It was a good year for Hon Hai Precision Industry, the contract manufacturer whose giant plants in China—operating under the trade name Foxconn—churn out millions of Apple iPhones and other popular products.

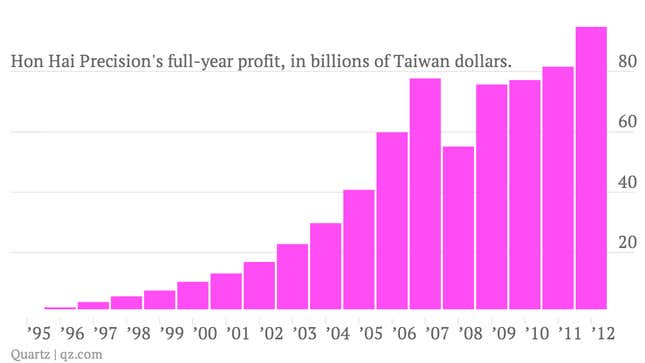

Hon Hai Monday reported a full-year 2012 profit of 94.76 billion new Taiwanese dollars ($3.2 billion), a 16% jump over the previous year. Here’s a look at the impressive profit growth at the firm going back to 1995.

Going forward, a key challenge for Hon Hai will be balancing its surging profits with rising demands for better pay and working conditions in China, where Foxconn is the country’s largest private sector employer. A number of high-profile incidents have raised concerns over working conditions in Hon Hai’s plants in recent years, including a rash of worker suicides in 2010. That’s put pressure on the company to clean things up. Foxconn has pledged to cut back on worker hours, raise pay and improve other conditions in 2013.

All else equal, that could make it tougher to post explosive profit growth going forward. Recent Foxconn moves—such as investing in electronics makers Sharp and GoPro and targeting Brazil and Indonesia as new factory locations—show it’s trying to address the challenge by further diversifying beyond Chinese manufacturing.

But the mounting pressures on Foxconn’s profitability are yet another sign that the next phase of China’s development will require China to find other competitive advantages—besides cheap labor.