Aluminum is a perfect reminder that China does not have a market driven economy.

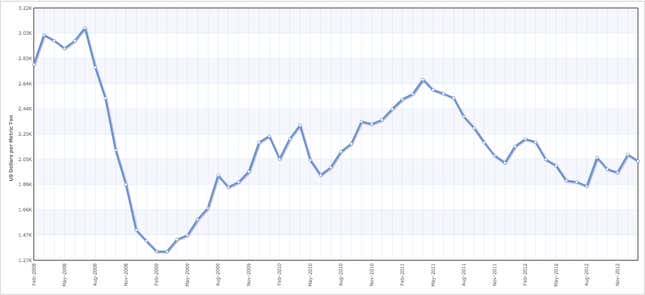

The price of the metal has been seriously weak for the last five years due to a global supply glut, yet China ignores that glut —pumping out a record 1.78 million metric tons in January, according to figures released today—and makes the oversupply worse. Stockpiles of the metals in Chinese warehouses also hit a record high in late February.

It all comes down to jobs and pride

In much the same way that the US and Russia lavished cash on their space programs in the 1960s, China since the late 1980s has worked tirelessly to perfect its aluminum production skills. And China’s economic planners like new aluminum smelters because they are mostly coal fired (pdf, p.175) and thus are useful consumers of the black stuff. The Beijing government has pushed for massive development of new coal mines in Xinjiang in Northwest China for example, and the aluminum plants will be natural customers for the mines.

China now has the world’s best aluminum production technology, according to Michael Komesaroff, principal of Australian commodities consultancy Urandaline Investments. But its over production hurts global miners. Rio Tinto has written down the value of Alcan, an aluminum company it bought in 2007, by an estimated $28 billion.

“Aluminum prices won’t do well for the next ten years,” says Komesaroff.

So China’s aluminum industry is a great window on how its economic planners think. New smelters create jobs for construction workers, smelter staff and miners, and aluminum gives China’s politicians some world class technology to feel proud of in a nation that is best known for making low value consumer goods. Supply and demand is neither here nor there.