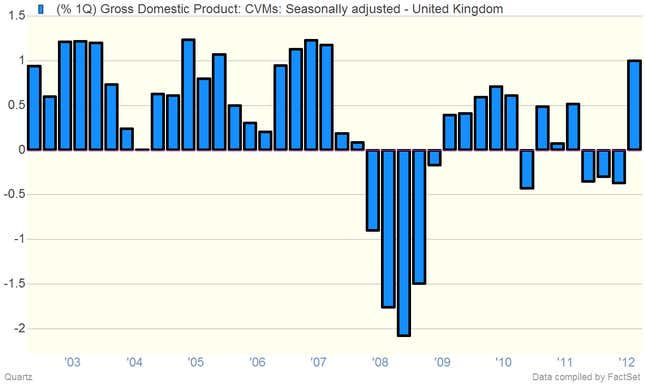

We give you the stat of the hour, over which many pixels will likely be spilled today. Quarterly gross domestic product growth for the United Kingdom:

The rather big jump during the first quarter — the bar all the way the the right — was announced this morning. Looks innocuous enough, right?

But that’s where you’re wrong. The British economy has become an outright proxy war in the ideological battle between the two fiscal paths governments can take in the aftermath of the financial crisis, bank bailouts, and boom in government debt over the last few years. On the right are the austerians, those arguing that the only way to get economic growth on a long-term stable footing is by “right-sizing” government budgets. Usually this is described as cutting spending, but the other component is raising revenues. The argument goes that by getting the government on a more sturdy fiscal footing, it will instill confidence in the business sector to expand without having to worry about nasty new expenses such as tax increases. In the other corner are the neo-Keynesians, who argue that such policies fly in the face of the historical record, which shows that tightening fiscal policy during a period of weak economic growth will obviously damage the economy further and may hurt it so deeply that its ability to grow is permanently impaired and unemployment will remain needlessly high.

British Prime Minister David Cameron and his finance minister George Osborne have become something of standard bearers of the austerians, embarking on a policy of austerity after his coalition of Conservative and Liberal Democrats came to power in 2010. At the time there was some serious huzzah-ing from the conservative press. But as you can see from the chart above, the GDP record of Mr. Cameron’s push for austerity has been less than thrilling. (Jobs numbers, somewhat paradoxically haven’t been as bad.) So the pro-austerity forces can be expected to take the GDP data point and turn it into a talking point. But as we’ve pointed out, there are plenty of reasons for Cameron to underplay this slightly. It’s a very preliminary number and it appears to have been goosed by one-time items such as the Olympics and the Queen’s 50-year jubilee celebration.

For the same reasons, expect some serious skepticism out of Keynesian camp, especially influential Nobel Laureate and New York Times columnist Paul Krugman, who has been making serious hay out of the double-dip recession that coincided with Mr. Cameron’s push on austerity.

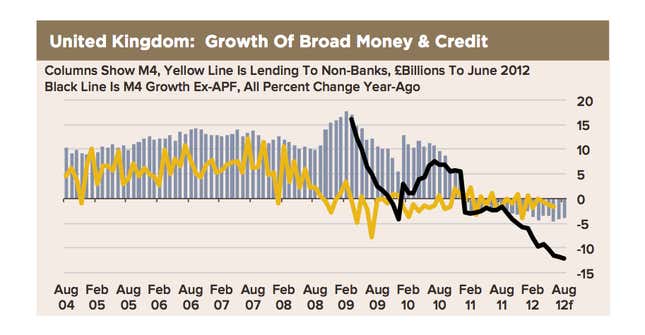

Likewise, we doubt British growth is going to be anything other than piddling over the foreseeable future. Why? Well, check out this chart, from the always-terrific High Frequency Economics:

This chart shows us that Britain is fighting off serious deflationary forces. Or should we say, the Bank of England is fighting them. The fiscal policies are making them much worse. The black line in the chart above shows how money growth would be going without the assistance of the British central bank’s quantitative easing program. (That’s when the bank creates new money and pushes it out into the economy through the bond markets.) As US Federal Reserve chairman Ben Bernanke has said a number of times, the central bank money creation is not a panacea. To fight off a persistent deflationary headwind like this, the government has to spend too. It just does. If it doesn’t, there’s little hope for real growth, unless you plan on having the Olympics every year.