The markets have had quite enough of David Cameron, George Osborne and British austerity

It’s true. Downgrades usually lag the markets when it comes to telegraphing the fact that investors think lending to a particularly borrower—whether a corporation or a country—is getting riskier.

It’s true. Downgrades usually lag the markets when it comes to telegraphing the fact that investors think lending to a particularly borrower—whether a corporation or a country—is getting riskier.

At the same time, seeing Moody’s defrock the UK of its AAA rating last week wasn’t exactly a great advertisement for British government bonds, or gilts, as they’re know to the cognoscenti.

We’ll be blunt. Investors are yanking cash out of the UK at the moment. How do we know? The markets are telling us.

Look at the yield on the benchmark 10-year UK gilt. The trend is clear. It’s rising, which means that prices for the bonds are falling. (Bond prices and yields move in opposite directions.)

“Wait! Wait!” say the bond market sophisticates, “Bond yields can rise for many reasons. They can be rising because the outlook on the British economy is getting better, which is driving people to shift their money from the safety of bonds—which keeps bond yields low—to the riskiness of stocks. Or it could be that bond yields were driven to ridiculous lows earlier this year, as people tried to get their cash out of euros and into something safer, like British pounds.”

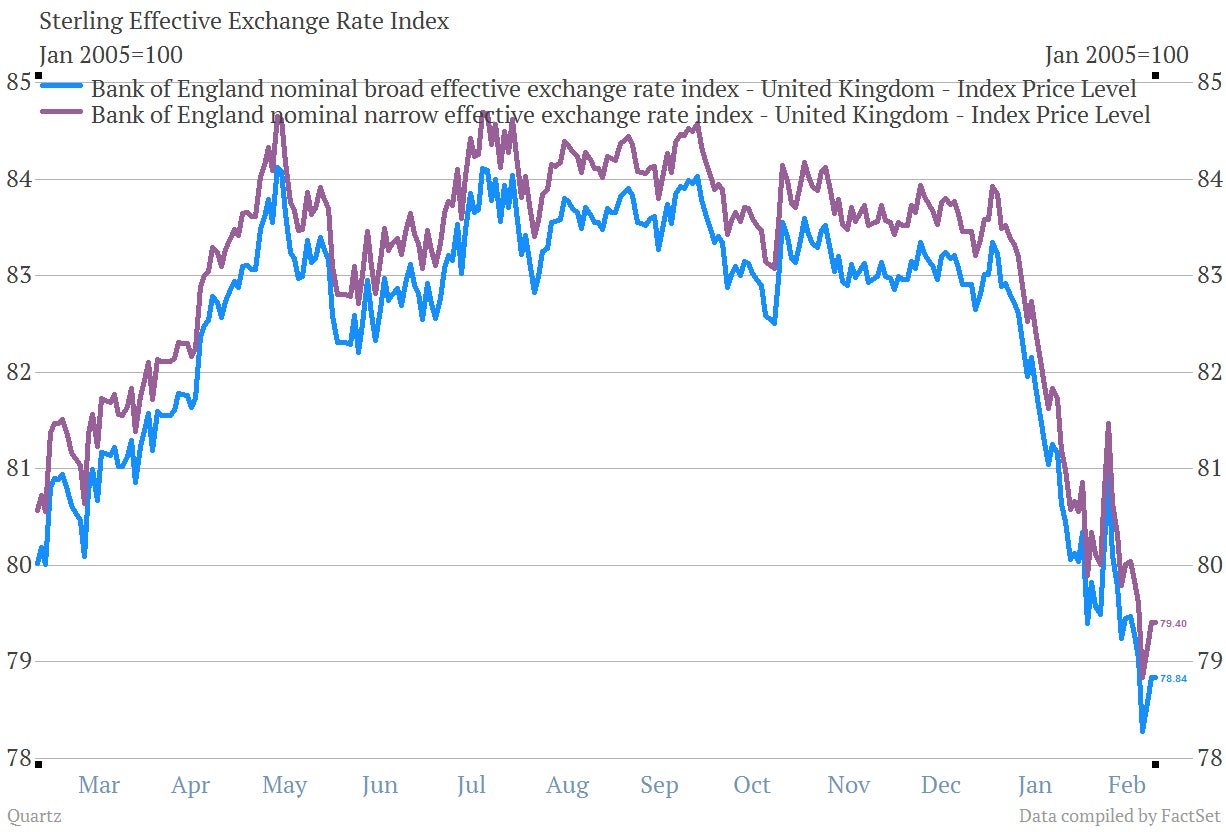

It is true. Bond yields can rise for a lot of different reasons. But it would be hard to argue that that prospects for the British economy are especially stellar at the moment, given that Brits are floundering in what may be a triple-dip recession. That’s why you also need to look at the currency to triangulate what’s going on. Here’s what’s going on. The pound is getting pounded.

Now, you could argue that some of the weakness in the pound is merely relief that the European debt crisis has appeared to ease a bit in recent months. Maybe. But it’s worth noting that Europe has been stabilizing for months—since Draghi’s “whatever it takes” speech last summer—and the pound has only started crumbling since the end of last year, not long after George Osborne—Britain’s finance minister—was forced to admit that the government wouldn’t hit its own goals to cut deficits because of weakness in the economy.

Ok, so let’s say investors are pulling cash out of the UK. Is this the end? We’ve all become crisis addicts over the last few years, but no, Britain is going to be fine. It’s not going to default. You see the thing about having a floating currency that you control—sorry, euro zone members—is that its weakness will actually help the economy because it makes British exports cheaper for foreign buyers. That’s a good thing.

But given that the British economy has become a proxy war in the political battle between “austerians” and neo-Keynesians, any signs that the markets—traditionally viewed as allies of the UK Premier David Cameron’s Conservative Party—are deserting the cause would be yet another painful blow for Cameron’s government. That’s far more important than any downgrade.

No, Britain isn’t going down. We’re not so sure about Cameron.