What on earth is going on with the euro today?

The bazooka is not the most accurate weapon. When wielded by a non-professional, it’s even more unpredictable.

The bazooka is not the most accurate weapon. When wielded by a non-professional, it’s even more unpredictable.

A year ago, Mario Draghi, president of the European Central Bank, brandished his “big bazooka,” as a commitment to buy more than €1 trillion ($1.1 trillion) in bonds became known. Since then, the euro zone’s weak, deflationary economy hasn’t responded to the onslaught, forcing “Super Mario” to reload again and again.

Today (Mar. 10), Draghi flashed yet more firepower. The ECB cut its main benchmark interest rate to 0%, pushed another key rate even further below zero, and upped its monthly bond purchases to €80 billion per month, from €60 billion before. It will also launch a special loan program for banks, whereby they can get cheap financing if they boost lending to companies; in some cases, this will come at a negative interest rate, meaning that the ECB will pay banks to lend.

“We have shown today that we are not short of ammunition,” Draghi said.

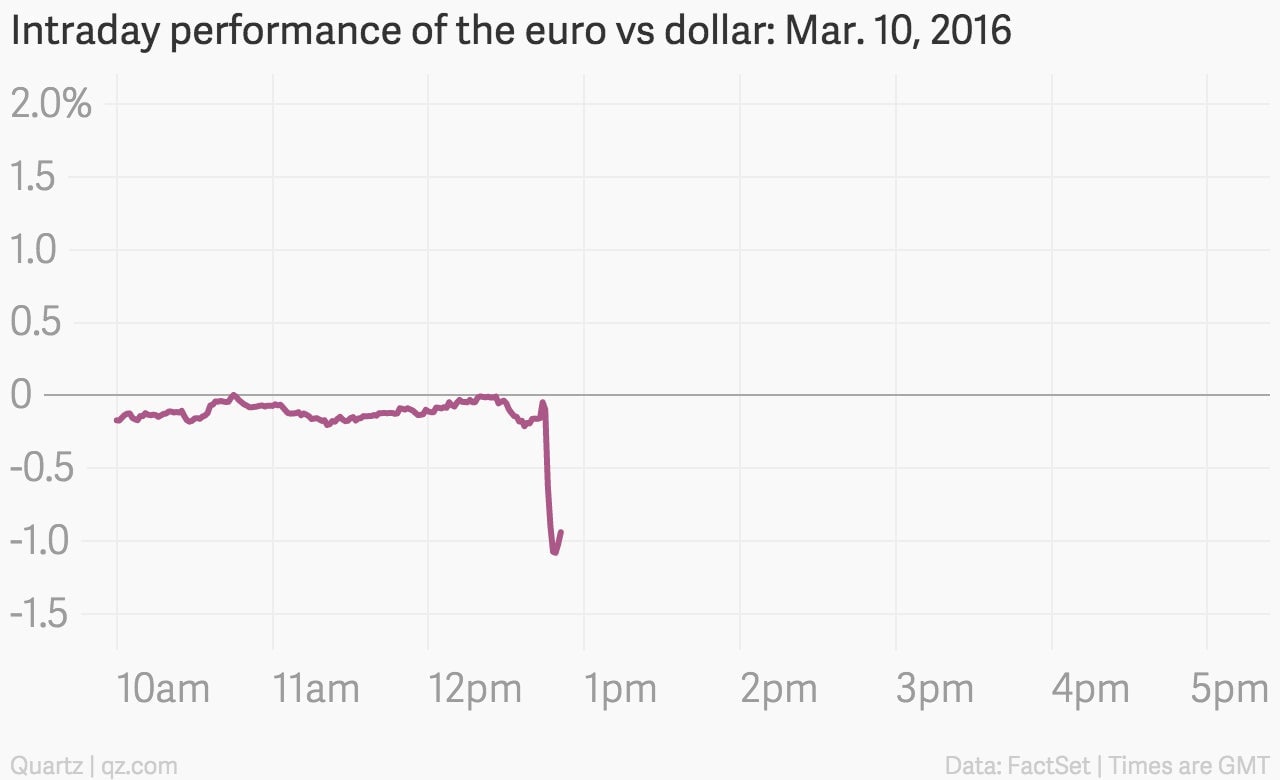

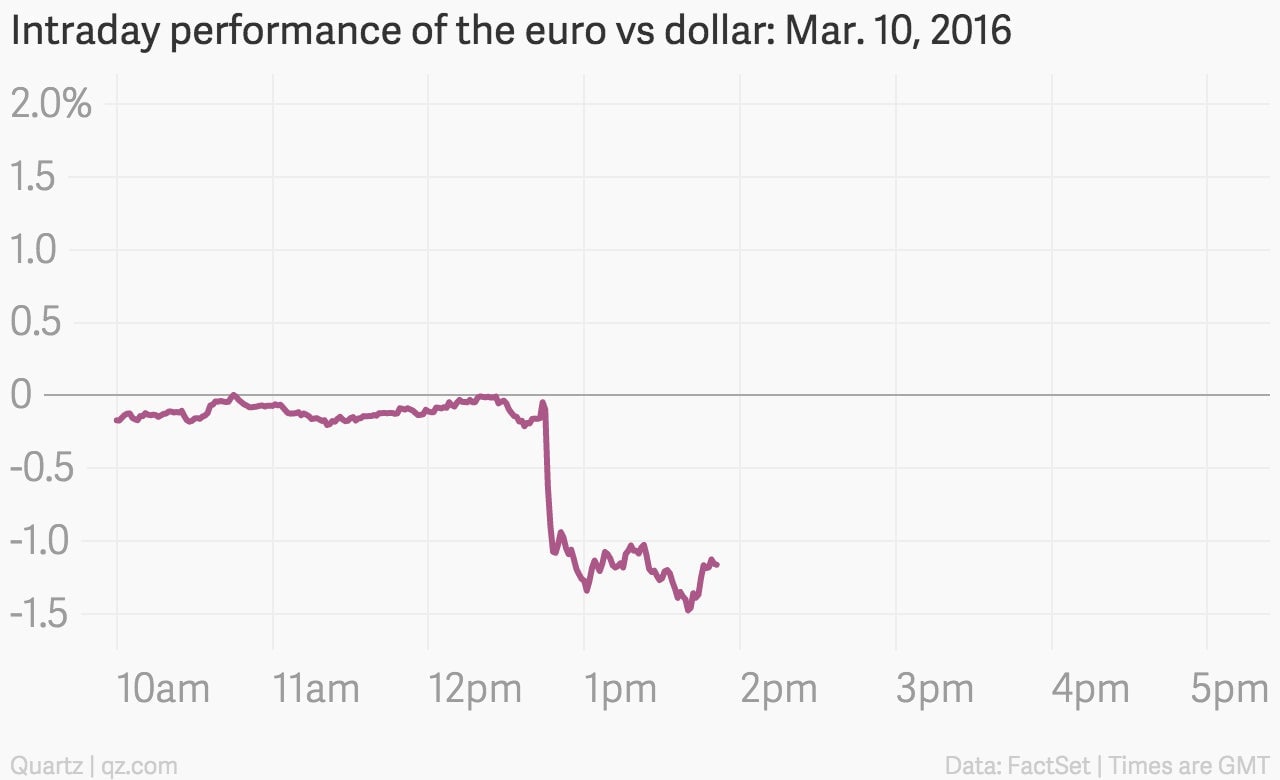

Going into the meeting, markets weren’t expecting such brazen bazooka wielding from Draghi. After the rate cuts and stimulus measures were announced, the euro dropped sharply, as it has on previous occasions when the ECB chief came out all guns blazing.

A weaker euro would help the region pull itself out of stagnation, boosting exports and stoking inflation at a time when the risk of deflation is one of the euro zone’s most pressing problems. Despite the new measures it announced, the ECB also cut its forecasts for economic growth (to 1.4% this year, from 1.5% three months ago) and inflation (to only 0.1% this year, from 1% before).

