Japanese bondholders rejoice: likely next BoJ governor plans to turbo charge the Abenomics engine

George Soros will be delighted. The famed currency trader shorted the yen and profited handsomely from new Japanese leader Shinzo Abe’s plan to print unlimited amounts of money, and now the man who is likely to be the next Bank of Japan governor has promised to put all his firepower behind “Abenomics”.

George Soros will be delighted. The famed currency trader shorted the yen and profited handsomely from new Japanese leader Shinzo Abe’s plan to print unlimited amounts of money, and now the man who is likely to be the next Bank of Japan governor has promised to put all his firepower behind “Abenomics”.

Abe’s BoJ nominee Haruhiko Koroda, also backed by Japan’s opposition, told lawmakers the central bank should try to achieve 2% inflation by purchasing “huge amounts” of long-dated government bonds. In doing so, the BoJ would be closely imitating the US Federal Reserve’s method of pumping cash into the economy by buying Treasurys.

Increasing the money supply is not only likely to suppress the yen and help Japanese exporters; Japanese bond holders will also be cheered by Kuroda’s plan, which would increase these securities’ value as their price rises and their “yield” (interest payment relative to price) falls. Japanese banks own scarily large amounts of government bonds so a rise in the value of these securities will also boost their balance sheets.

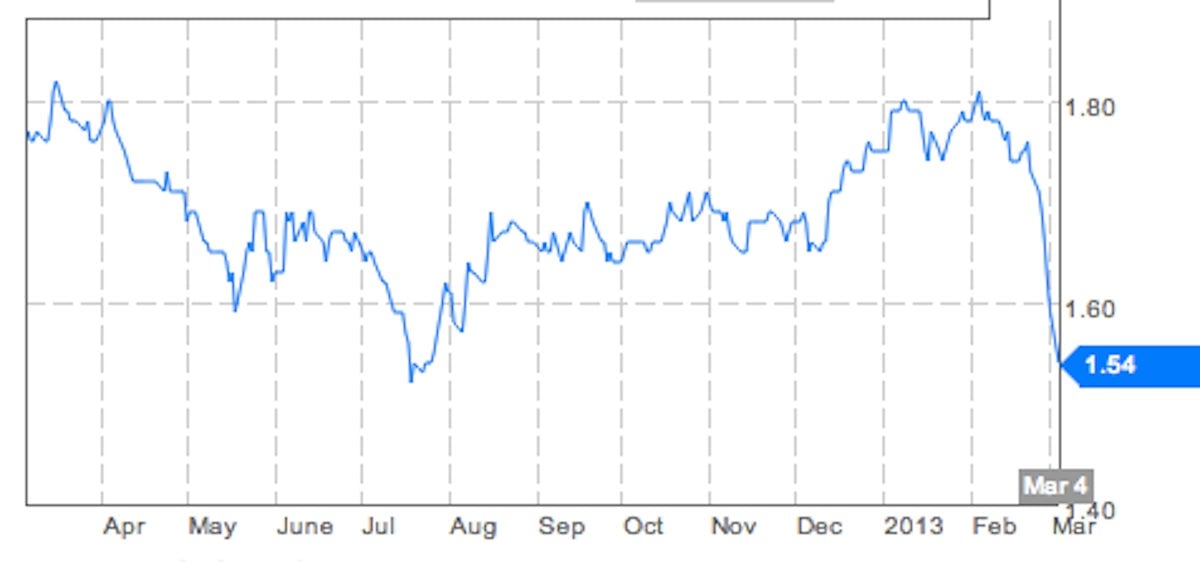

Here is what has been happening to the yields on 20 year Japanese government bonds over the last month in anticipation of the Bank of Japan getting in step with Abenomics:

Still, Abenomics comes with deep political and economic risks, including the prospect of even worse relations with China. If the weakened yen continues to make Japanese exporters more competitive, that will hit China’s bottom line. And China’s central bank has vowed it is ready for a “currency war” with Japan.

More fundamentally, Abe’s policies could sink Japan even more deeply into debt without providing anything more than a short-term, artificial boost to growth and to exporters’ earnings.

As Quartz has already pointed out, the Japanese economy has many huge structural problems—such as its ageing population and inefficient model of crony capitalism—that monetary pump priming cannot solve.