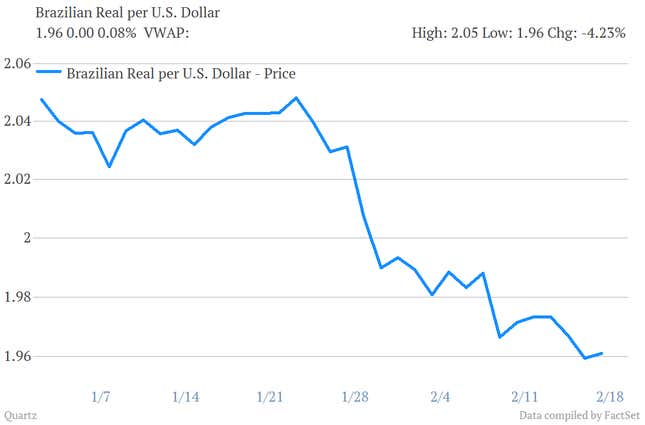

The real has been getting stronger (i.e., fewer reals needed to buy one dollar) since the beginning of the year. Take a look:

Yesterday, a confidential source involved with Brazilian economic decision making told Reuters that in the near-term, the real could strengthen (link in Portuguese) past 1.95 per dollar—long thought to be the trading limit until Mantega’s remarks last week. The real is currently trading at around 1.96 per dollar, as markets inch closer to 1.95.

The source told Reuters that the net strengthening of the real would help fight inflation, which, at around 6%, has been eating up spending power and consequently, consumer growth in Brazil. All else equal, a stronger real holds back inflation’s gallop. But a stronger real also hurts local exporters (especially in the industrial and agricultural sectors) by making their products more expensive abroad.

We’ll be waiting to see when—and if—the Brazilian government steps back into the markets to push down its currency, especially given its record of faulting other countries who let their currencies depreciate. In the meantime, though, speculators will likely keep pushing the value of the real higher, until Brazilian policy makers decide to beat them back.