On the cusp of its leadership change, Bank of Japan board resists Abenomics once again

Japan’s new prime minister, Shinzo Abe, wants the nation’s central bank to pump cash into the economy to suppress the value of the yen and end deflation. But while markets have assumed he will get his way, the nation’s fiercely independent central bank reminded Abe earlier today that he is not omnipotent.

Japan’s new prime minister, Shinzo Abe, wants the nation’s central bank to pump cash into the economy to suppress the value of the yen and end deflation. But while markets have assumed he will get his way, the nation’s fiercely independent central bank reminded Abe earlier today that he is not omnipotent.

In the last meeting before its leadership changes hands, the Bank of Japan’s board voted 8-1 against immediately beginning open-ended asset-purchases (in other words, buying government bonds in a similar measure to the US Federal Reserve’s efforts to keep liquidity flowing into the economy). Though the BoJ’s vote in January okayed open-ended asset-purchases, it deferred the start date to January 2014.

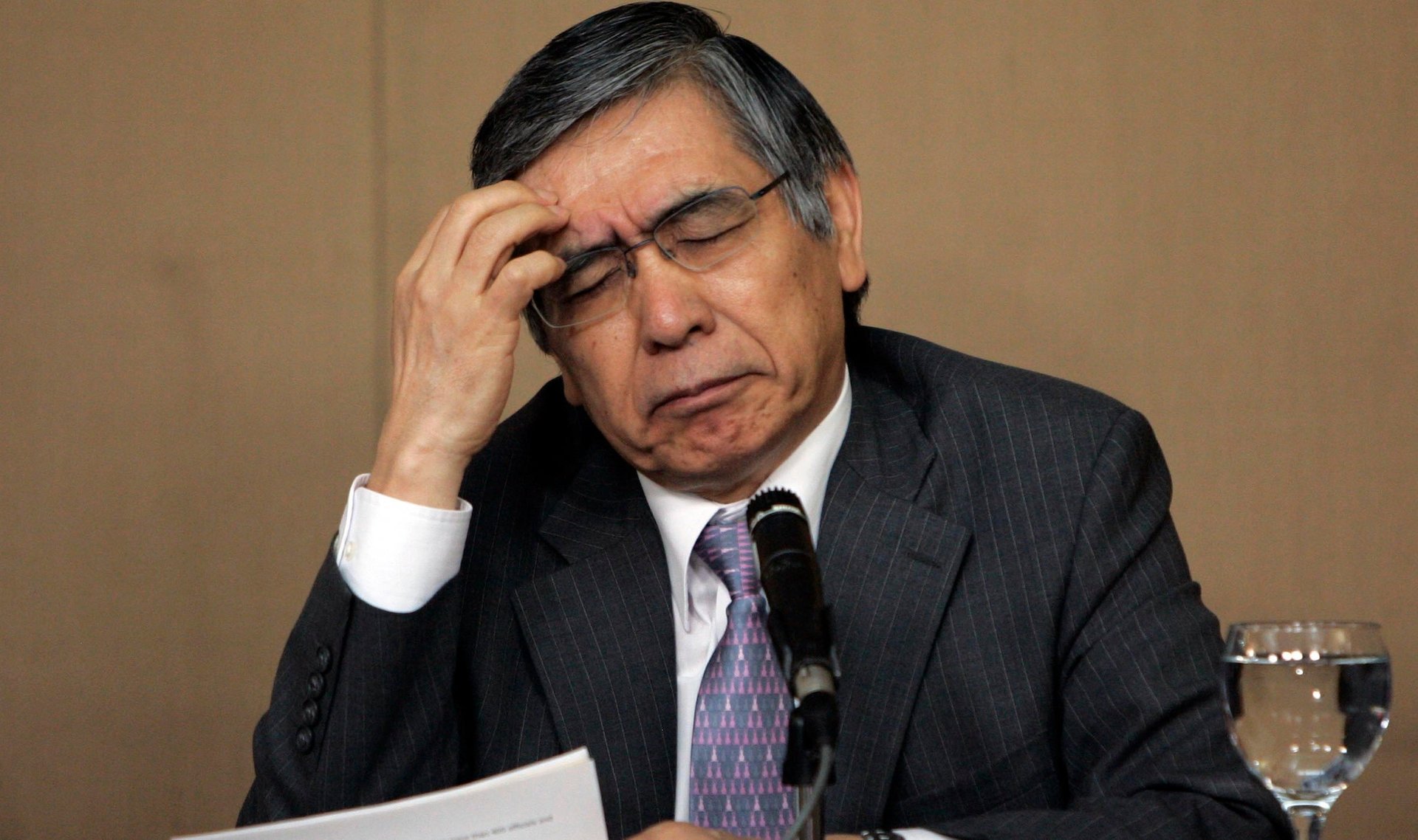

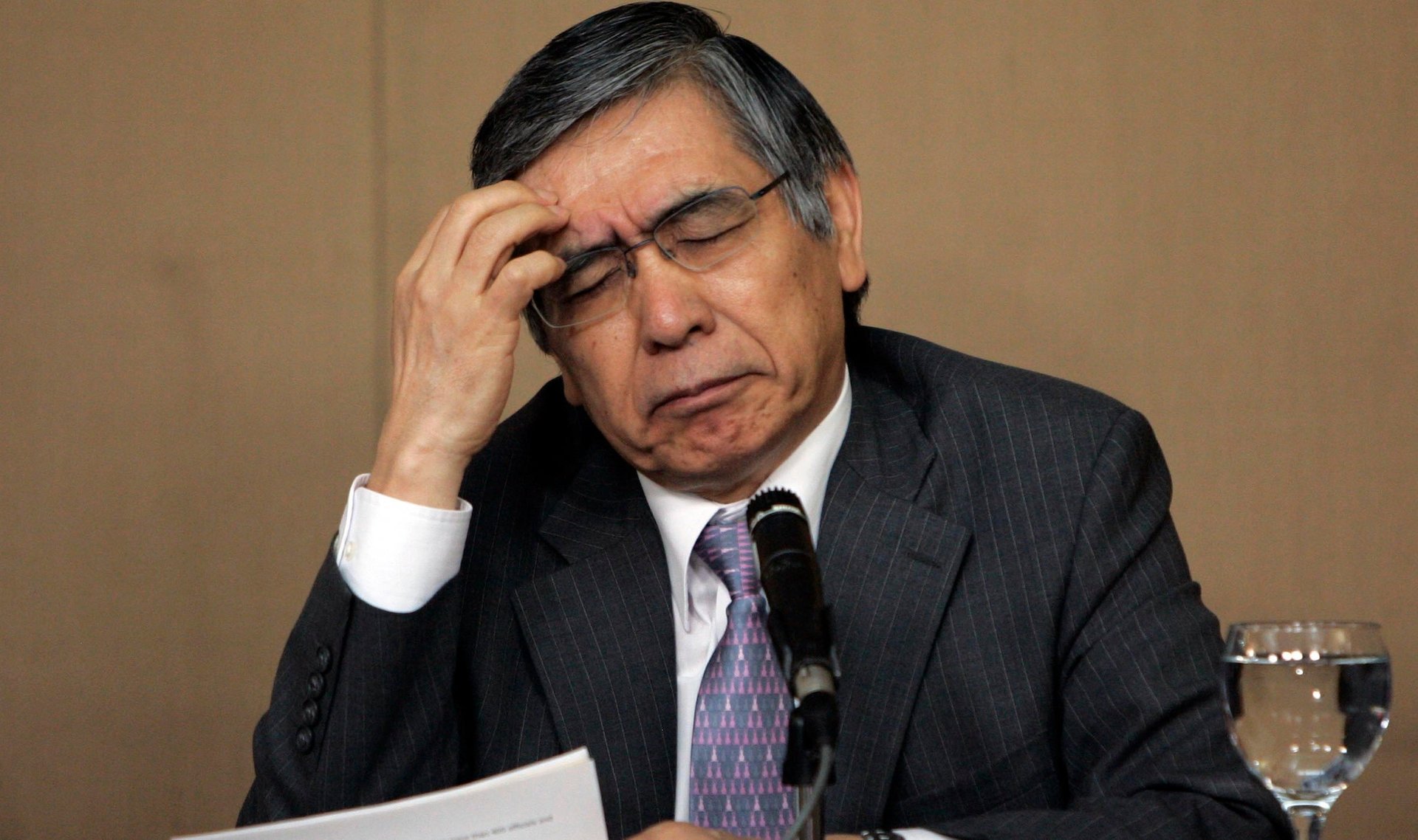

That show of defiance is bound to have taken traders by surprise. The prices of long-dated Japanese government bonds have soared in recent days on speculation that open-ended asset-purchases were a done deal. The plan to buy government bonds in bulk is supported by Haruhiko Kuroda, Abe’s choice to head up the BoJ when current governor Masaaki Shirakawa steps down on March 19. But today’s decision is a stark reminder of the BoJ’s long history of resisting political pressure.

Here is what has happened to the yield on Japanese 10-year bonds of late (since yields express interest payments as a percentage of price, they fall when prices rise):

And here is the effect Abe’s plans for Japan’s revival have had on the yen, and on Japanese stocks, which have risen inversely with the currency’s collapse, on assumptions that Japanese exporters will do much better as the prices of their goods become more competitive abroad:

Yet the market could be getting ahead of itself in assuming Abe’s plans will save Japan from its seemingly never-ending cycle of disappointment and deflation. Atsushi Mizuno, a former BoJ board member, has warned that (probable) incoming BoJ governor Kuroda will hit a “wall of reality” if he manages to implement his bond-buying scheme. Mizuno said the plan will cause a bubble in Japanese bonds, without addressing underlying problems in the Japanese economy, such as workers’ low productivity.