Don’t look now: The Starwood-Marriott merger might actually be happening

The Starwood-Marriott saga may finally be nearing its conclusion.

The Starwood-Marriott saga may finally be nearing its conclusion.

On Friday, shareholders of Marriott International and Starwood Hotels and Resorts voted to approve a merger between the two companies, which would create the world’s largest hotel chain. Marriott’s stock edged up 1% Friday afternoon, to $66.17 a share. Starwood rose about half a percent, to $78.68.

The vote likely brings an end to the bidding war over Starwood that cropped up fast and escalated even faster last month.

Marriott initially hammered out an agreement to acquire Starwood last fall, but the deal fell apart in mid-March when Chinese conglomerate Anbang Insurance Group made Starwood a $13.2 billion all-cash offer. A few days later, Marriott returned with another bid: a cash-and-stock mix valued at $13.6 billion. And then Anbang tried again, this time offering $14 billion.

The twist came last week, when Anbang suddenly walked away from that $14 billion bid, “due to various market considerations,” leaving Starwood with Marriott’s proposal.

Anbang was thought to be interested in acquiring Starwood as part of a larger play to reshuffle its assets amid a continued economic slowdown in China. It wouldn’t be the only one: Chinese firms have already agreed to more than $100 billion in foreign deals this year, rivaling the $106 billion exchanged in all of 2015. Highlights include the $43 billion cash offer that government-owned ChemChina made for Swiss pesticide and seed company Syngenta in February, and a $5.4 billion deal China’s Qingdao Haier struck to buy General Electric’s appliance business in January.

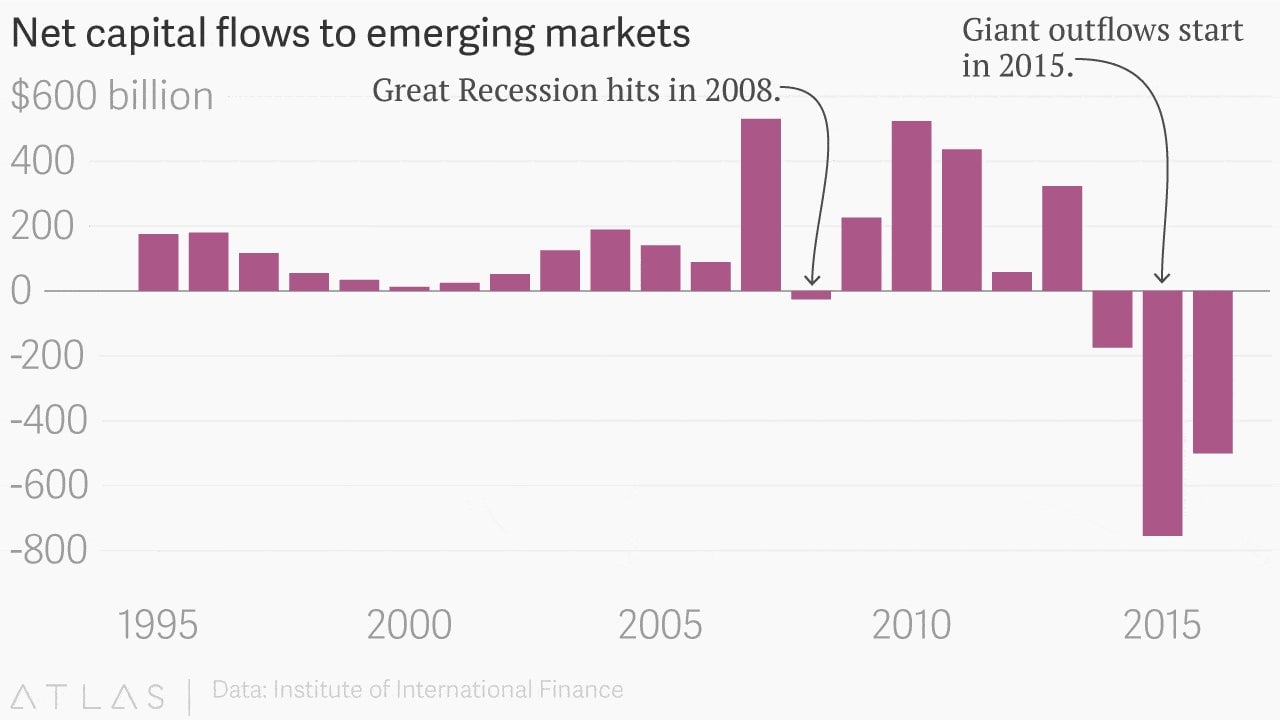

In short, massive amounts of money are washing out of China:

Marriott’s motives, on the other hand, are more strategic. Forming the world’s largest hotel chain and acquiring Starwood’s revered loyalty program should help Marriott fend off competition from other big hotel companies, not to mention alternative lodging upstarts like Airbnb. “With today’s successful stockholder approval milestone, we are that much closer to completing our transaction,” Marriott CEO Arne Sorenson said after Friday’s vote. “We are committed to a timely and smooth transition.”

The deal still needs regulatory approval in Europe and China.