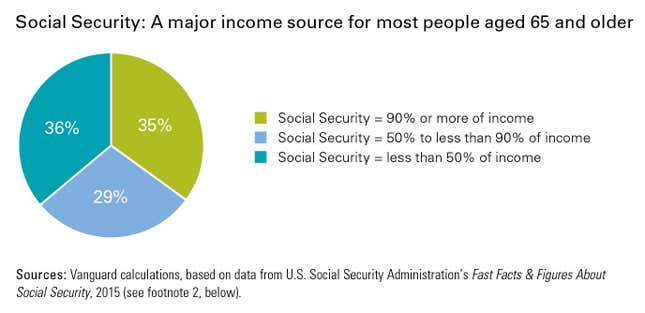

For most Americans, Social Security is a big part of their retirement income

An estimated 91% of Americans aged 65 or older receive Social Security benefits1—the average annual benefit for a retiree is about $16,000.2 For most of these retirees (64%), Social Security represents a significant portion of their income. Even for affluent retirees (those aged 60–79 with at least $100,000 in financial assets), Social Security accounts for 29% of total retirement income, on average.3 Given that Social Security provides a base level of guaranteed income for most retirees, it’s an important benefit for investors and their advisors to consider when designing a comprehensive plan for retirement income.

By delaying Social Security, retirees can stretch their savings

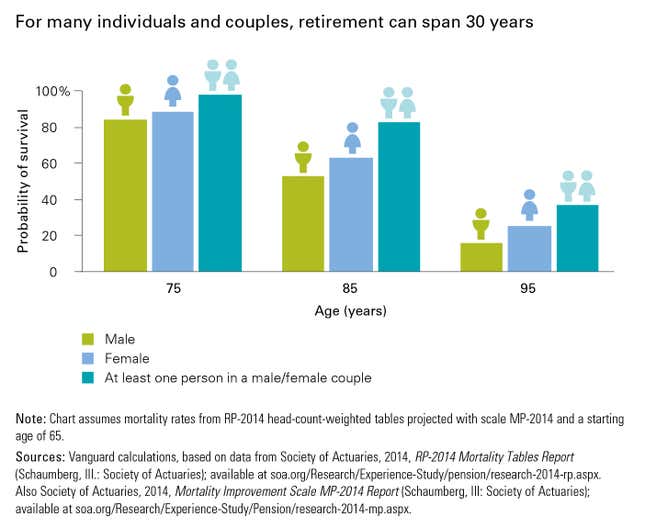

In the past, the decision as to the “right” time to claim Social Security has often been based on a break-even analysis of a retiree’s expected benefits versus his or her life expectancy. That approach, however, ignores two key features of Social Security, namely: Once you start receiving it, it’s paid for the rest of your life, no matter how long you live, and is adjusted upward for inflation. A big concern for most retirees is the risk of outliving their savings. For many retirees who can afford to do so, deferring Social Security for a few years (even past their “full retirement age”—defined by Social Security according to one’s birth year—to the maximum annual benefit at age 70) greatly increases their lifetime monthly benefit. Given that at age 65, more than 50% of women can expect to live past age 88 (and 50% of men past 85), delaying Social Security can provide powerful longevity protection.

