There are lots of ways to talk about inequality in the US, but one good measure is university endowments. While many public schools are straining from years of budget cuts, elite American institutions are stockpiling incredible amounts of cash. In 2015, 20 US colleges and universities—less than 1% of the nation’s total—netted 30% of all donations, or $11.6 billion.

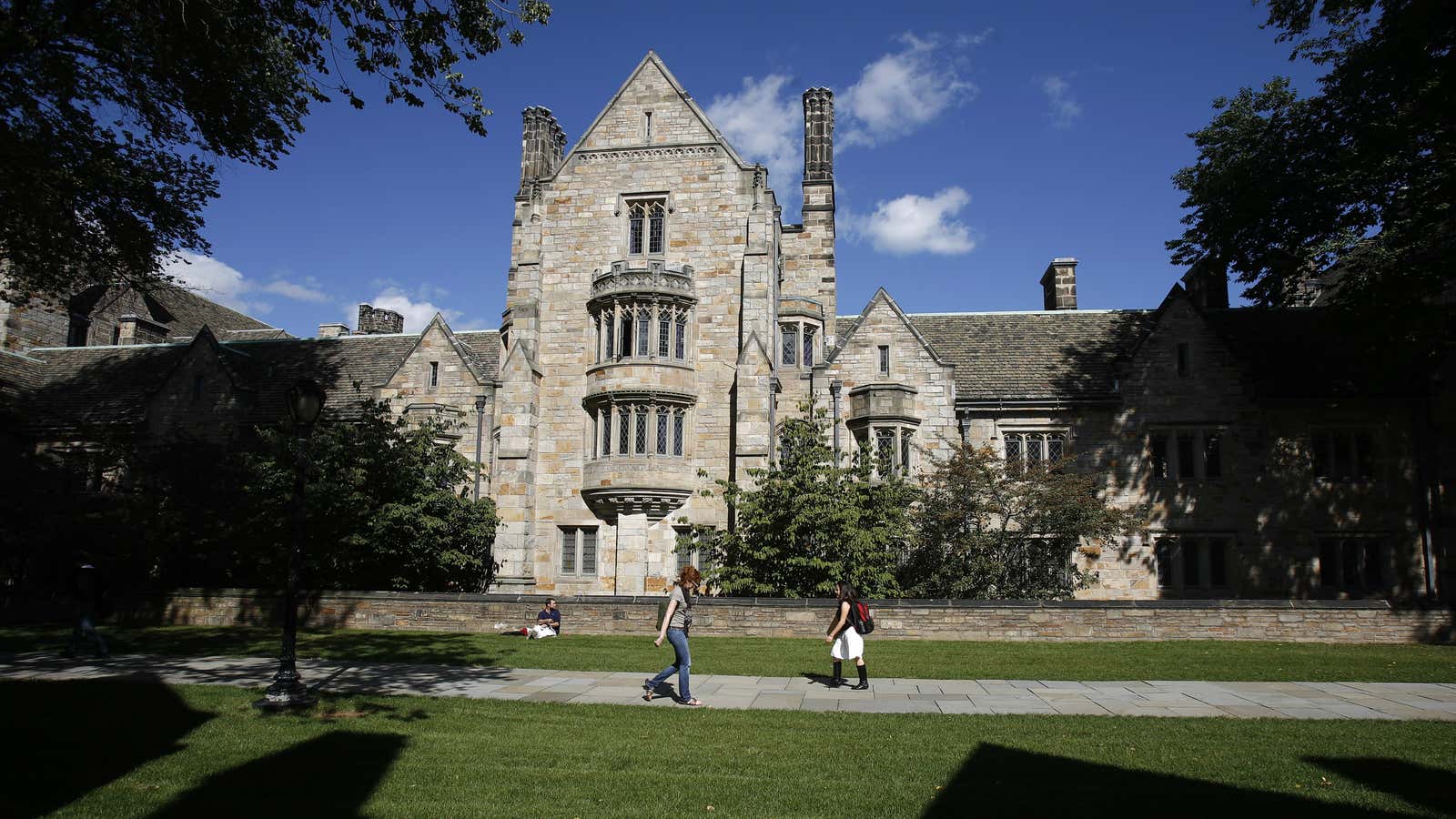

These institutions benefit from federal policies that allow them tax-free gains. Harvard ended its last fiscal year with an endowment of $37.6 billion. Yale finished up with $25.5 billion in its investment coffers and in 2015 secured a $150-million bestowal from Stephen Schwarzman, the billionaire co-founder of the Blackstone Group, to create a “world-class” student center. Which was only the second-largest gift in the school’s history.

New legislation introduced in Connecticut could change that. A bill proposed by Connecticut legislators would permit the state (which happens to be facing a hefty budget deficit) to tax gains in any “independent institution of higher education” with an endowment of $10 billion or more. In practice, that only means Yale.

Already, the university is bristling at the idea. Rich Jacob, Yale’s associate vice president for federal and state relations, called the bill a “specific attack on higher education” and suggested it would hurt the school’s ability to provide “generous” financial aid to low-income students.

It’s a legitimate-sounding concern, but one that starts to ring hollow when you look a bit deeper. For Yale’s current juniors, the class of 2017, 69% of students come from families that earn more than $120,000 per year, putting them solidly in the top quintile. (The median household income in the US last year was $53,657.) In 2014, an analysis by the New York Times ranked Yale 44th (paywall) in the nation in terms for economic diversity, the lowest of any Ivy League school. (It was up to 26th last year.)

Congress is already eyeing private university endowments, last month querying 56 schools with assets over $1 billion on how they manage and spend their funds. And in the past, people have proposed things like forcing universities to spend more each year (paywall), or, similar to Connecticut’s bill, taking away some of their tax benefits.

None of these proposals are perfect. As Jordan Weissmann has explained at length in Slate, requiring colleges to spend more wouldn’t necessarily make them spend better. Schools might allocate more money to financial aid and faculty wages, or they might use it on extravagant new dorms and tofu apple crisp. Taxing university endowments would open up the possibility of taxing other nonprofits, like museums and cultural institutions. And why would we tax the wealth of rich universities, but not so much of rich individuals?

In short, there’s no obvious answer, only an obvious problem. With any luck, Connecticut will get us to think it through again.