After days of dodges and denials, David Cameron has finally admitted that he held a stake in his father’s offshore fund before he became Britain’s prime minister. For a leader who once dubbed tax-avoidance schemes “morally wrong,” this has made things awkward, to say the least.

After the so-called “Panama papers” revealed the extensive offshore dealings of world leaders, executives, and other important public figures—including Cameron’s late father, Ian—the prime minister initially rebuffed suggestions that he profited personally from offshore accounts, and dismissed questions about his family’s finances as a “private matter.” But after a few carefully worded clarifications later didn’t satisfy the press or his opponents, Cameron admitted to ITV in a televised interview that, in the past, he did indeed benefit from funds based offshore.

In this case, it was a fund—Blairmore Holdings—founded by Ian Cameron in the 1980s, registered in Panama by the Mossack Fonseca law firm, and based in the Bahamas. The fund is still active, now based in Ireland and administered by asset manager Smith & Williamson. It has around $30 million in assets under management; its top holdings currently include Alphabet, Walt Disney, and Tencent.

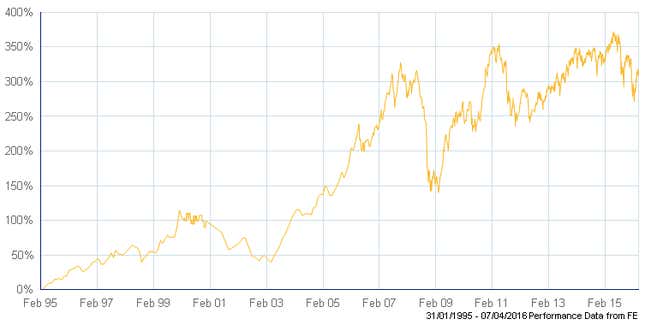

It has been tough going for the equity-focused fund of late, with it losing around 7% of its value over the past five years, versus a 20% rise in the FTSE World stock index over the same period. But when the prime-minister-to-be held his stake in the fund, between April 1997 and January 2010, its performance was much perkier:

A statement from Cameron notes that he and his wife invested £12,497 in 1997 and sold it for £31,500 in 2010. That is a chunky 152% return, comfortably outperforming global stock benchmarks over that time:

Cameron says that he paid taxes on dividends from the fund (which begs the question, doesn’t he know about the benefits of dividend reinvestment?) but not on the capital gains when he sold his stake, as the profit fell below the tax-free allowance for couples at the time (£20,200). It wasn’t a life-changing sum, especially in relation to the £300,000 inheritance that Cameron said he received from his father after his death in 2010. (When asked about the origins of his inheritance, Cameron told ITV, “I obviously can’t point to every source of every bit of money and dad isn’t around to ask the questions now.”)

Iceland’s prime minister was forced out of office earlier this week for his involvement with Panama-linked offshore accounts. Cameron’s most strident opponents are now calling for him to go, too. The prime minister is unlikely to get many plaudits for the shrewdness of his offshore investment strategy.

His job seems safe for now, but this week’s clumsy offshore revelations have put the prime minister on the back foot at a crucial time. Ahead of a referendum on the UK’s EU membership in June, Cameron is desperately trying to convince voters to trust him that Britain is better off inside the bloc. With each day that he spends rehashing the details of past dealings in opaque trusts with links to tax havens, his credibility suffers.