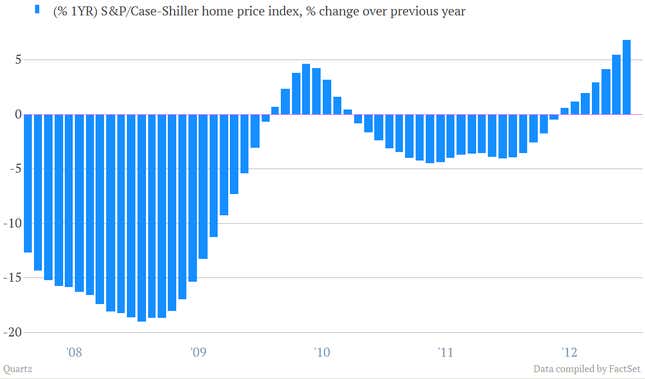

It’s pretty simple really. The latest data on the all-important US housing sector is good. As a result, US stocks—as measured by the S&P 500—are up about 0.5%. Here’s a look at the pertinent chart:

Americans are right to ignore the nonsense in Italy. The US economy has shown itself to be perfectly capable of trucking along—thanks to several pronounced pushes from the Federal Reserve—as the European debt crisis raged. That’s because much of the strength is centered in housing—i.e., domestic demand. With US consumption worth about 70% of GDP, that’s a good thing.

On the other hand, the sequester—that’s the meat-clever that is about to fall on the US budget—shouldn’t be dismissed. JP Morgan economists assume that cuts to federal spending due to the sequester will shave 0.4% off of GDP this year. And Goldman Sachs thinks the sequester will slow US growth toward the middle of 2013, but that at the end of the year the economy will accelerate again.

The truth is nobody really knows how the US economy will react to sharp cuts in fiscal spending. Traditional economic models have been shown to underestimate the impact of government spending and taxation in the aftermath of the debt crisis. That’s why it would seem unwise to sharply cut spending now. Alas, policymakers in Washington aren’t taking our calls.