As Draghi explained the ECB’s new tactics to reporters, the euro drifted lower against the dollar. All was going according to plan.

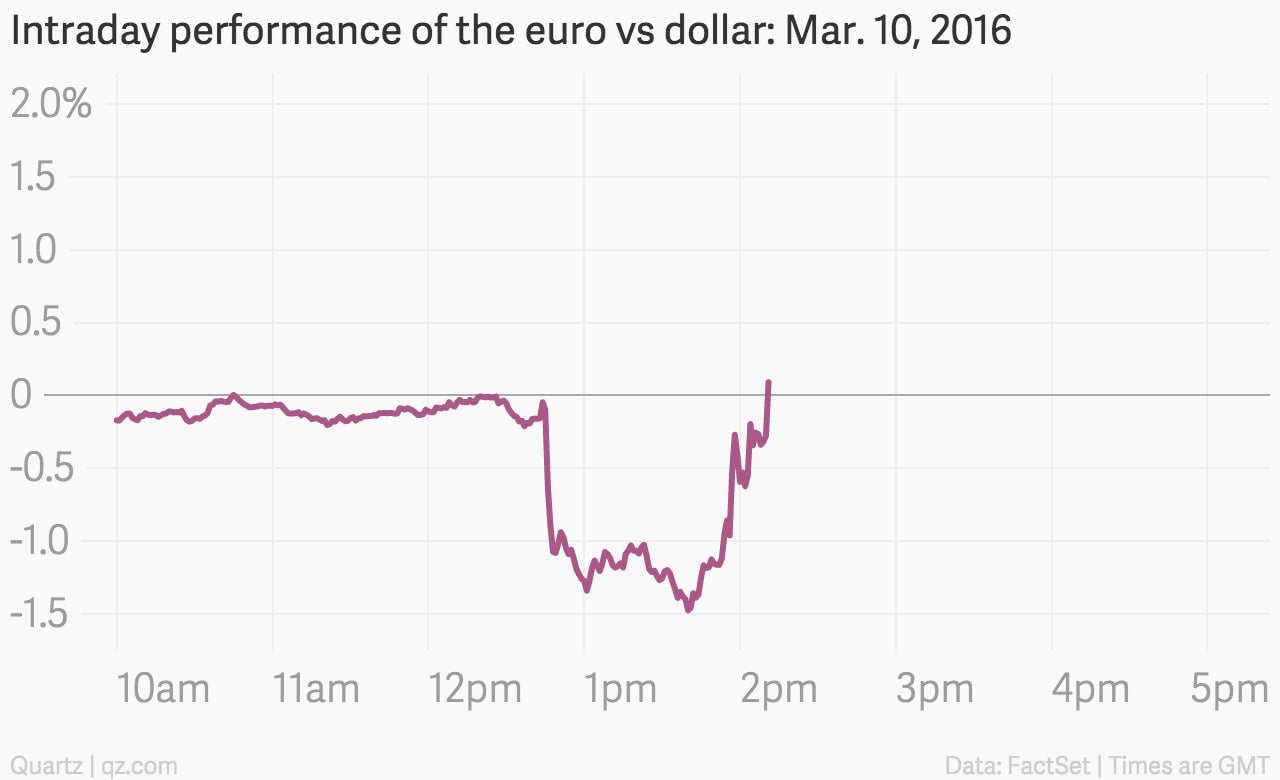

But then came the Q&A portion of Draghi’s press conference. “We don’t anticipate it will be necessary to lower rates further,” he said. And even if circumstances warranted more rate cuts, he added, “does it mean we can go as low as we want without having any consequences on the banking system? The answer is no.”

In a sense, Draghi revealed that his arsenal isn’t unlimited. (Those bazooka shells don’t come cheap.)

