It’s finally happened.

The Chinese economic slump, the global energy bust, the European debt crisis, and the increasingly uncertain American economy have finally fused into one very large, unpleasant economic story.

The latest economic data out of China show Chinese authorities continue to buy up yuan with the country’s foreign exchange reserves in an effort to prop up the currency.

In part because of sluggish demand from China—the world’s largest consumer of commodities—stock prices of commodities producers have slid sharply, pushing markets in the US closer to a bear market.

In the US, investors dumped shares of Chesapeake Energy, the second-largest US producer of natural gas, after news reports that the company hired restructuring attorneys. Chesapeake stressed that it has no plans to pursue bankruptcy.

The stock market selloff has helped push investors into government securities, pushing yields on bonds to their lowest levels in a year. (Bond yields fall as prices rise.)

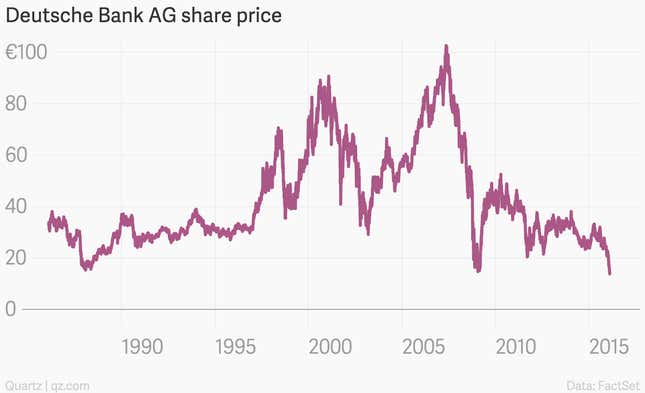

Those lower long-term bond yields—along with potential exposure to the slumping energy sector and China—are weighing on bank shares. (When long term bond yields fall it hurts banks because it effectively lowers interest rates that they can charge borrowers, squeezing profits.)

Deutsche Bank, a bank that has gotten attention for its exposure to energy over the last few days, got clobbered today after a credit analyst brought up the prospect that it wouldn’t be able to make a payment on an obscure set of its bonds. (Deutsche has vigorously contested that notion.)

On top of all those concerns, banks in Europe are getting burned by a fresh flare-up of the European debt crisis.

In short, the markets are about as messy right now as they’ve been at any time over the last couple years. So when Janet Yellen appears before the US Congress on Wednesday as part of her semiannual testimony, everyone is going to be waiting to hear some soothing words.

If she doesn’t sing the market’s tune, look out below.