Yen and the art of Toyota Motor maintenance

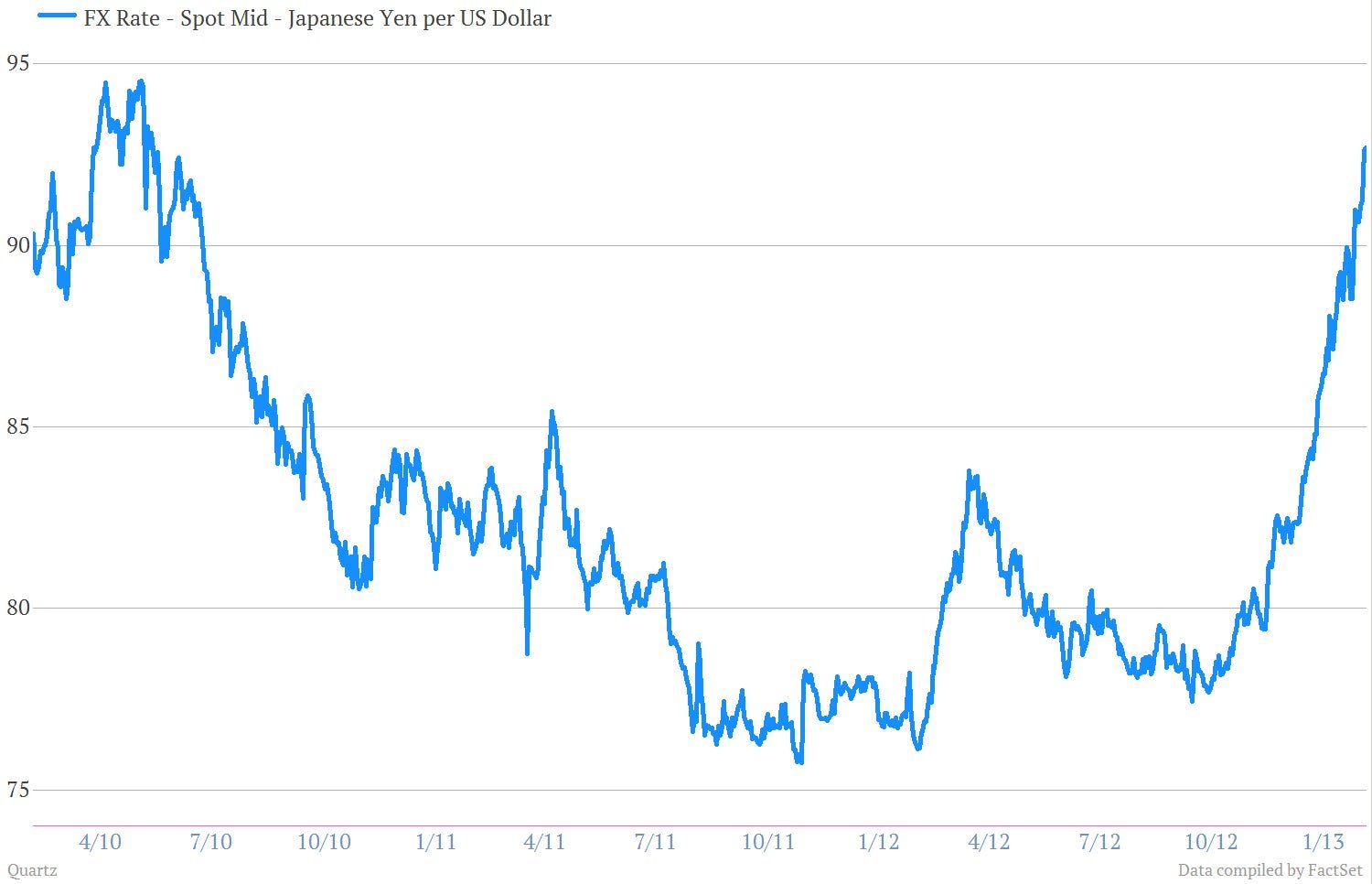

As those obsessed with the phenomenon of Abenomics know, the yen’s posted a pretty sharp decline in recent months, as the markets braced for a new round of money creation from the Japanese central bank. The chart below shows the dollar’s recent strengthening against the yen.

As those obsessed with the phenomenon of Abenomics know, the yen’s posted a pretty sharp decline in recent months, as the markets braced for a new round of money creation from the Japanese central bank. The chart below shows the dollar’s recent strengthening against the yen.

The weak yen makes Japanese exports cheaper for foreign buyers, giving an advantage to Japan’s all-important export sector. Case in point: Toyota, which today raised its full-year operating earnings estimate, in part because of expectations of a weaker currency. Toyota executives told analysts on its post earnings conference call, (conversions ours):

In consideration of the latest currency environment in which the excessive appreciation of the yen is being eased and the progress of our profit improvement activities, thus far, we upwardly revised our operating income forecast by ¥100B ($1.08 billion) to ¥1.15 trillion ($12.3 billion).

That helps explain why Toyota’s stock price started running upwards at just about the same time as the yen started weakening.

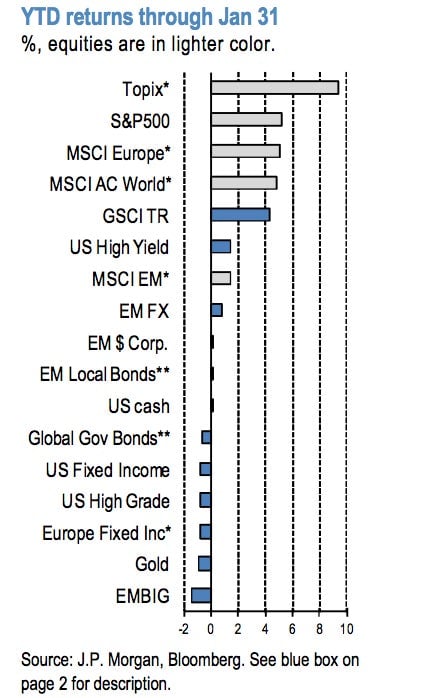

And that favorable linkage between weak yen and large Japanese exporters helps explain why Japanese stocks—expressed here via the Tokyo Stock Exchange Price Index, or TOPIX—have been one of the hottest assets to own in so far in 2013.

That’s all well and good. But there are costs to a yen-printing campaign too. As Quartz’s Gwynn Guilford recently pointed out, a weak yen will drive prices of imports, notably oil, much higher, and the recent results of Tokyo’s electric power utility gave the first indication of how much that will hurt. This will have political ramifications too: It will raise the hackles of Japanese anti-inflationists who could form an anti-Abenomics front. And if they’re strong enough, they could stop any central bank effort to jolt Japan’s economy back to life.