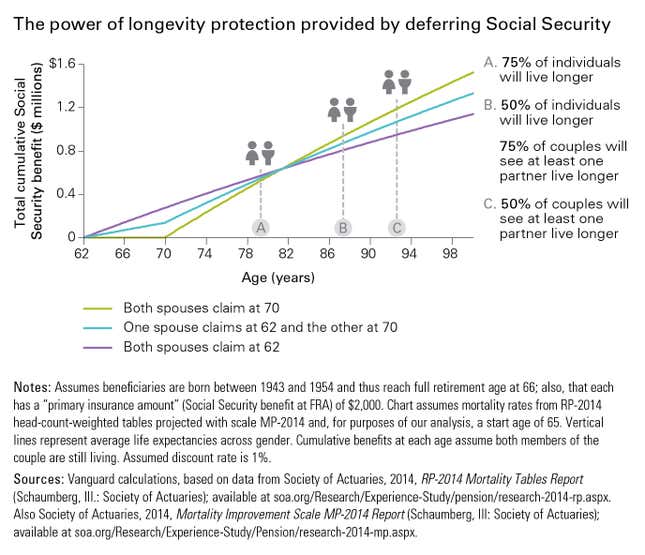

Social Security acts like an inflation-protected annuity

The act of delaying the claiming of Social Security is analogous to purchasing an inflation-protected deferred income annuity. Benefits increase by up to 8% in real terms for every year that claiming is delayed. The chart below demonstrates the effectiveness of a deferred claiming strategy both for increasing guaranteed income and for providing longevity protection. Also, in the case of a married couple, one of whom, for instance, delays claiming until age 70 (for maximum benefit), a surviving spouse receives the larger of the two Social Security benefits—thus further demonstrating Social Security’s role in protecting lifetime income.

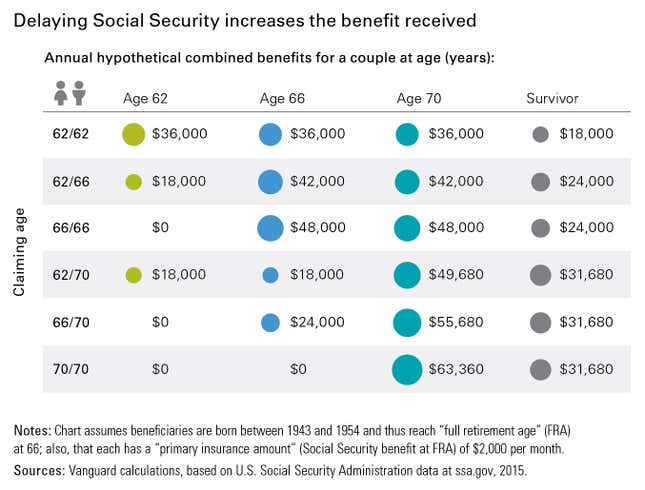

Thoughtful claiming strategies can help retirees make the most of their benefits

A careful review of Social Security regulations, your financial situation, and any health considerations you may have are crucial to developing a strategy to maximize income during retirement. (Note that the regulations can be complex, and you may benefit from seeking professional advice.) For individuals in poor health or with little or no other financial resources, early Social Security claiming may be appropriate, but for most retirees, the increase in guaranteed income gained by deferring Social Security makes waiting to start benefits an appropriate strategy. The accompanying chart shows the potential impact on a couple’s lifetime Social Security income of three different approaches: both spouses claiming at 62 (the earliest possible age), a hybrid strategy where one spouse claims at age 62 while the other delays until age 70, or both spouses delaying until age 70 to accumulate the maximum amount of delayed retirement credits.

Read the whitepaper

Vanguard research authors: Nathan Zahm, CFA, FSA; Jonathan R. Kahler

1 U.S. Census Bureau, Population Division, June 2015, Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States: July 1, 2014 ; available at factfinder.census.gov/ faces/tableservices/jsf/pages/productview.xhtml?src=bkmk. Also U.S. Social Security Administration, 2015, Annual Statistical Supplement to Social Security Bulletin, 2015 (Washington, D.C.: U.S. Government Printing Office). (Note: All Social Security benefit amounts shown in this article are before any federal income tax.)

2 U.S. Social Security Administration, 2015, Fast Facts & Figures About Social Security (Washington, D.C.: GPO).

3 Anna Madamba, Stephen P. Utkus, and John Ameriks, 2014. Retirement Income Among Wealthier Retirees (Valley Forge, Pa.: The Vanguard Group).

CFA® is a register trademark owned by CFA Institute.

This article was produced by Vanguard and not by the Quartz editorial staff.