Rarely do the world’s energy-related companies–oil, gas, coal, chemicals–directly attack one another: The spoils are so large, and the dangers of blowback so pernicious, that no one wants to risk blowing the party for themselves. But the battle to monetize the US shale revolution is different. We are witnessing the opening act of what seems likely to be a bloody, drawn-out battle between Big Oil and Big Chemicals for control of the US natural gas supply.

At stake are hundreds of billions of dollars in profit to companies from around the world that have invested in the US shale patch. A surge in US gas production has made the country self-sufficient in the fuel, and disrupted global economics and geopolitics–Russia is weaker, OPEC is worried, and Europe is suddenly replete with supply.

But as a result, US wholesale gas prices are so low—now $3.92 per thousand cubic feet—that drillers say they are “losing our shirts.” In hopes of capitalizing on far higher prices abroad, they would like to start exporting from the US in the form of liquefied natural gas (LNG). For instance, here is an application by BG, the British gas company, to export 20 billion cubic meters of LNG from Louisiana for 25 years.

That pits them against US chemical and metals companies. These companies argue that LNG exports should be restricted—unfettered exports, they say, will undermine a resurgent US industrial and manufacturing sector that is being revitalized by cheap gas. Dow, Alcoa and Huntsman are among six US industrial giants that have formed a lobbying group called America’s Energy Advantage to push for limits.

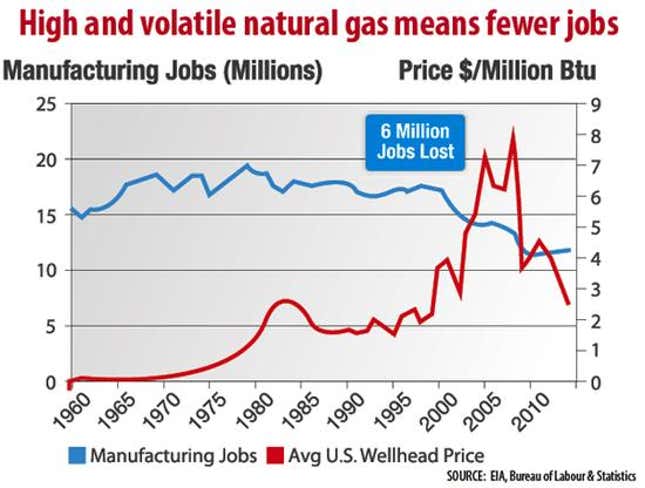

Here is a chart distributed by America’s Energy Advantage. It suggests a future of job volatility if the oil companies have their way.

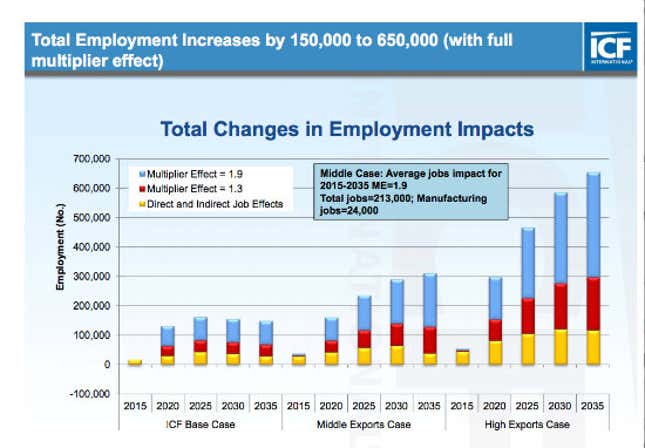

Meanwhile, ExxonMobil is banging the drum for unrestricted US LNG exports. ExxonMobil’s Ken Cohen has dismissed the go-slow group as “a small gaggle of companies” that “is playing a weak hand.” ExxonMobil is distributing data by ICF International that show the opposite results from those claimed by the chemical giants. They say that you can give a jolt to US manufacturing and Big Oil at the same time, and produce a swollen US jobs market. Look at this chart.

Think tanks and consultant firms are lining up in the battle. In a May 2012 study, the Brookings Institution concludes that LNG exports will motivate drillers to produce even more gas, thus leveling off any price surge. On a website that includes an interactive, state-by-state jobs display, the US Chamber of Commerce trumpets a study it paid for, conducted by energy research firm IHS CERA, which concludes that shale gas will generate three million US jobs by 2020. Here is a Chamber-CERA chart:

The likelihood is that the Obama Administration will hew a moderate course—it will approve a bit less than a quarter of the yearly 280 billion cubic meters of exports currently under review. That is also the most prudent course for a cyclical industry involving a new resource that is the subject of enormous hyperbole.