Goldman Sachs is bullish on the cryptocurrency technology known as the blockchain.

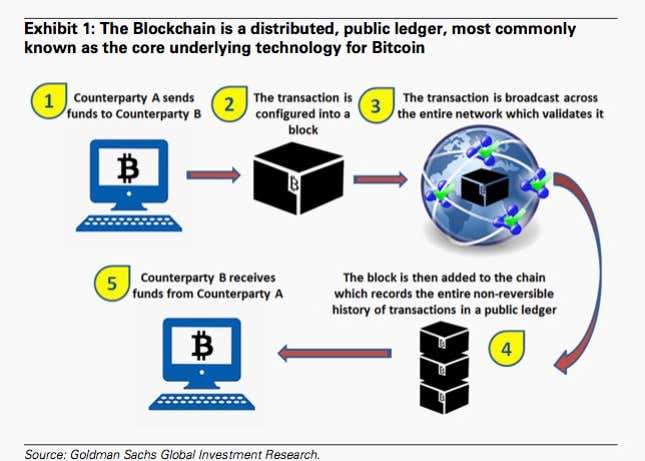

The New York based financial institution spotlighted blockchain—the technology behind bitcoin and other cryptocurrencies—in an end-of-the-year research report about emerging technology. Blockchain is essentially a shared online public ledger that is supposedly impervious to tampering and revision.

Goldman’s analyst thinks the technology “has the potential to redefine transactions and the back office of a multitude of different industries.” He writes:

From banking and payments to notaries to voting systems to vehicle registrations to wire fees to gun checks to academic records to trade settlement to cataloguing ownership of works of art, a distributed shared ledger has the potential to make interactions quicker, less-expensive and safer. By removing the need for a middle man one lowers potential security concerns from hacking to corruption as well as speeding up manual processes that are antiquated and can take too long.

Goldman isn’t the only financial institution interested in blockchain. UBS opened a research lab in London to study and analyze blockchain and look for potential uses within financial services and beyond. A white paper from Santander published over the summer estimates blockchain technology could help banks save $20 billion in infrastructure costs for cross-border payments, settlements, and compliance.

But Goldman does seem to be one of the most gung-ho financial institutions when it comes to cryptocurrency. The US Patent and Trademark Office recently published an 2014 patent application in which Goldman laid out its development of its own cryptocurrency to be used in a settlement system for trading stocks, bonds and other assets. Goldman was also recently part of a $50 million investment round in Circle, a payments app that utilizes bitcoin and the blockchain.

Given Goldman’s business interests in blockchain technology, one could—perhaps cynically—suggest Goldman analysts are talking their book in their recent research. On the other hand, you could also argue that the firm is putting its money where its mouth is.