We’ve told you again and again and again. Strength in US housing is not to be dismissed. Housing got the US into the worst recession since the Great Depression. And it appears to be leading the way out. Here’s the latest updates on the sector today.

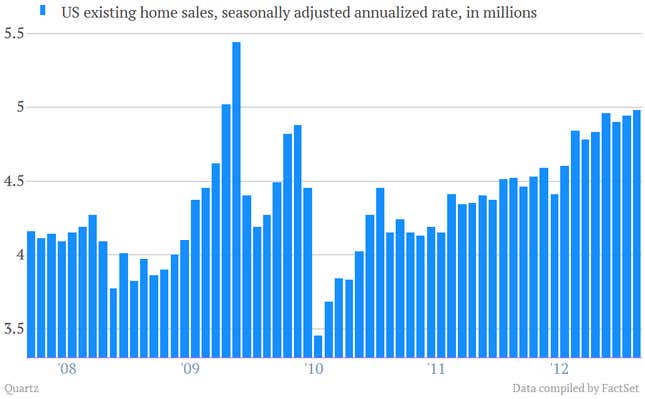

Existing home sales hit three year high

- Purchases rose 0.8% in February to a yearly clip of 4.98 million, the highest level in three years. Still nowhere near the peak of the housing boom—when the annual pace topped 7 million—but given that surge was premised on a pervasive society-wide fraud participated in by consumers and financiers alike, it’s probably better that we’re not seeing those levels.

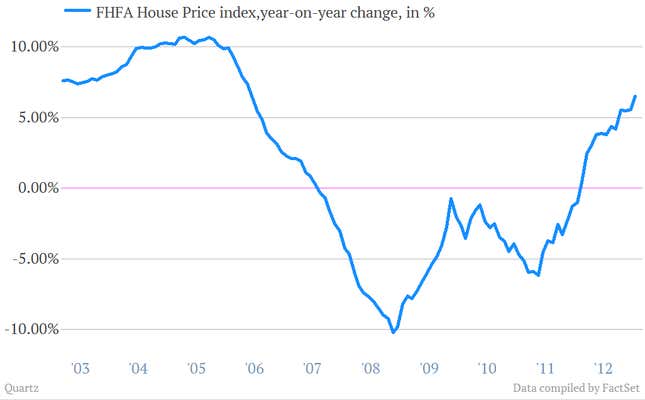

Gauge of existing home prices continues to rise

- The US Federal Housing Finance Agency’s gauge of house price increases rose 0.6% in January from the previous month. Compared to January of 2012, prices are up 6.5%. The improvement in housing prices is part of a virtuous cycle for the US economy. Rising prices help more homeowners emerge from being underwater on their loans, making more eligible for refinancing. Once they refinance their mortgages, less of their monthly income goes to paying for housing. That frees up cash to be spent elsewhere, helping to shore up consumer spending. This might be yet another reason why the payroll tax hike hasn’t hammered US consumers as much as some had feared.