Global markets have had an absolutely terrible week

After a brief respite yesterday (Jan. 14), global stocks have gone right back into a nosedive. The S&P 500 is off about 2.3% in early trading, and another poor performance would cap what has been a rotten week around the globe. “Sell everything,” indeed.

After a brief respite yesterday (Jan. 14), global stocks have gone right back into a nosedive. The S&P 500 is off about 2.3% in early trading, and another poor performance would cap what has been a rotten week around the globe. “Sell everything,” indeed.

The two biggest worries are obviously China and oil prices. The former has seen a resurgence of concerns over its slowing industry (possibly the wrong way to look at the country, but markets aren’t always rational), and that’s fed into worries about the latter (combined with a drilling match between Saudi Arabia and US oil producers).

Worries about China tend to fan out westward, with Europe being the first stop. Europeans love using their cheap currency to export things to China, so when investors get scared about what’s happening in China they get scared about what’s happening in Europe. That, and Europe’s recovery has yet to find its legs.

Those worries spook investors in Britain; the likelihood of the Bank of England hiking interest rates wanes by the day, which has taken a toll on the pound. That’s not the only currency losing steam, though. The Canadian dollar is hurting because of the turmoil in oil, and Chinese authorities are doing their darnedest to prop up the yuan.

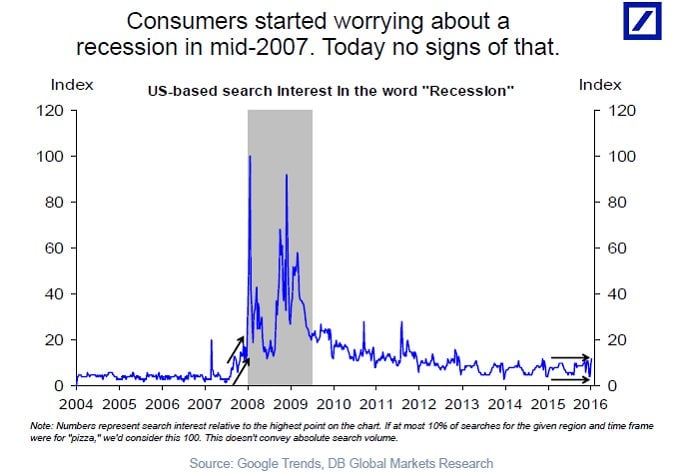

It’s tempting to think all this means a global recession is on the way, but that’s not some inevitability. Lots of global equities have had relatively long bull runs since the last recession ended, and this might just be the end of that. And although bear markets and recessions are often correlated, it’s not a perfect match. Big stock drops are scary, but not necessarily a harbinger of doom.

And as Deutsche Bank’s optimistic Tortsen Sløk points out, the only people worried about a big slowdown are the ones in the financier class.