Wal-Mart’s stock is taking it on the chin this afternoon. At last glance the stock is down 3.5%, after Bloomberg got hold of an email from Jerry Murray, Wal-Mart’s vice president of finance and logistics.

Wal-Mart Stores Inc. had the worst sales start to a month in seven years as payroll-tax increases hit shoppers already battling a slow economy, according to internal e-mails obtained by Bloomberg News.

“In case you haven’t seen a sales report these days, February MTD sales are a total disaster,” Jerry Murray, Wal- Mart’s vice president of finance and logistics, said in a Feb. 12 e-mail to other executives, referring to month-to-date sales. “The worst start to a month I have seen in my ~7 years with the company.”

Likely not what investors wanted to hear ahead of Wal-Mart’s Feb. 21 quarterly earnings report. Economy watchers will also likely raise at least one eyebrow at indications that the world’s biggest retailer is sucking wind.

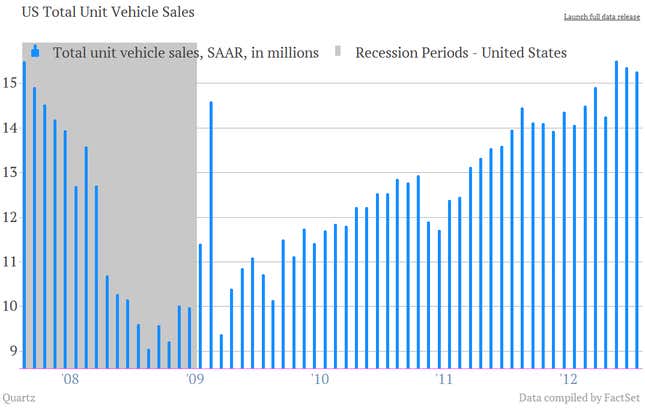

Globally, the US economy remains in the best shape among developed markets. But, as always, there are questions. And the question du jour is whether the payroll tax increases that came as part of the fiscal cliff deal are going to severely hamper consumer spending. They might. January retail sales were slower than expected, for instance. But by and large, the consumer has been hanging tough. Look at US auto sales, for instance, which remained sturdy in January.

Goldman Sachs analysts pointed to US car sales in a recent research note on the implication of the payroll tax increase:

There is not yet much evidence for a significant hit. With the January data in hand, core retail sales—which exclude autos, building materials, and gasoline—are tracking at a 4.3% (annualized) growth rate in the first quarter, the same pace as seen in all of 2012. Total vehicle sales in January similarly held up at 15.2 million (annualized). Measures of consumer sentiment have been more mixed, with strength in the daily Rasmussen Consumer Index, a small uptick in the University of Michigan consumer sentiment index after a sizable drop in December, and a significant decline in the Conference Board consumer confidence index. But overall the consumer has held up better than we expected so far.