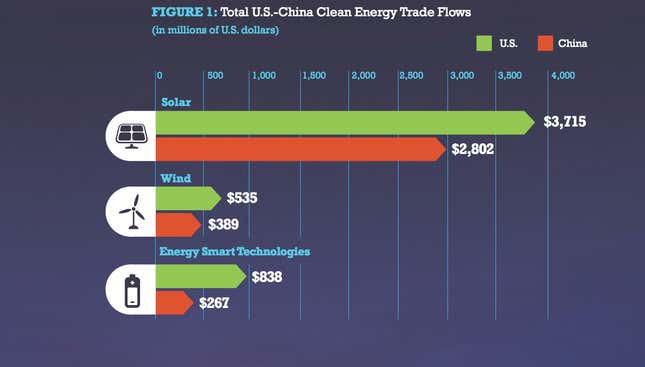

For those who fret over the US trade deficits and China’s dominance of the solar industry, here’s some good news: The US is in the black with a massive $1.6 billion green technology trade surplus with China.

That’s according to a study released today by the Pew Charitable Trusts based on data gathered and analyzed by market research firm Bloomberg New Energy Finance from 2011, the most recent year complete data is available.

Even in the $6.5 billion solar trade between the two countries, the US ran a $913 million surplus.While China’s supremacy in photovoltaic (PV) modules is uncontested–it exported $2.7 billion in solar panels and imported only $12 million (that’s not a typo)–the US supplied the high-tech machines and materials to make those modules.

That included $2.2 billion in capital equipment, $684 million in high-grade polysilicon that is the key ingredient in solar cells, along with half a billion dollars in other materials and components. China, on the other hand, exported no capital component or materials to the US, the reports’ authors write.

China’s strength in high-volume production of solar modules is matched on the US side by leadership in high-tech goods and services that are key components in the solar value chain.

The US clean energy strength in trading derives from its competitive advantage in producing high-value inputs (polysilicon and wafers, both for making PV cells), materials used in making PV modules, and the capital equipment and systems necessary in solar factories.

Likewise in the wind industry, the US maintained a $146 million surplus by exporting technologically sophisticated products such as electronics and controls and blade materials. The ever-increasing size of turbines makes them expensive to export, and thus China only sold $26 million worth to the U.S.

In what the report calls “energy smart technologies”–LEDs, lithium-ion batteries, electric cars and smart meters–the US maintained a $571 million surplus with China.

Will the status quo hold? Not necessarily.

“The US-China clean energy trade’s ties are every bit as nuanced and complex as those in other industries,” wrote Michael Liebreich, chief executive of Bloomberg New Energy Finance, in the report. “They stand to become even more so in coming months as the two nations quarrel over issues of intellectual property rights, dumping of goods onto international markets, and tariffs.”