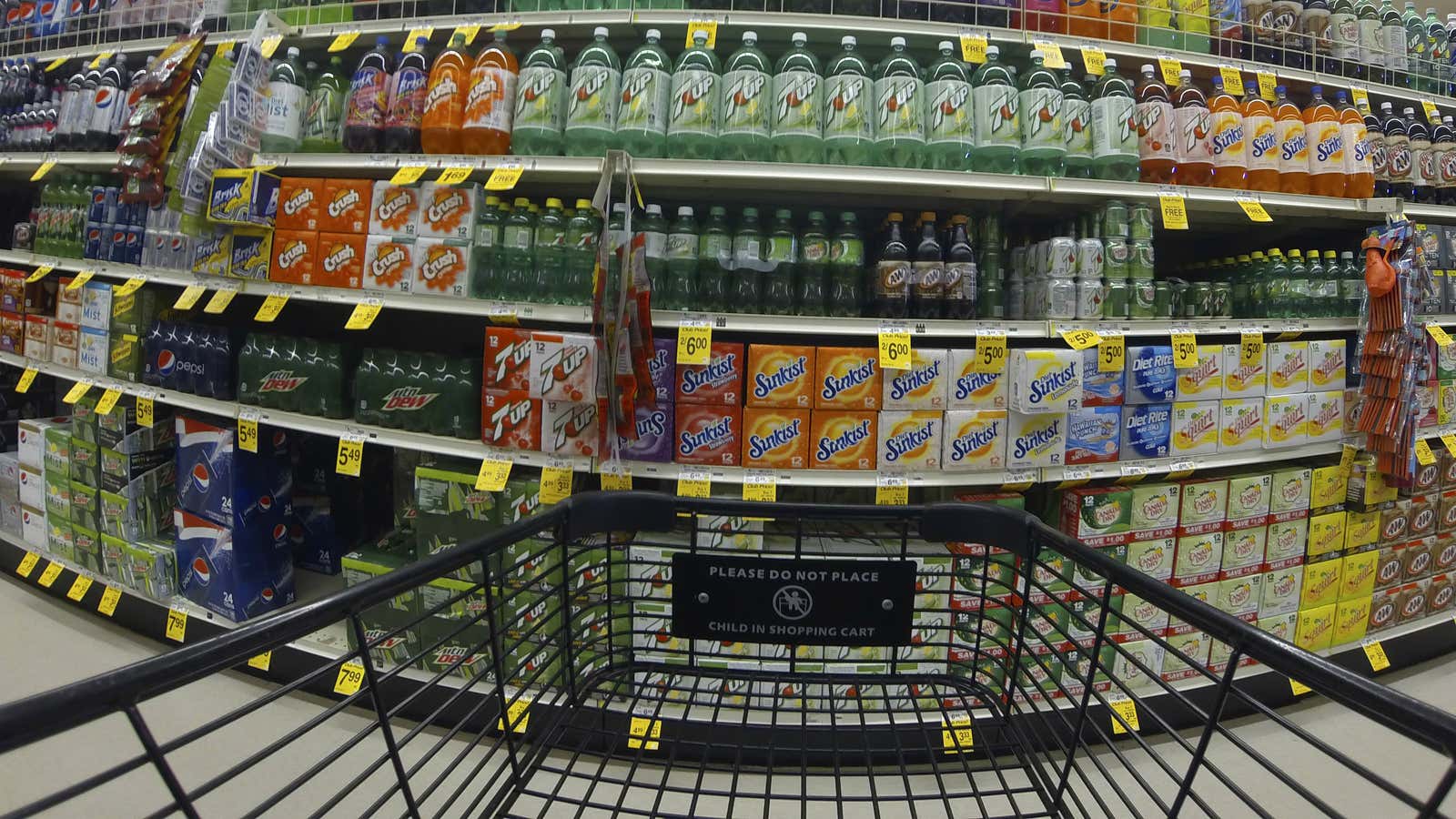

The public health arm of the United Nations is recommending that countries consider taxing junk foods—especially sugary drinks—in an effort to curb the growth of childhood obesity worldwide. That’s bad news for the soda industry, which has fought vigorously against such levies.

The call for taxes suggests that the long-term downtrend in carbonated beverage sales seen in the developed world, could be set to spread to remaining areas of growth in emerging markets.

The recommendation from the World Health Organization’s commission on ending childhood obesity amounts to a high-profile call to action. Essentially it adds the WHO to a growing chorus of public health officials urging local and national governments address health concerns that have been linked to sugar intake.

In 2014, the WHO estimated about 41 million children under 5 years old were impacted by weight problems. Globally, some 13% of adults are obese, with rates much higher in countries such as the US and Mexico. The WHO estimates that one-third of all US adults are obese, and one-in-16 are severely obese.

The theory is that a soda tax will help by increasing soda prices and reducing overall consumption. Such taxes on sugary foods and drinks have already been enacted in a handful of places, including Hungary, France, Finland, Denmark, the Navajo Nation, Mexico and Berkeley, California.

There’s still a lot of skepticism about the efficacy of such taxes. For starters, there simply aren’t enough data to show how taxes change a consumer’s diet as a whole. (A tax might stop a person from buying soda, but they could just as easily redirect that money to other junk food such as cookies and potato chips.)

And while it may have made sense to tax cigarettes to battle lung disease, the cause-and-effect relationship between the two was very tight. Critics of taxes stress that obesity can be caused by a number of factors—of which sugar consumption could be a part—including a person’s unique metabolic condition.

“We don’t think this is the silver bullet that anyone was looking for,” said James Quincy, Coca-Cola’s chief operating officer said of taxes during an October 2015 investor call, “We think that much more work needs to be done if, indeed, a solution is to be brought to bear on the whole obesity crisis, which overconsumption of anything, including soft drinks, would be a contributor and a part of the problem.”

The American Beverage Association added that companies give consumers lots of choices, package sizes and calorie information.

Effective or not, additional soda taxes would be a challenge for a soda industry already facing political and financial headwinds, especially in the US where carbonated cola sales have been shrinking relatively quickly. (Researchers found the tax in Mexico, led to a 6% decrease in sales of taxed beverages from. Mexico is the world’s third-largest market for carbonated drinks, according to Euromonitor.)

This week’s recommendations from the WHO obesity commission suggests that more soda taxes could be on the horizon, leaving the soda industry with a set of unappealing choices. A surge of taxes would likely hammer sales. But fighting to hold back the tide could quickly get expensive. In Berkeley, the industry spent about $30 per voter—more than $3 million—in an unsuccessful bid to defeat the California city’s ballot initiative aimed at taxing soda. But in that year the soda industry only faced two tax proposals in the US. (One in San Francisco was narrowly defeated.) In 2016, health advocates say they plan to launch up to a dozen in the US alone.