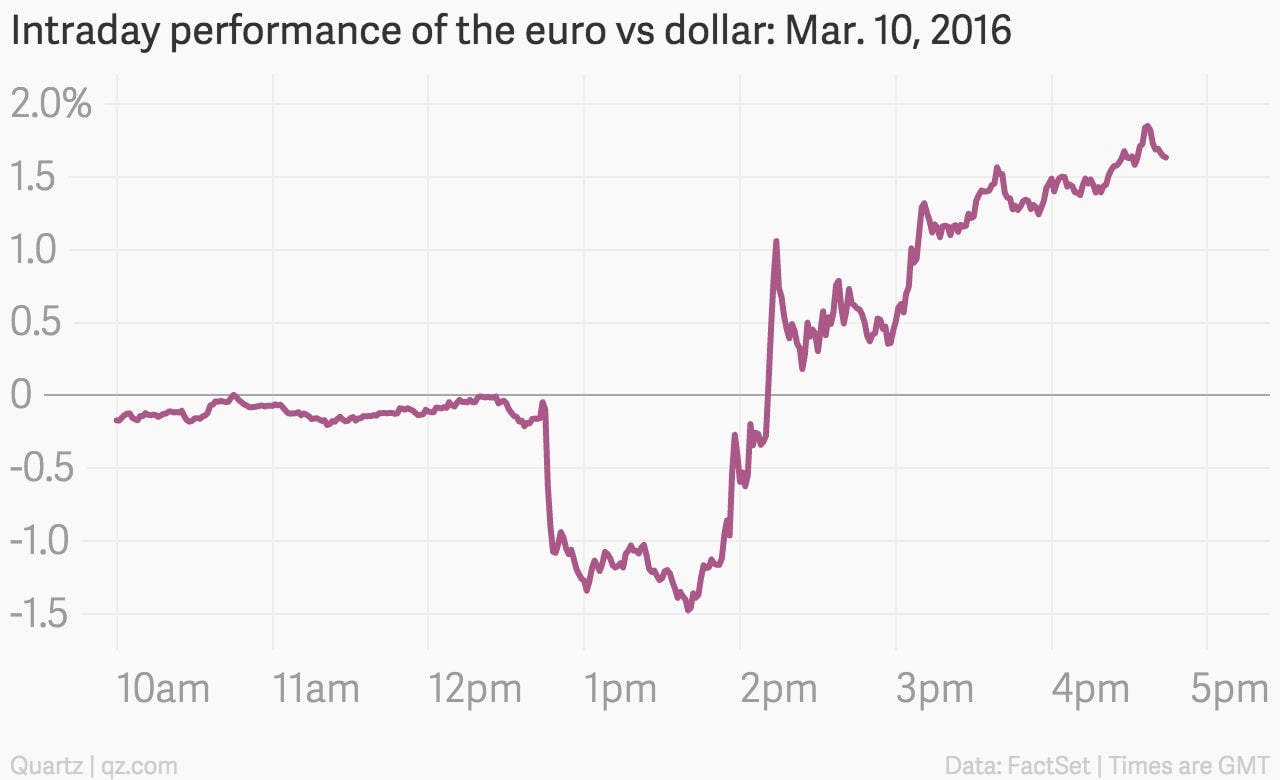

Within about an hour, the euro regained all of its lost ground.

And then some.

Oh dear.

At the time of writing, the euro is up by more than 1.5% against the dollar, having fallen by a similar amount when Draghi started talking a few hours earlier. The euro-dollar trade is one of the world’s biggest, deepest markets, with some $1.3 trillion changing hands every day. Vast fortunes can be made on moves of less than a penny—it is simply not supposed to swing around as wildly as this.

But such is the febrile atmosphere in the euro zone these days. The markets celebrate more stimulus, but freak out as soon as there are hints that it isn’t infinite. And even as the ECB unveils increasingly aggressive measures, it acknowledges that it won’t be enough to boost growth or bring inflation back up to its medium-term target. Low interest rates are pummeling banks’ balance sheets, even as the ECB showers them with free money.

You can’t shoot a bazooka over and over again without collateral damage.